|

You know that I've bought PV Crystalox (LSE:PVCS) shares; so you know I'm prepared to face up to the risks. But I thought it might be worthwhile listing my main concerns. (That way, I'll be able to remember them myself a few months down the line!). If you have some more, or would like to add a point or change of emphasis, I invite you to comment. Worries

There is a lot that could go wrong (if you have any information please tell us):

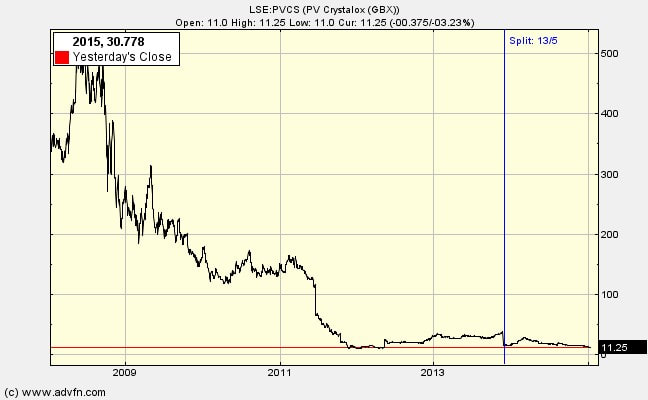

Conclusion Looking at the qualitative factors this is a risky share. It is in an unstable industry with over-supply and plenty of government interference. Prices have been below costs of production for years. On the other hand, to reflect the worries, the share price has fallen so much that it is now 2.4% of what it was a few years ago. Much more importantly, it has declined to one-half of the net current asset value. While it is true that NCAV is being run down, it is happening at a relatively slow rate, giving time for something good to turn up. There are sound reasons to expect this company to find a way out of the darkness, either through long-awaited industry improvement, managerial excellence, being taken over or by liquidation. So despite the risks of being wrong greater than 50% I think it is worth holding these shares. It could be a multi-bagger. The first entrant to my 2015 net current asset value portfolio!

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed