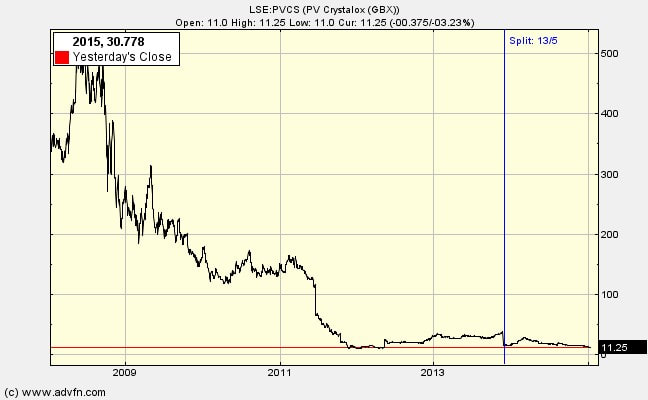

Newsletter 61 – PV Crystalox - A strong balance sheet, but is there significant dissipation of cash?6/10/2020 Assuming that the managers and auditors of PV Crystalox (LSE:PVCS) have been diligent in provisioning for the liability to purchase raw material at prices significantly above the current market clearing rate, we can see that the balance sheet is strong. It has a net current asset value of £40m, with no bank or bond debt, compared with a MCap of £19.36m. But is it diminishing so much, month-by-month, that NCAV will rapidly fall below MCap? Here are some things I have found – this is a far from settled question in my mind; if you have other evidence to offer please tell us. Losses

There was such a lot of restructuring (selling off a division, etc.) that there is little to be gained by examining the income or cash flow statements for 2012 and 2013. Things had settled down by December 2013. So I’ll take a look at the half-year report to June 2014. Here the directors talk about ‘intensely competitive PV industry’ and ‘wafer prices have fallen back to mid-2013 prices’. So not much ground for optimism there then. They also talk about ‘oversupply from weaker market demand…driving prices below industry production costs’. One point of light: polysilicon has increased in price. Given that PVC trades excess polysilicon at market prices this is helpful. Another point of light: ‘In the case of one polysilicon contract, the Group has recently formally concluded an amendment to reduce prices significantly and reschedule volumes’ However, despite increasing sales the company made a loss from continuing operations of €6.9m in the half year. Looking forward: ‘Industry analysts forecast a sharp increase in PV demand…this market recovery should at least halt the wafer price decline’ Comparing NCAV across time So, from the P&L we get the impression that PVC is losing about £1m per month. We could also look at the decline in net current asset value over that six months. In December 2013 it was €55.6m or £43.4m. Later in the year it was €51.3m or £40m. From this, the decline is around £0.5m per month. Capital investment Are management planning to spend their way out of a moribund condition? They say they are in ‘cash conservation mode’. And there is evidence to back that up. First, they are contracting the business, mothballing plant, rather than expanding. ‘Restricting production levels to around 30% of our 750MW operating capacity’. Costs are down. Second, capital expenditure is running at about €0.1m per year – ‘only essential items were purchased’. My overall impression is that cash is being dissipated, but not at an alarming rate - there is still time to turn things around. Tomorrow's newsletter will look at managerial quality and ask what might turn the business around.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed