|

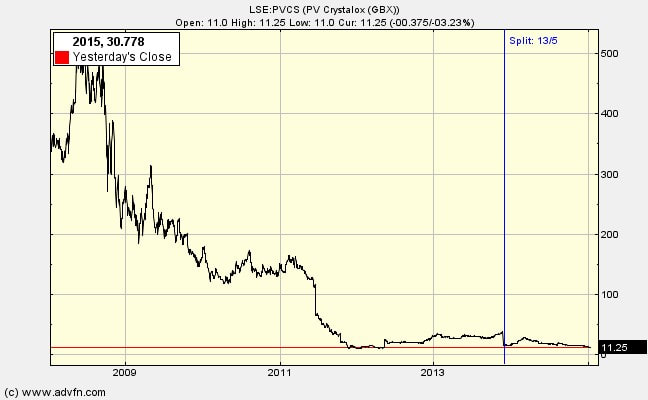

PV Crystalox (LSE:PVCS) has a strong balance sheet relative to its market capitalisation, but it keeps losing money. A key consideration is whether the managerial team is equipped, intellectually and in terms of integrity regarding shareholders, to turn things around for the owners. The evidence on managerial quality feeds into a consideration of a range of factors that might cause the share price to rise. Managerial quality

Iain Dorrity, CEO, has a PhD in physical chemistry and joined the company as early as 1986. He owns 17.8m shares (10.58%). He was a member of the MBO team that acquired the Crystalox business in 1994. I think we can guess that he is likely to have quite a large emotional investment in the business. Ex-colleagues and other old friends who helped with the MBO are still significant shareholders and so there is some pressure on Dr Dorrity to do well by shareholders from families who might have a high proportion of their net wealth in PVC shares. Having said that, the Board have not yet adjusted to the reality that they are a tiddler company. They pay themselves €1m per year, with Dorrity walking away with €386,510 (at least it is less than the €554,934 in 2010). The other executive director, Mathew Wethey, FD, has only recently joined the Board so there is not much on him apart from joining the company in 2009. To their credit they have not gone chasing after empty revenues: reduced output, and fewer employees, from over 299 to only 88 people. They have generated cash by ensuring that customers compensated PVC if they reneged on their fixed-price contracts….…and then handed large amounts of money (more than the current MCap) back to shareholders. Thus there is some evidence to suggest they are not empire-builders and really do care for shareholders. On the other hand they remain optimistic that the market will recover and they can again grow the company. Perhaps they are right. But perhaps they forecast what they wish for; and in positioning the company for the expected upturn they destroy shareholder value if they prove too optimistic. Finally, shareholders from years ago followed the company closely and wrote bulletin board posts on ADVFN. The consensus seems to be that they a good managers. What might lead to a revival in the share price? Ben Graham had a checklist for possible improvement routes:

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed