|

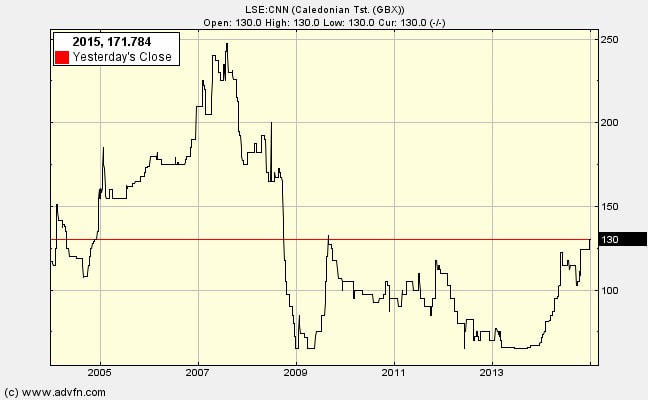

Caledonian Trust (LSE:CNN) spent the last 7 years doing very little to gain annual revenue. It has, on the whole, held onto its properties throughout the recession. Given its annual costs of a few hundred thousand pounds it has therefore reported a string of losses. But reported losses are different from an absence of value creation. A great deal of value has been created here by gain planning permission for most of the property it holds. That value will be realised over the next few years as the property market improves. This newsletter reproduces the comments I posted in July 2013, which still have resonance.

Why accept a dearth of profits? As a property developer myself, I’m aware that it often makes sense to delay the realisation of value. This can create reported losses in the short run as you have to cover expenses with little cash coming in. Delay might be sensible because the depressed housing and/or commercial property market means that you will not cover your infrastructure costs, build costs and local authority demand costs. It might make sense because you want to modify the development plans to gain even greater value. Delay could also be wise if you anticipate that the property market will be much healthier two-three years down the line. Quotes related to this idea of delay: “Heavy infrastructure investment would result in an illiquid investment with very limited or nil profit margin. Accordingly, we continue to delay any major investment but to start, or prepare to start, on small low investment, low infrastructural projects.” (Chairman, 2012 annual report) “Unfortunately other potential new sites and many of the conversion sites are commercially difficult to realise. Current market conditions are unhelpful, but major continuing constraints are the high cost of conversion and the overall cost of upgrading the inadequate infrastructure, partially due to the required enhancement of the public services. Considerable effort has been expended on minimising the costs of reinstatement and development by operational efficiencies, but the current burdens and restrictions will curtail earlier plans, unless some relaxations become available or other development opportunities emerge.” (Chairman, 2012 annual report) Thus, for many of the sites it is not economically viable to build the properties which have planning permission due to high costs and an illiquid property market. This means that a valuation of the company hinges on the potential of the sites in a normal property market. There is good reason for hope: “Our development portfolio contains a very high proportion of sites with excellent planning consents, many of these gained in the last few years. Our several strategic land sites have been extensively promoted for inclusion in Local Plans and we have secured bridgeheads there. The investment in these long planning processes has been considerable and will be further reduced next year.” (Chairman, 2012 annual report) The only debt is £2.7m loan stock granted by Chairman’s other company. Interest is only 3% over base. Chairman has continued to roll over the debt for many years. Note the tax loses that have accumulated over the years. Tomorrow's newsletter will look at the quality of management and the worries I had in July 2013.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed