|

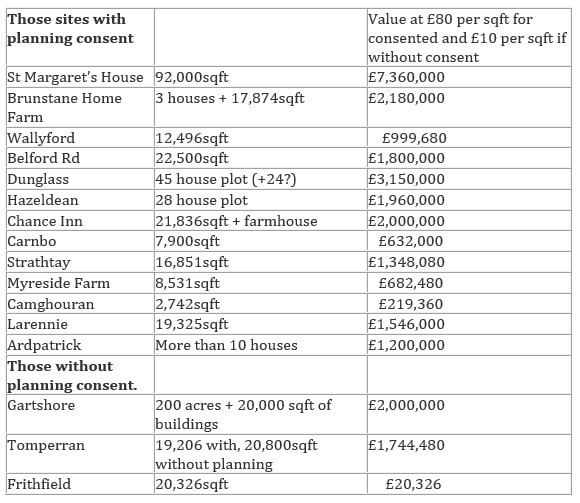

Caledonian Trust (LSE:CNN) has a market capitalisation of 11.88m shares x 134p = £15.92m, but my estimation of its net asset value is significantly greater than this. The balance sheet shows £9.4m in ‘investment property’ and £11.5m in ‘trading property’. The distinction is blurry because those that are rented out could be sold quickly, and therefore traded. Indeed, it seems the directors are constantly looking to increase value by obtaining planning permissions to make alterations to investment and trading properties alike with a view to taking them to market. While the reality is that the properties are all ‘for sale’ the accounting distinction causes profound differences in perception. Investment properties are valued in the BS at fair value at each BS date, but trading properties have a BS value that is the LOWER OF cost or net realisable value. This is where most of the hidden value lies because the directors have spent the past eight years gaining planning permissions for a score of sites that they bought as farmland or as brownfield sites. We need to estimate the current market values of these properties. I attempt to do this in the table below, but before that you need to know about the liabilities to be deducted from the asset total. The main liability is a loan via unsecured loan stock from the chairman to CT of £2,725,000 at base rate plus 3%, and an unsecured loan from the chairman of £455,000 at base rate plus 3%. The only other liabilities total up to about £0.5m. Thus liabilities are about £3.68m. In the list of assets in the table I have made a very rough and ready estimate of value based on the following notions:

Bear in mind that I have not allowed for any success in persuading councils to include acres of farmland in local plans, e.g. the 200 acres at Gartshore where “proposals have been prepared for a village of a few hundred mixed cottages and houses”. If these proposals are accepted then the value of the company becomes a multiple of its current MCap., a real bonanza. Thus I estimate that the properties have a total current market value of over £28m. If we deduct liabilities of £3.68m we get net assets of around £24m, which is reasonably comfortably above MCap of £15.92m.

And there is the potential of the supercharger from new planning permissions on top. Update on managerial frugality In 2013 eight people worked for this company costing a total of £482,000. This was obviously considered a bloated bureaucracy! Dealing with this extravagance they have now cut staff numbers down to six. Total staff costs are only £444,000, with director remuneration down from £295,000 to £275,000, and the executive chairman’s remuneration dropping to £115,000 from £135,000. Continuing worries

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed