|

I'll look at three key aspects of the company in today's blog: indicators of (a) good management, (b) good business prospects and (c) stability. 1. Good management.

There are 18 members of staff. The three leaders have been with the company for a minimum of 14 years. They each have decades of experience in commercial property management. They have seen recessions come and go. David Fletcher, founding director and chairman, has 40 years of experience. He also owns 14.6% of the shares. The managers have formed good relationships with clients, some over decades. Seemingly honest and realistic appraisal of the business prospects through the recession years: using words/phrases such as ‘challenging’, ‘keep a steady eye on overhead costs’ ‘it will take all our ingenuity and resource to maintain turnover’ 2. Good prospects Profits before tax for the last three years have not fallen below £0.29m pa and dividends have consistently been 1.5p. With a share price of 31p (when I wrote this in August 20123, now 52p) the dividend yield is just under 5% (dividends now raised to 3p). This performance has been achieved at a low point in the property cycle. At the last high point (2007) dividends amounted to 4.75p pa. Given the company’s balance sheet strength there is every reason to believe that what remains of the current recession will be survived. Could dividends then go back to 4.75p? If they do then the Mr Market might push up the share price. Of the reasons Benjamin Graham gives for a turnaround in the prospects of a NCAV company perhaps the most compelling for this case is that the earning power will be lifted to the point where it is commensurate with the company’s asset level. This will not come about through either the benefit of competitor exit from the industry or from the replacement of the senior managers, but by an improvement in the property market combined with tight management practices (honed in the recession). FK has high operational gearing: with high fixed costs, small percentage increases in revenues should feed through to large percentage increases in eps. Another possibility is a merger, as another firm may value the brand name and the long-standing relationships with property fund managers, but this is unlikely given the sense of continuity of the existing managerial team. The final alternative of liquidation would be wasteful given the profitability and the reputational competitive advantage enjoyed by this firm. 3. Stability Positive profits have been achieved year-in-year-out through a difficult period (satisfying Graham’s high average past earnings power requirement) and the balance sheet has remained robust. Much of the income comes from collecting rents on buildings for client quarter after quarter, providing a solid source of revenue. I cannot detect manipulation of earning numbers and sense that such a conservatively run firm is unlikely to play accounting tricks. In tomorrow's blog I'll examine some reasons for concern with FK both in August 2013 and in December 2014

0 Comments

I first bought Fletcher King in August 2013 at a price of 30p. Since then profits have taken off, but the share has already responded by rising to 52p. The question is: do I want to buy? Market capitalisation (£4.78m) is now significantly above net current asset value, NCAV (£2.8m, with £3.3m in cash).

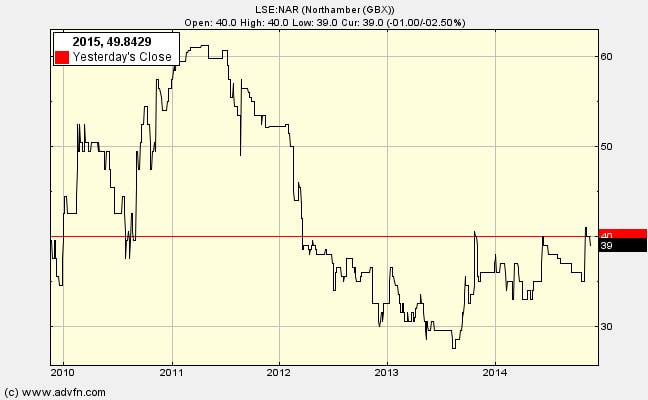

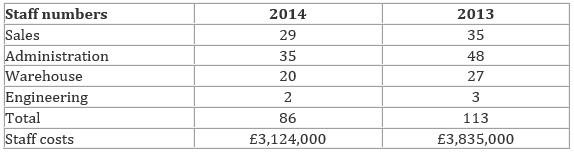

But off-setting that is the good operating performance (profits up 62%, dividend yield of 5.8%). Can it qualify as a strong economic franchise share even if it no longer qualifies as a NCAV share? (Background: Fletcher King advises and assist owners of commercial property. It manages office letting, for example, by collecting rent, negotiating with tenants. It values property and manages property assets for investment funds as well as running its own property fund. It does something in every town in the UK, but its main activity is in London. Over 400 individual properties, 607 tenants, £68m rent roll, £954m of property) Here is what I wrote in August 2013: FLETCHER KING: A Classic Benjamin Graham Net Current Asset Value Share? Do we have a company here that is trading below its net current asset value, NCAV, while also meeting Benjamin Graham’s criteria of: 1. Good management 2. Good prospects for the business 3. Stability? Any light you can shed will be welcomed. What have I missed? Market capitalisation is £2.7m. Current assets are £4m (which includes £2.6m of cash). If we deduct all the liabilities we arrive at a NCAV of £3.1m, significantly greater than Mr Market currently values the company. A further adjustment might be to reduce the receivables as recommended by Graham. Let’s remove 20% of receivables which amounts to £0.29m bringing NCAV to only slightly above market capitalisation. However, an argument can be made for adding to the NCAV the £0.5m classified as non-current ‘available-for-sale investments’ (actually stakes in three property investment syndicates run by FK). A further consideration is that the NCAVs shown on recent balance sheets have consistently been above £3m for at least three years. In tomorrow's blog I'll look at FK in the light of Benjamin Graham's three qualitative factors. These encouraged me to buy in August 2013, and remain valid. newsletter 29 - northamber - let's check to see if they are throwing Money around 27th november 201426/7/2020 Alex Phillips, new Strategy Director of Northamber has been recruiting staff, which came as a shock to me given my view that the company had settled in for a long run-down period combined with an attack on “unstable margins…and…exposure to empty revenues”. Look a little closer and you discover that Alex has hired a dozen “experienced and qualified staff” presumably to extend the product range into more modern areas such as gaming, and to do something about the poor web-presence (type ‘computer wholesalers’ or ‘computer trade’ into Google and you’ll see that Northamber is difficult to find). “We increased the quality and quantity of resources put into marketing, selling and liaising with suppliers” he says. Hiring staff has, it is true, used our precious cash. But look at the overall staffing and other spending and you'll find a very significant decline: The good news is confirmed by other data; overall ‘overhead costs’ (pretty well everything other than what they pay suppliers) was cut by £1.55m. That is, administrative costs were £0.8m lower than in 2013 at £2.549m and distribution costs were £0.75m lower than in 2013 at £2,948m. Thus overall overhead was lower by 22%. This hardly constitutes evidence of a wildly optimistic plunge into new ventures.

There is more evidence of tight purse strings. First, there was no net investment in property plant and equipment in 2014. Second, director’s pay is very modest totalling £159,000 – believe it or not, that is the total for all the directors. David Phillips waived his right to £165,000, for the third year running, believing that it not right that he should take it while staff are being made redundant (and, perhaps, while shareholders face losses) Conclusions and concerns The managerial team say that they are “on an accelerated path to recovery and profitability….we see significant potential in both our existing vendors and categories and some new categories we are exploring”. And the data seem to provide some early-days evidence in support. But the mood has changed. I thought this was a liquidation-by-stealth share; now, the reinvigorated management are talking about a Phoenix rising from the ashes. I had to adjust my thinking and accept the risk of Phillips’ strategy-thinking failure. But, so long as the operating numbers are headed in the right direction, and so long as the share price is covered by net current assets and also covered by property, giving an underpinning, I’ll give them the benefit of the doubt on this new journey of discovery. It could be a fun ride. Remaining concerns There are still some things we need to watch out for on this journey – let us know if you spot anything pertaining to the following:

On the face of it Northamber (LSE:NAR) is struggling, with losses of over £1m in each of the last two years. However, there may be hope. The poor overall result for the year to 30th June 2014 needs to be split into two halfs. Naturally, managers reporting poor overall results will try and direct your attention at the good bits. It is left to us to discern if the positives outweigh the negatives, so sceptical analysis is required. Here are the up-beat statements:

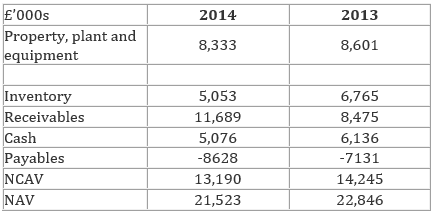

“tough decisions allowed us to implement our new strategy in the second half and this has already led to a significant improvement versus the first half……..when examined as the first half versus the second half in light of the strategy shift the results are more encouraging. The second half delivered our highest half year growth rate in revenue for more than five years with a revenue growth of almost 8% between the first half and the second half and a reduction in losses of over 30% over that time period.” “the upward momentum we have experienced in the latter part of this year may well continue. On that basis I am more optimistic than I have been for some time on the future for the company.” What is the evidence for improvement? David Phillips, chairman, rather clumsily and confusingly (perhaps he got too excited) opens his review by directing our attention at ‘Good Debtors’ (there was ‘a 38% increase, then rising to 57% as at end of September 2014’). Quite a few shareholders did not know what he was on about. I think the secret lies in Note 13 showing trade receivables of £11,669,000, and that, of these, only £282,000 are ‘past due but not impaired’ by more than 30 days. I may be misunderstanding here, but I think that means a lot of additional sales went through in the final two months of the year – boosting receivables by £3.2m compared with the previous year (up from £8.5m to £11.7m), but not greatly increasing the amounts owed beyond the normal due date. In other words, the quantity of goods dispatched in May and June have risen significantly and will have been paid for in July and August. So when David Phillips says the “upward momentum we have experienced in the latter part of this year may well continue. On that basis I am more optimistic than I have been for some time on the future for the company”, I think I know the base on which his optimism if founded. Of course, short term boosts can quickly reverse, so caution is still required. In the final blog on Northamber I'll examine whether they are wasting money trying to find a new formula. Northamber has a share price of 42.65p and a market capitalisation, MCap, of £12m. Is it a 'buy' at these levels? The latest annual report was published last week, and the headline numbers do not make for comfortable reading:

But we need to dig deeper than that to get a picture of what is going on. First let’s check on the balance sheet NCAV is greater than the MCap (if we can trust the BS figures for inventory and receivables), with £5m in cash. On top of that we have two highly marketable properties to take into account:

Thus the value of its property is about the same as the MCap, which means that the MCap is covered twice, once by net current assets and once by saleable property. Tomorrow I'll check out the how trading is going Northamber's (LSE:NAR) managers showed some steel in 2013, encouraging me to buy back then. But are they able to overcome the obstacles they face? Comments made in 2013:

Managerial quality and commitment Directors have sensibly withdrawn from the most unprofitable activities rather than chase after sales in a highly competitive industry. There is always a worry that majority share controlling directors will behave dishonourably and suck money out of the company while it is decline. However here is evidence of a sense of responsibility and duty to fellow shareholders and workers: Chairman and CEO, David Phillips, again waived a large portion of his salary in 2012. It was reduced to only £15,000. The annual reductions in workforce shows grit, but as also resulted in reported low morale on the shop floor. The sound financial position is used as a competitive weapon in negotiating with both customers and suppliers. Lost vendors such as IBM, Fujitsu and Allied Telesis in the past 2 years, often due to failure to push through enough volume. High degree of realism in assessing the business and the industry economics, e.g. ‘it is not possible to be positive about the immediate future’. (Interim Statement 2012) Stability Over the last five years profits average out at just above zero. However, this must be seen in the context of very poor sales in the industry and a halving of sales for this company. There seems to be an ability to stabilise the roughly breakeven position by improved overhead control (down by £0.6m in 2012), improved stock turnover ratios (9.9 times in 2011 and 13.8 times in 2012 resulting in £4.7m of cash being released), shift to higher gross margin product lines (gross margin in 2010: 6.69%, 2011: 6.8%, 2012: 7.7%) and directors waiving of salary. The saving of £0.6m rent each year will again help stabilise. Solvency is not an issue, nor is pension fund obligations (there are none) nor rent obligations (none). Dividend yield is currently 4.5% (1.3p/29p). Given the BS strength, this should be sustainable. Despite the high dividends (2008: 2.2p, 2009: 1.6p, 2010: 1.6p, 2011: 2p) NAV has declined only a small amount: 2008: 90.1p, 2009: 89.4p, 2010: 88.5p, 2012: 85.7p December 2012: 82.7p. It is thus treading water rather than collapsing in a heap. David Phillips, the founder and 61.47% shareholder, is now 68 years old and has shown some signs of wishing to hand over responsibility to others. The transition phase may lead to some instability. Peter Hammett was brought in as a senior operations manager (not on Board) in 2013, but left after just 6 months ‘to save costs’. He is on ‘holiday’ – classed as a consultant. Questions: (1) Will they get swamped by the competitive pressure in this industry, resulting in perennially low profits but continued high capital commitments? Or will the industry economics improve sufficiently to allow acceptable ROCE? (2) Alternatively, will they increasingly see themselves as ‘property plus cash firm’ with an irritating appendage of a wholesaling business draining managerial attention and other resources for little reward? If so will ROCE potential outside of wholesaling become the guiding light? Or will outright liquidation or liquidation by stealth be attractive options? If so will the directors treat the minority shareholders decently? (3) Are they capable of weighing up the alternative uses of the capital at their disposal rather than automatically stick with what the activities they know and love regardless? Is there sufficient clarity on the future industry economics for them to work out the best uses of shareholder capital? Are they true to the fundamental meaning of the statement in the Dec 2012 interims: ‘we are best placed to benefit from any commercial viable opportunity that becomes available that do not overly risk our custodianship of our shareholder asset base’? Tomorrow I'll update the analysis to November 2014 Before selecting Northamber for the 2013 portfolio I worried about its business environment and wondered how the value tied up in its net current assets could be released. Here is what I wrote in August 2013 (it has a bearing on the November 2014 decision): The fly in the ointment

Northamber trades in an industry with some of the worst economic characteristics I have come across. It is a medium sized player in an industry in which entry is wide open (there is little customer captivity/loyalty). Suppliers hold a great deal of power. Customers can quickly obtain alternative prices from competing wholesalers. Substitute methods of getting the product (e.g. computer) to the end-user are viable (e.g. manufacturer selling direct). Furthermore, the year on year product price falls and manufacturers on wafer thin margins expect wholesalers to also operate with low gross profits (in Northamber’s case 7.7%). So what can save this company from cash burn and continuous slide? NCAV shares have serious problems but they usually improve their positions in one or more of the following ways: (1) Industry economics change as result of competitors exiting the industry. The last man (men) standing gains in pricing power to return to reasonable profitability. This is possible with Northamber, but unlikely. It will be one of last standing because of its strong BS and its ability to reduce overheads as sales fall to remain close to breakeven, but I cannot rely on there being a sufficient number of competitors exiting to make a material difference to profitability. There is a good chance that new competitors will emerge. (2) Earnings power will be lifted. Management will stop the slide by returning the company to fair ROCE through excellence in operations or by stopping the head-against-brick-wall-banging and reallocating assets to areas of business with better returns. Here we have some hope. The senior team are very experienced and have shown a willingness to drop low margin products. (3) Liquidation. This is a possibility. It seems to be happening to some degree by stealth: Over the past 6 years turnover has declined from around £200m to around £80m, and with that there has been the release of cash from working capital and quite high dividends and share buy backs. (4) Takeover. Perhaps another industry player will bid for it, but how valuable is the client list when buyer switching cost is so low. The next blog will tackle managerial quality and commitment, and pose some critical questions about this business. I was all set to reject the idea of adding more Northamber (LSE:NAR) shares to my Net Current Asset Value, NCAV, portfolio, despite its reappearance on my simple first-stage quantitative filter. My main reason for doubt, following an enthusiastic purchase for the 2013 NCAV portfolio, is that I thought the corporate strategy had changed too much. In 2013 my hope was that the managers continued to turn inventory and debtors into cash by gradually running down the operating business. But, I thought that changed this summer with the arrival of the 61% shareholder’s son as ‘Strategy Director’. Here we go, I thought, a freshly-minted management consultant given the brief to regenerate the operating business. Cue millions spent on ‘exciting ideas’. Bang goes the safer approach of liquidation-by-stealth.

But, it is not like that. At least, I’m now willing to give the benefit of doubt that money will not splashed around liberally. My change of heart came from reading the detail in the notes to the accounts and combining that with a few other things I know about the company. Before I explain why I’ve bought Northamber for the 2014 NCAV portfolio it’ll be useful background to explain first my motivation for buying it in 2013. Here is what I wrote in August 2013: Northamber appears to qualify as a Net Current Asset Value, NCAV, share. However, Benjamin Graham and I both like(d) an NCAV company to also have ‘good prospects for the business’. This is where the doubts creep in. Any help would be appreciated. Market capitalisation, MCap, is £7.7m. Based on the last (interim) balance sheet to 31 December 2012 the company has current assets of £22.4m including £3.2m of cash (no debt). To calculate NCAV we deduct current liabilities (£7.4m) and non-current liabilities (£0.05) to give an NCAV of just under £15m – almost double the current market cap. Of course, we cannot take the receivables and inventory at face value but need to reduce them to build in a margin of safety. Even taking an ultra-pessimistic approach NCAV is greater than market cap. A further consideration is the shift in the balance sheet over the past two years. Whereas it used to have over £11m of cash (resulting in the net cash being greater than MCap) the directors decided to stop paying rent on its warehouse. They had been trying for years to buy the freehold and they finally got a chance to do so. They paid £6.7m. Rent expense will now fall to zero from £0.6m (a 9% return on the spare cash rather than virtually zero). The company also owns its office building. In total there are around £9m of property assets. These have a reasonably stable market value. So, if worst came to the worst the company could run down its inventory (£6.6m) and its trade receivables (£12.7m). The proceeds, after paying off creditors (£7.4m), could be added to the cash of over £3m to provide a very nice cash pile (even if the amounts received for inventory and receivables are much less than the BS value). On top it could sell or rent out its £9m of property. There could be a company consisting of property plus cash of £3m? £10m? or £15m? Thus, there is reasonable hope that market capitalisation is covered by either (a) NCAV, or (b) property assets. If both turn out to be as valuable as the BS makes out we have a potential trebling in market price. Tomorrow I'll write about my 2013 doubts concerning the operating business, and the possible catalysts for change. This blog considers first the possible sources of revival in the business of Airea, and second the important questions we need to ask while holding its shares. What could cause a revival for the company?

Questions I need help with

Can anyone help with the following?

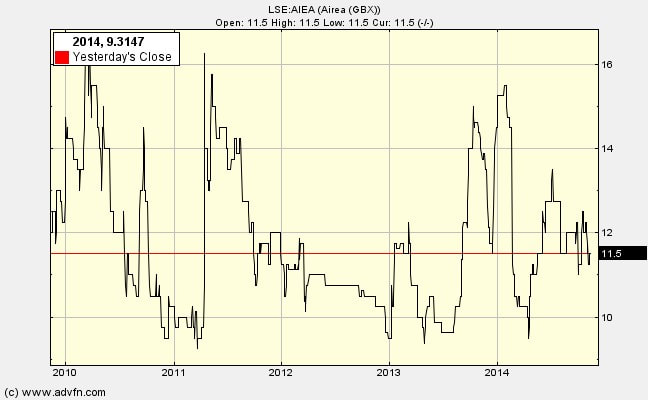

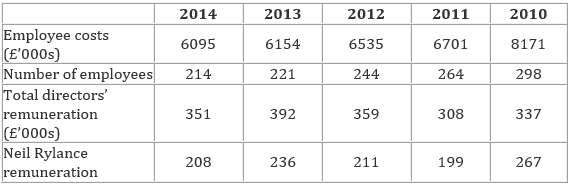

Airea has been purchased as a net current asset value share. This means that it must score reasonably well on a qualitative analysis of its business prospects, management and stability. Overall, it comes out well. Prospects for the business Carpet sales, particularly those for offices, schools, etc., are particular vulnerable to an economic downturn. Through the Great Recession Airea lost sales, but remained profitable. This demonstrates some resilience. It also indicates that the competition is not as cut-throat as it is in some other industries. Or, at least, it has not been too margin-damaging in the past; whether, in the future, competitors will pressurise more on price remains a possibility. Can anyone reading this help us make an assessment here? If carpets are a strongly cyclical then 2015 might be seen in retrospect as the year when sales, profits and owner earnings took off. Up to June 2014 no take-off was detected, with the directors talking of ‘the long awaited recovery in the residential carpet market still awaited’. Quality of managers They have certainly been tested in a harsh environment. Neil Rylance joined the company (Sirdar) as MD of floor coverings in 2008 and shortly afterwards became CEO of Airea. Talk about baptism of fire! He had to deal with the Sirdar legacy and a large decline in demand. But, he had faith – he bought 5.43% of the shares. Martin Toogood joined as an independent NED and he too put his money where his mouth is by buying 4.54% of the shares, mostly at prices higher than today. He is now Chairman. Roger Salt joined in 2004 became Company Secretary in 2009 and FD in 2011. He has a relatively small shareholding. Is that a negative indicator? A case can be made arguing that there is some degree of alignment of managers’ and shareholders’ interests given the share stakes held by the two main leaders. While 45% of the share capital is in ‘non-public’ hands, most of this is held outside of the current Board and so the current managerial team must feel some vulnerability to being replaced if they prove unsatisfactory. These highly experienced managers are not prone to over-optimistic statements on the prospects for the business as you can see by reading the annual reports. While they hope for recovery they anticipate that ‘competition will remain fierce’ and that in the meantime they concentrate on product innovation and efficiency gains in operations: ‘the cost base remains constantly under review.’ A glimpse of that focus on efficiency is provided by the employee statistics, with a gradual lowering of employee costs and flat-lining of director’s remuneration. Employee statistics Stability of the business

First, with no debt and £2m on hand there is no financial gearing risk. Second, with profits shown through a recession the indications are that the underlying operating business is stable. But this could change in the blink of an eye of a competitor’s strategy meeting. But would a price war suit any of the carpet suppliers? Third, the managers seem to want to stick to their knitting, concentrating on the business within their circle of competence rather than experimenting. Fourth, the pension deficit is volatile and could conceivably crush the business given the size of the liability (over £40m) relative to the MCap of the firm (£5.41m) and the value of net current assets (£5.465m). Fifth, if the worst of the economic cycle is behind us, then stability could improve as the BS is strengthened further and the pension deficit is eliminated. Tomorrow's blog raises the questions we need to keep asking |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed