|

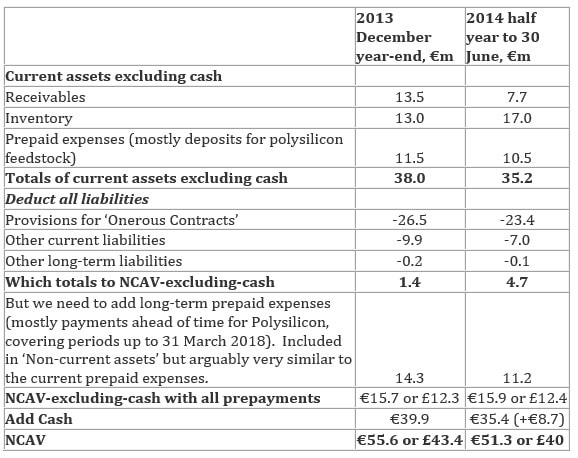

PV Crystalox's (LSE:PVCS) balance sheet took quite a lot of work to understand what is going on. I think I have it now - but perhaps that's my usual hubris. Anyway, he is my interpretation of what the BS is telling us. You'll notice that I've modified it somewhat. (Note the numbers are in euros) Market capitalisation is 160m shares x £0.121 = £19.36m. Clearly the balance sheet is dominated by items you do not see every day in a set of accounts, namely very large prepaid expenses, and provisions for onerous contracts. I’d better explain.

Troublesome contracts When times were good the managers thought it would be a ‘cunning plan’ to lock-in high prices for wafers supplied to their customers for many years ahead. With the demand for solar power rocketing customers were happy to have clarity on the price and surety about the volume of wafers. Thus, in 2007-8 PVC entered into a number of long-term agreements with customers. There is an obvious risk here: if you are selling your product at a fixed price but buying raw material at a variable price things could go wrong very quickly. The obvious solution is to get suppliers to deliver an agreed quantity of polysilicon in each of the next few years at a price you have agreed. There are two suppliers of polysilicon. In 2008 and 2010 they agreed to supply at fixed prices. Then the crash came. Solar panel prices collapsed, wafer prices collapsed and polysilicon prices collapsed. This is no matter for PVC…….if it is perfectly hedged. But a hedge is only as good as the counterparties. Many of PVCs customers struggled to continue in existence. They asked for renegotiated contracts. For years PVC gave in and sold wafers somewhere between the contracted price and the new market price. Worse was to come: many customers went bust. PVC could try and get something from the liquidator for breach of contract but what are the odds of being successful? Well, much of the time pretty poor, but that €8.7m cash entry you see in the 2014 BS numbers is due to a successful claim against a liquidated customer (cash received after 30th June, but I threw it into the BS anyway). Naturally, the two suppliers wanted PVC to stick to the high prices they agreed. It was not long before PVC had far too much polysilicon (photovoltaics use less these days and PVC was running down its sales because so much of it was unprofitable). In 2011 and 2012 the dreaded ‘Onerous Contract Provision’ was shoved into the accounts ‘as non-cash charges to the cost of material in respect of the onerous nature of the Group’s long-term polysilicon supply agreements. The OCP unwinds from period to period as the related contract move towards expiry’ – it is less in July 2014 than in December 2013. In other words the managers, no doubt egged on by their auditors, put a big negative in their balance sheets to allow for the losses caused by buying way above the market rate and then having to sell surplus into the market. In fact the OCP goes in two places in the BS: they have one as a current provision and one as a non-current provision. Whatever way they present it in the accounts, there is a €23.4m liability depressing the company’s value. But at least it is diminishing as time goes on. Note: The carrying value of polysilicon and wafers has been reduced to net realisable value. That is, selling price less all estimated costs of completion, marketing, selling and distribution. The auditors have paid particular attention to the provision for fixed-priced polysilicon: “Our work included testing management’s onerous contract provision model and evaluating and challenging key inputs and assumptions…..including agreeing future sales prices and future polysilicon purchase prices and volumes to available evidence”. In the next newsletter I ask: A strong balance sheet yes, but is there significant dissipation of cash?

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed