|

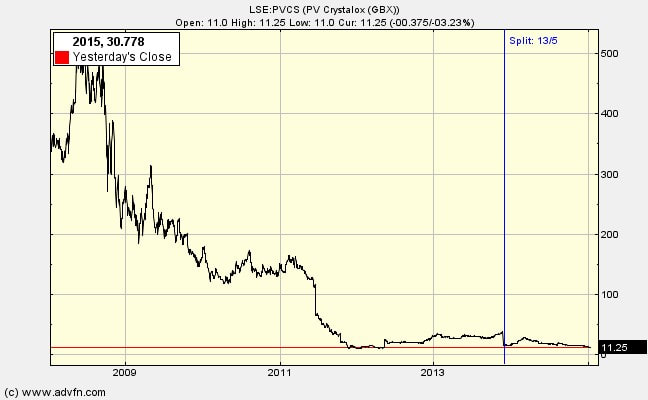

You know that I've bought PV Crystalox (LSE:PVCS) shares; so you know I'm prepared to face up to the risks. But I thought it might be worthwhile listing my main concerns. (That way, I'll be able to remember them myself a few months down the line!). If you have some more, or would like to add a point or change of emphasis, I invite you to comment. Worries

There is a lot that could go wrong (if you have any information please tell us):

Conclusion Looking at the qualitative factors this is a risky share. It is in an unstable industry with over-supply and plenty of government interference. Prices have been below costs of production for years. On the other hand, to reflect the worries, the share price has fallen so much that it is now 2.4% of what it was a few years ago. Much more importantly, it has declined to one-half of the net current asset value. While it is true that NCAV is being run down, it is happening at a relatively slow rate, giving time for something good to turn up. There are sound reasons to expect this company to find a way out of the darkness, either through long-awaited industry improvement, managerial excellence, being taken over or by liquidation. So despite the risks of being wrong greater than 50% I think it is worth holding these shares. It could be a multi-bagger. The first entrant to my 2015 net current asset value portfolio!

0 Comments

PV Crystalox (LSE:PVCS) has a strong balance sheet relative to its market capitalisation, but it keeps losing money. A key consideration is whether the managerial team is equipped, intellectually and in terms of integrity regarding shareholders, to turn things around for the owners. The evidence on managerial quality feeds into a consideration of a range of factors that might cause the share price to rise. Managerial quality

Iain Dorrity, CEO, has a PhD in physical chemistry and joined the company as early as 1986. He owns 17.8m shares (10.58%). He was a member of the MBO team that acquired the Crystalox business in 1994. I think we can guess that he is likely to have quite a large emotional investment in the business. Ex-colleagues and other old friends who helped with the MBO are still significant shareholders and so there is some pressure on Dr Dorrity to do well by shareholders from families who might have a high proportion of their net wealth in PVC shares. Having said that, the Board have not yet adjusted to the reality that they are a tiddler company. They pay themselves €1m per year, with Dorrity walking away with €386,510 (at least it is less than the €554,934 in 2010). The other executive director, Mathew Wethey, FD, has only recently joined the Board so there is not much on him apart from joining the company in 2009. To their credit they have not gone chasing after empty revenues: reduced output, and fewer employees, from over 299 to only 88 people. They have generated cash by ensuring that customers compensated PVC if they reneged on their fixed-price contracts….…and then handed large amounts of money (more than the current MCap) back to shareholders. Thus there is some evidence to suggest they are not empire-builders and really do care for shareholders. On the other hand they remain optimistic that the market will recover and they can again grow the company. Perhaps they are right. But perhaps they forecast what they wish for; and in positioning the company for the expected upturn they destroy shareholder value if they prove too optimistic. Finally, shareholders from years ago followed the company closely and wrote bulletin board posts on ADVFN. The consensus seems to be that they a good managers. What might lead to a revival in the share price? Ben Graham had a checklist for possible improvement routes:

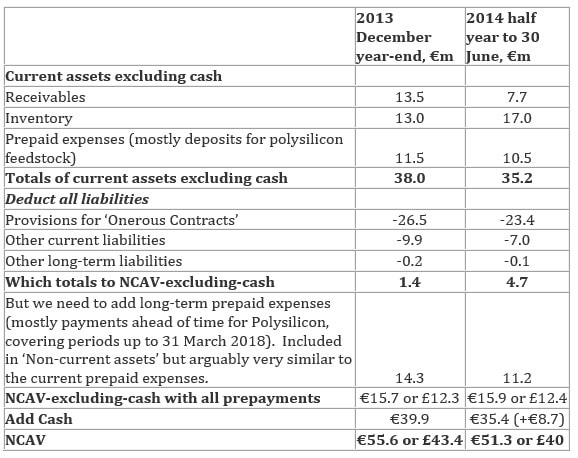

Newsletter 61 – PV Crystalox - A strong balance sheet, but is there significant dissipation of cash?6/10/2020 Assuming that the managers and auditors of PV Crystalox (LSE:PVCS) have been diligent in provisioning for the liability to purchase raw material at prices significantly above the current market clearing rate, we can see that the balance sheet is strong. It has a net current asset value of £40m, with no bank or bond debt, compared with a MCap of £19.36m. But is it diminishing so much, month-by-month, that NCAV will rapidly fall below MCap? Here are some things I have found – this is a far from settled question in my mind; if you have other evidence to offer please tell us. Losses

There was such a lot of restructuring (selling off a division, etc.) that there is little to be gained by examining the income or cash flow statements for 2012 and 2013. Things had settled down by December 2013. So I’ll take a look at the half-year report to June 2014. Here the directors talk about ‘intensely competitive PV industry’ and ‘wafer prices have fallen back to mid-2013 prices’. So not much ground for optimism there then. They also talk about ‘oversupply from weaker market demand…driving prices below industry production costs’. One point of light: polysilicon has increased in price. Given that PVC trades excess polysilicon at market prices this is helpful. Another point of light: ‘In the case of one polysilicon contract, the Group has recently formally concluded an amendment to reduce prices significantly and reschedule volumes’ However, despite increasing sales the company made a loss from continuing operations of €6.9m in the half year. Looking forward: ‘Industry analysts forecast a sharp increase in PV demand…this market recovery should at least halt the wafer price decline’ Comparing NCAV across time So, from the P&L we get the impression that PVC is losing about £1m per month. We could also look at the decline in net current asset value over that six months. In December 2013 it was €55.6m or £43.4m. Later in the year it was €51.3m or £40m. From this, the decline is around £0.5m per month. Capital investment Are management planning to spend their way out of a moribund condition? They say they are in ‘cash conservation mode’. And there is evidence to back that up. First, they are contracting the business, mothballing plant, rather than expanding. ‘Restricting production levels to around 30% of our 750MW operating capacity’. Costs are down. Second, capital expenditure is running at about €0.1m per year – ‘only essential items were purchased’. My overall impression is that cash is being dissipated, but not at an alarming rate - there is still time to turn things around. Tomorrow's newsletter will look at managerial quality and ask what might turn the business around. PV Crystalox's (LSE:PVCS) balance sheet took quite a lot of work to understand what is going on. I think I have it now - but perhaps that's my usual hubris. Anyway, he is my interpretation of what the BS is telling us. You'll notice that I've modified it somewhat. (Note the numbers are in euros) Market capitalisation is 160m shares x £0.121 = £19.36m. Clearly the balance sheet is dominated by items you do not see every day in a set of accounts, namely very large prepaid expenses, and provisions for onerous contracts. I’d better explain.

Troublesome contracts When times were good the managers thought it would be a ‘cunning plan’ to lock-in high prices for wafers supplied to their customers for many years ahead. With the demand for solar power rocketing customers were happy to have clarity on the price and surety about the volume of wafers. Thus, in 2007-8 PVC entered into a number of long-term agreements with customers. There is an obvious risk here: if you are selling your product at a fixed price but buying raw material at a variable price things could go wrong very quickly. The obvious solution is to get suppliers to deliver an agreed quantity of polysilicon in each of the next few years at a price you have agreed. There are two suppliers of polysilicon. In 2008 and 2010 they agreed to supply at fixed prices. Then the crash came. Solar panel prices collapsed, wafer prices collapsed and polysilicon prices collapsed. This is no matter for PVC…….if it is perfectly hedged. But a hedge is only as good as the counterparties. Many of PVCs customers struggled to continue in existence. They asked for renegotiated contracts. For years PVC gave in and sold wafers somewhere between the contracted price and the new market price. Worse was to come: many customers went bust. PVC could try and get something from the liquidator for breach of contract but what are the odds of being successful? Well, much of the time pretty poor, but that €8.7m cash entry you see in the 2014 BS numbers is due to a successful claim against a liquidated customer (cash received after 30th June, but I threw it into the BS anyway). Naturally, the two suppliers wanted PVC to stick to the high prices they agreed. It was not long before PVC had far too much polysilicon (photovoltaics use less these days and PVC was running down its sales because so much of it was unprofitable). In 2011 and 2012 the dreaded ‘Onerous Contract Provision’ was shoved into the accounts ‘as non-cash charges to the cost of material in respect of the onerous nature of the Group’s long-term polysilicon supply agreements. The OCP unwinds from period to period as the related contract move towards expiry’ – it is less in July 2014 than in December 2013. In other words the managers, no doubt egged on by their auditors, put a big negative in their balance sheets to allow for the losses caused by buying way above the market rate and then having to sell surplus into the market. In fact the OCP goes in two places in the BS: they have one as a current provision and one as a non-current provision. Whatever way they present it in the accounts, there is a €23.4m liability depressing the company’s value. But at least it is diminishing as time goes on. Note: The carrying value of polysilicon and wafers has been reduced to net realisable value. That is, selling price less all estimated costs of completion, marketing, selling and distribution. The auditors have paid particular attention to the provision for fixed-priced polysilicon: “Our work included testing management’s onerous contract provision model and evaluating and challenging key inputs and assumptions…..including agreeing future sales prices and future polysilicon purchase prices and volumes to available evidence”. In the next newsletter I ask: A strong balance sheet yes, but is there significant dissipation of cash? How do you fancy a company which has about £34m of cash but is selling for £19m. Quite tempting? But you would also need to look at the total liability position relative to the easily realisable assets to be reassured that the cash is not needed to pay off debts. So, ignoring cash, what is the net current asset value, ‘NCAV-excluding-cash’. I get a figure of positive £12.4m. Thus all liabilities are more than covered by marketable assets, and then you get the cash on top. But, this is not enough for a decision. You also need to know if the management are pursuing a crazy course and throwing away the cash. Are they rapidly dissipating the cash surplus by persisting with loss-making operations or by making speculative capital investments, so that shareholders’ money will shortly be gone? I spent a long time trying to answer these questions – hence the delay since my last post, sorry – but I think I have reached a reasoned conclusion. Warning: risk of loss

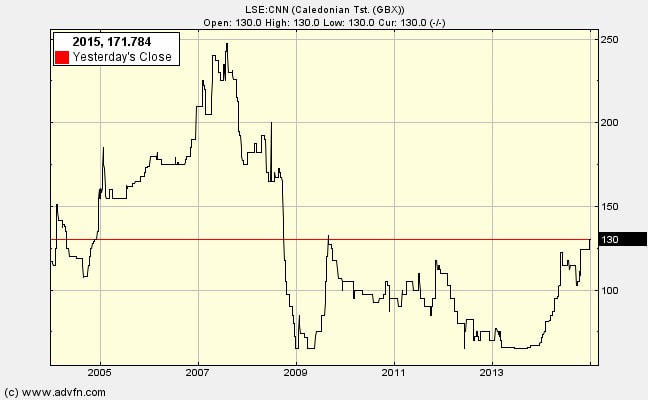

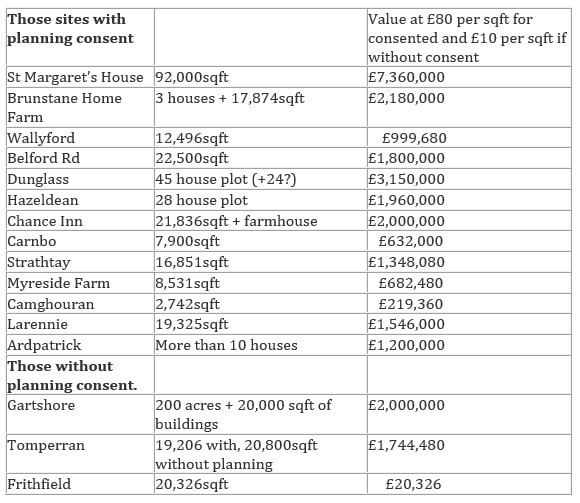

Be aware that this investment in my view has a more than 50% chance of being a loser. Should that automatically exclude it from a portfolio? No. If the payoff is 3 or 4 times money put in then even with a failure probability of 60% I will still invest. I tell myself to avoid narrow framing; think of the overall portfolio returns, not narrow sections of it. The business Back in the 1980s the company’s boffins/founders developed “multicrystalline silicon technology on an industrial scale, setting the industry standard for ingot production”. Let me explain. It sells its product to the photovoltaic solar cell industry worldwide, which as you know needs silicon. But not just any old silicon; it has to be from large crystals (PVC grows them up to 66cm). To make crystals it buys in something called “polysilicon”. After it has done its thing (I hope I’m not being too technical for you!) it has ‘ingots’ of ‘multicrystalline silicon’. It does not sell these lumps, but slices them into wafers and sells these to customers. This is where it does these things: Abingdon, UK: Ingots are produced. It has four production plants but two are mothballed (you’ll understand why later). High purity polysilicon under carefully controlled conditions is directionally solidified to multicrystalline silicon ingots. Erfurt, Germany: Wafers sliced from blocks Tokyo: Japanese subcontractors section ingots into blocks and wafers. Rollercoaster As you know, the demand for PV electricity production has rocketed in the last decade, with output of wafers rising in double percentage figures year after year. So PV Crystalox, PVC, has been able to charge high prices and make bumper profits year after year, right? Well it started that way. Until 2010 things were hunky-dory. Then the reality of no barriers-to-entry for the industry struck home. This industry story illustrates an important general lesson: you can have fast growth in customer demand together with losses - just ask the airline companies around the world, or TV manufacturers, or PC manufacturers, or…… The Chinese and others threw massive resources at solar power, including wafer makers. The result was oversupply, large annual losses and the scything of companies. PVC shares were priced at over £5 in 2008. They are now 12.1p. Such a decline would indicate that the generality of investors think they are going to keep-on selling wafers at a loss, and sooner or later go bust. Perhaps it will. But I think there is good reason for hope. I’ll start with a look at the balance sheet in tomorrow's post Caledonian Trust (LSE:CNN) has a market capitalisation of 11.88m shares x 134p = £15.92m, but my estimation of its net asset value is significantly greater than this. The balance sheet shows £9.4m in ‘investment property’ and £11.5m in ‘trading property’. The distinction is blurry because those that are rented out could be sold quickly, and therefore traded. Indeed, it seems the directors are constantly looking to increase value by obtaining planning permissions to make alterations to investment and trading properties alike with a view to taking them to market. While the reality is that the properties are all ‘for sale’ the accounting distinction causes profound differences in perception. Investment properties are valued in the BS at fair value at each BS date, but trading properties have a BS value that is the LOWER OF cost or net realisable value. This is where most of the hidden value lies because the directors have spent the past eight years gaining planning permissions for a score of sites that they bought as farmland or as brownfield sites. We need to estimate the current market values of these properties. I attempt to do this in the table below, but before that you need to know about the liabilities to be deducted from the asset total. The main liability is a loan via unsecured loan stock from the chairman to CT of £2,725,000 at base rate plus 3%, and an unsecured loan from the chairman of £455,000 at base rate plus 3%. The only other liabilities total up to about £0.5m. Thus liabilities are about £3.68m. In the list of assets in the table I have made a very rough and ready estimate of value based on the following notions:

Bear in mind that I have not allowed for any success in persuading councils to include acres of farmland in local plans, e.g. the 200 acres at Gartshore where “proposals have been prepared for a village of a few hundred mixed cottages and houses”. If these proposals are accepted then the value of the company becomes a multiple of its current MCap., a real bonanza. Thus I estimate that the properties have a total current market value of over £28m. If we deduct liabilities of £3.68m we get net assets of around £24m, which is reasonably comfortably above MCap of £15.92m.

And there is the potential of the supercharger from new planning permissions on top. Update on managerial frugality In 2013 eight people worked for this company costing a total of £482,000. This was obviously considered a bloated bureaucracy! Dealing with this extravagance they have now cut staff numbers down to six. Total staff costs are only £444,000, with director remuneration down from £295,000 to £275,000, and the executive chairman’s remuneration dropping to £115,000 from £135,000. Continuing worries

Caledonian Trust's (LSE:CNN) latest annual report to June 2014, published in preliminary form on Christmas Eve, is much more upbeat on the prospects for the Scottish property market, and for the realisation of value from Caledonian Trust’s portfolio in particular, than the 2013 comments. Considering the decades of experience and the cautious nature of the directors I think these are bullish remarks from the chairman:

“….the prospects for the investment market are better than at any time since 2007….The underlying factors that brought about this year's great improvement seem likely to continue” “Demand for investment has many components but a major one is a synthesis of perception, analysis, future expectation, momentum, confidence and "gut" feeling: possibly a variant of Keynes's "animal spirits" all contributing to "group think". During the deteriorating phase of the cycle the "group think" view that predominates is that the market will continue flat or deteriorate further, so reducing demand. When the "group think" changes.. the transformation in demand is dramatic. The value change that accompanies these reversals of "animal spirits" is very large; and such a reversal took place in the general property investment market last year.” “The increasing supply of credit increases the demand for investment property.” “Jones Lang Lasalle are slightly more optimistic than Savills [on house price rises], as in 2015 they forecast 4.0% growth in the UK and 3.5% in Scotland, together with a five year growth of 22.8% in the UK and 19.3% for Scotland.” “Last year I said there would be an imminent turning point in the housing market: "... the key determinant of the long-term housing market will be a shortage of supply, resulting in high prices. For most UK markets that position has now been reached." “Current demand will be reinforced by an increase in the long-term requirement for houses …. There will be an imbalance between the demand and supply leading to higher long-term prices. The prospects for the housing market are extremely good.” “The Group has positioned itself to take advantage of a housing market which is improving and which I expect to continue to improve over the next few years. We have completed major investments in long planning processes and although larger schemes are still being promoted, most of the required investment has been made. Our emphasis is on the completion and realisation of development opportunities which can be marketed shortly, and within our development portfolio there are sufficient opportunities to allow several years of such sales. As these sales take place other development opportunities will then be brought forward to provide replacements for these realisations.” “We will seek to develop our major sites as soon as those immediately available are completed. In a liquid and improving market we plan to secure all practicable developments, as there is ample opportunity to reinvest elsewhere as opportunities continue to be presented for the use of our strong development expertise to create high returns.” “We do not depend on a further recovery in prices for the successful development of our sites as most of these sites were purchased unconditionally, i.e. without planning permission, for prices not far above their existing use value, and before the 2007 house price peak. A major component of the Group land development value lies in the grant of planning permission, and in its extent, and it is relatively independent of changes in house values. For development or trading properties no change is made to the Group's balance sheet even when improved development values have been obtained. Naturally, however, the balance sheet will reflect such enhanced value when the properties are developed or sold.” “Unlike many other property companies, the Group has successfully negotiated the worst economic crisis for over a century. The prospects, contrary to the last seven years, are very good.” The good times are only just getting started judging by the fact that they sold very little in the year to June 2014 (nor did they buy much), as they bide their time waiting for true lift-off. In the final post I'll attempt an estimation of minimum balance sheet value when assets are valued at fair value rather than cost. Caledonian Trust (LSE:CNN) directors have decades of experience in the property game, plus high quality degrees, plus a lot of skin in the game, plus no sign (so far as I can tell) of poor sense of decency with respect to minority shareholders. The Chairman’s letters with the annual report show both awareness and analytical understanding of the macro and micro economic environment and a high degree of openness about the company’s strategy and individual projects. Douglas Lowe, Chairman and Chief Executive.

Date of Birth 24/03/1937. A graduate of Clare College Cambridge (MA Hons in Natural Science and Diploma in Agriculture) and Harvard MBA and Certificate in Advanced Agricultural Economics. Until 1977 CEO of his family business, David Lowe and Sons of Musselburgh, property owners, farmers and market growers established in 1860, which farmed 2,000 acres and employed over 200 people. In 1978-9 Deputy Managing Director of Bruntons, a listed company which manufactured mainly wire and wire rope and employed 1,000 people. He was a significant shareholder and, from 1986 until shortly after joining the Company, Executive Deputy Chairman of Randsworth Trust PLC, a property company with a dealing facility on the USM. The market capitalisation of Randsworth Trust PLC increased from £886,000 to over £250 million between April 1986 and sale of the company in 1989. Purchased shares in Caledonian Trust in 1987, became CEO. Owns 78.47% of shares of the company. Michael J Baynham, Executive Director. Date of Birth 09/10/1956. Graduated in law (LLB Hons) from Aberdeen in 1978. Prior to joining the Company in 1989, he worked as a solicitor in a private practice specialising in commercial property and corporate law. Roderick J Pearson, FRICS, (NED). Date of Birth 27/10/1954. Graduate of Queens' College Cambridge (MA Modern Languages and Land Economy). Held senior positions in Ryden and Colliers International, and now runs his own consultancy, RJ Pearson Property Consultants. The directors have complete control with 86% of the shares in their hands. Less than 1m shares are in free float (out of 11.9m), so these are very illiquid. Eight employees. Modest director remuneration: Total employees (with pension payments) cost under £0.5m. I D Lowe £142,000 and MJ Baynham £152,000 WHAT AM I MISSING? WHAT IS THE CATCH?(Written July 2013) Possible answers, if I was to play devil’s advocate and assume the worst:

Caledonian Trust (LSE:CNN) spent the last 7 years doing very little to gain annual revenue. It has, on the whole, held onto its properties throughout the recession. Given its annual costs of a few hundred thousand pounds it has therefore reported a string of losses. But reported losses are different from an absence of value creation. A great deal of value has been created here by gain planning permission for most of the property it holds. That value will be realised over the next few years as the property market improves. This newsletter reproduces the comments I posted in July 2013, which still have resonance.

Why accept a dearth of profits? As a property developer myself, I’m aware that it often makes sense to delay the realisation of value. This can create reported losses in the short run as you have to cover expenses with little cash coming in. Delay might be sensible because the depressed housing and/or commercial property market means that you will not cover your infrastructure costs, build costs and local authority demand costs. It might make sense because you want to modify the development plans to gain even greater value. Delay could also be wise if you anticipate that the property market will be much healthier two-three years down the line. Quotes related to this idea of delay: “Heavy infrastructure investment would result in an illiquid investment with very limited or nil profit margin. Accordingly, we continue to delay any major investment but to start, or prepare to start, on small low investment, low infrastructural projects.” (Chairman, 2012 annual report) “Unfortunately other potential new sites and many of the conversion sites are commercially difficult to realise. Current market conditions are unhelpful, but major continuing constraints are the high cost of conversion and the overall cost of upgrading the inadequate infrastructure, partially due to the required enhancement of the public services. Considerable effort has been expended on minimising the costs of reinstatement and development by operational efficiencies, but the current burdens and restrictions will curtail earlier plans, unless some relaxations become available or other development opportunities emerge.” (Chairman, 2012 annual report) Thus, for many of the sites it is not economically viable to build the properties which have planning permission due to high costs and an illiquid property market. This means that a valuation of the company hinges on the potential of the sites in a normal property market. There is good reason for hope: “Our development portfolio contains a very high proportion of sites with excellent planning consents, many of these gained in the last few years. Our several strategic land sites have been extensively promoted for inclusion in Local Plans and we have secured bridgeheads there. The investment in these long planning processes has been considerable and will be further reduced next year.” (Chairman, 2012 annual report) The only debt is £2.7m loan stock granted by Chairman’s other company. Interest is only 3% over base. Chairman has continued to roll over the debt for many years. Note the tax loses that have accumulated over the years. Tomorrow's newsletter will look at the quality of management and the worries I had in July 2013. I first bought into Caledonian Trust, a small Edinburgh property developer, in July 2013 at 70p. They have almost doubled to 134p. Despite the rise I looked at the company as if for the first time last week, and concluded that even at 134p it meets the criteria for a net current asset value (NCAV) share, and so I bought some more. It might be helpful to first repost here my original analysis from a July 2013 post (put on my personal website). In those dark days there was much uncertainty about a property recovery outside of London. Other blogs will follow to update the numbers, including a more detailed look at the property it owns.

2013 Analysis I need help with this one. It has a market capitalisation of £7.7m and investment properties (long term lets) of £8.1m. In addition it has a portfolio of properties (something like two dozen sites) described as for ‘trading’. These are valued at the lower of cost or net realisable value, which is very significant as the open market value may be much more. The balance sheet values of the trading properties are £11.6m. Total liabilities are £3.2m. There are a few small items, leaving NAV at £16.9m and net current asset value at £8.8m. It seems to pass the first test of Benjamin Graham’s net current asset value investing. This reported balance sheet looks nice enough, but also consider the achievement of the management over the past five years. They might not have reported profit but they have created value by obtaining planning permissions on the properties. Here are some examples:

In the next newsletter I'll explain why it's OK that there are no profits. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed