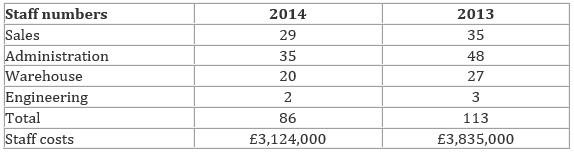

newsletter 29 - northamber - let's check to see if they are throwing Money around 27th november 201426/7/2020 Alex Phillips, new Strategy Director of Northamber has been recruiting staff, which came as a shock to me given my view that the company had settled in for a long run-down period combined with an attack on “unstable margins…and…exposure to empty revenues”. Look a little closer and you discover that Alex has hired a dozen “experienced and qualified staff” presumably to extend the product range into more modern areas such as gaming, and to do something about the poor web-presence (type ‘computer wholesalers’ or ‘computer trade’ into Google and you’ll see that Northamber is difficult to find). “We increased the quality and quantity of resources put into marketing, selling and liaising with suppliers” he says. Hiring staff has, it is true, used our precious cash. But look at the overall staffing and other spending and you'll find a very significant decline: The good news is confirmed by other data; overall ‘overhead costs’ (pretty well everything other than what they pay suppliers) was cut by £1.55m. That is, administrative costs were £0.8m lower than in 2013 at £2.549m and distribution costs were £0.75m lower than in 2013 at £2,948m. Thus overall overhead was lower by 22%. This hardly constitutes evidence of a wildly optimistic plunge into new ventures.

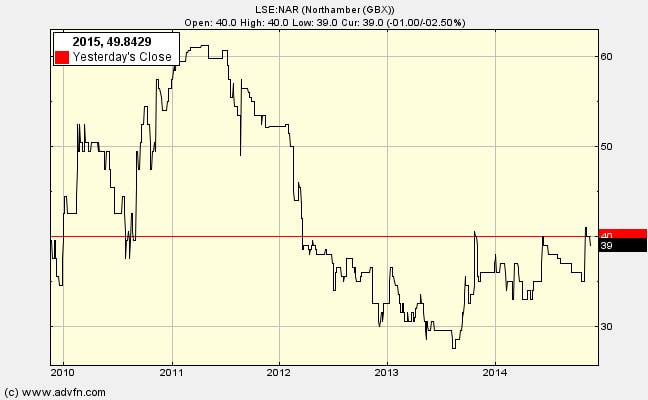

There is more evidence of tight purse strings. First, there was no net investment in property plant and equipment in 2014. Second, director’s pay is very modest totalling £159,000 – believe it or not, that is the total for all the directors. David Phillips waived his right to £165,000, for the third year running, believing that it not right that he should take it while staff are being made redundant (and, perhaps, while shareholders face losses) Conclusions and concerns The managerial team say that they are “on an accelerated path to recovery and profitability….we see significant potential in both our existing vendors and categories and some new categories we are exploring”. And the data seem to provide some early-days evidence in support. But the mood has changed. I thought this was a liquidation-by-stealth share; now, the reinvigorated management are talking about a Phoenix rising from the ashes. I had to adjust my thinking and accept the risk of Phillips’ strategy-thinking failure. But, so long as the operating numbers are headed in the right direction, and so long as the share price is covered by net current assets and also covered by property, giving an underpinning, I’ll give them the benefit of the doubt on this new journey of discovery. It could be a fun ride. Remaining concerns There are still some things we need to watch out for on this journey – let us know if you spot anything pertaining to the following:

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed