|

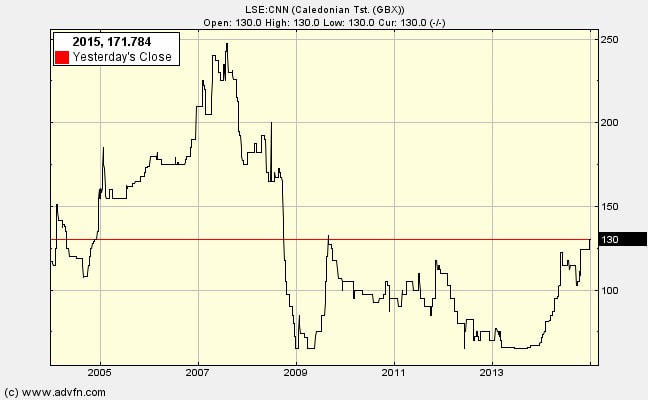

Caledonian Trust (LSE:CNN) directors have decades of experience in the property game, plus high quality degrees, plus a lot of skin in the game, plus no sign (so far as I can tell) of poor sense of decency with respect to minority shareholders. The Chairman’s letters with the annual report show both awareness and analytical understanding of the macro and micro economic environment and a high degree of openness about the company’s strategy and individual projects. Douglas Lowe, Chairman and Chief Executive.

Date of Birth 24/03/1937. A graduate of Clare College Cambridge (MA Hons in Natural Science and Diploma in Agriculture) and Harvard MBA and Certificate in Advanced Agricultural Economics. Until 1977 CEO of his family business, David Lowe and Sons of Musselburgh, property owners, farmers and market growers established in 1860, which farmed 2,000 acres and employed over 200 people. In 1978-9 Deputy Managing Director of Bruntons, a listed company which manufactured mainly wire and wire rope and employed 1,000 people. He was a significant shareholder and, from 1986 until shortly after joining the Company, Executive Deputy Chairman of Randsworth Trust PLC, a property company with a dealing facility on the USM. The market capitalisation of Randsworth Trust PLC increased from £886,000 to over £250 million between April 1986 and sale of the company in 1989. Purchased shares in Caledonian Trust in 1987, became CEO. Owns 78.47% of shares of the company. Michael J Baynham, Executive Director. Date of Birth 09/10/1956. Graduated in law (LLB Hons) from Aberdeen in 1978. Prior to joining the Company in 1989, he worked as a solicitor in a private practice specialising in commercial property and corporate law. Roderick J Pearson, FRICS, (NED). Date of Birth 27/10/1954. Graduate of Queens' College Cambridge (MA Modern Languages and Land Economy). Held senior positions in Ryden and Colliers International, and now runs his own consultancy, RJ Pearson Property Consultants. The directors have complete control with 86% of the shares in their hands. Less than 1m shares are in free float (out of 11.9m), so these are very illiquid. Eight employees. Modest director remuneration: Total employees (with pension payments) cost under £0.5m. I D Lowe £142,000 and MJ Baynham £152,000 WHAT AM I MISSING? WHAT IS THE CATCH?(Written July 2013) Possible answers, if I was to play devil’s advocate and assume the worst:

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed