|

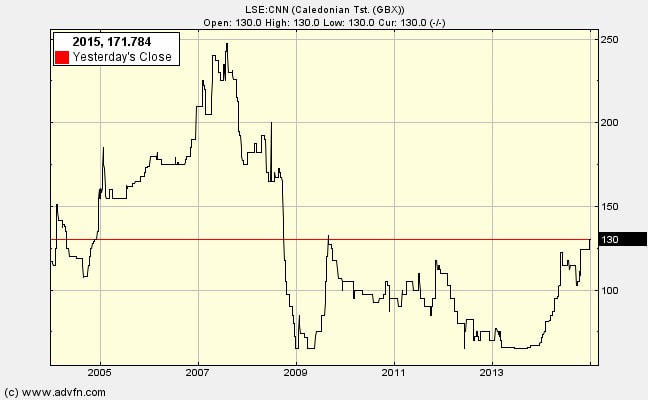

I first bought into Caledonian Trust, a small Edinburgh property developer, in July 2013 at 70p. They have almost doubled to 134p. Despite the rise I looked at the company as if for the first time last week, and concluded that even at 134p it meets the criteria for a net current asset value (NCAV) share, and so I bought some more. It might be helpful to first repost here my original analysis from a July 2013 post (put on my personal website). In those dark days there was much uncertainty about a property recovery outside of London. Other blogs will follow to update the numbers, including a more detailed look at the property it owns.

2013 Analysis I need help with this one. It has a market capitalisation of £7.7m and investment properties (long term lets) of £8.1m. In addition it has a portfolio of properties (something like two dozen sites) described as for ‘trading’. These are valued at the lower of cost or net realisable value, which is very significant as the open market value may be much more. The balance sheet values of the trading properties are £11.6m. Total liabilities are £3.2m. There are a few small items, leaving NAV at £16.9m and net current asset value at £8.8m. It seems to pass the first test of Benjamin Graham’s net current asset value investing. This reported balance sheet looks nice enough, but also consider the achievement of the management over the past five years. They might not have reported profit but they have created value by obtaining planning permissions on the properties. Here are some examples:

In the next newsletter I'll explain why it's OK that there are no profits.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed