|

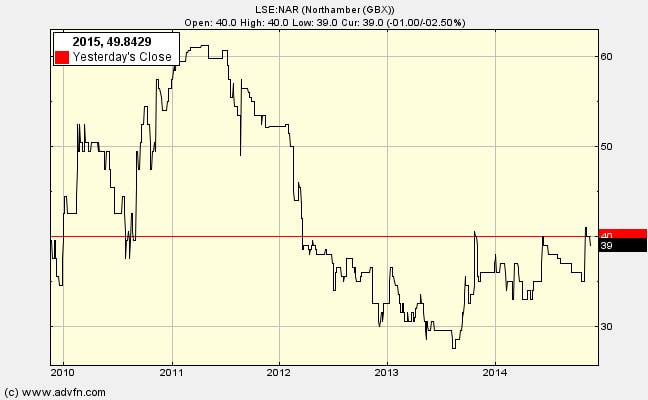

Northamber has a share price of 42.65p and a market capitalisation, MCap, of £12m. Is it a 'buy' at these levels? The latest annual report was published last week, and the headline numbers do not make for comfortable reading:

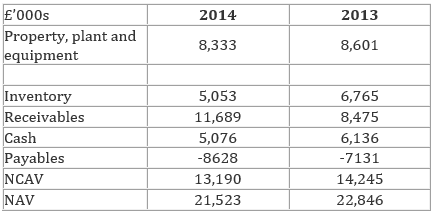

But we need to dig deeper than that to get a picture of what is going on. First let’s check on the balance sheet NCAV is greater than the MCap (if we can trust the BS figures for inventory and receivables), with £5m in cash. On top of that we have two highly marketable properties to take into account:

Thus the value of its property is about the same as the MCap, which means that the MCap is covered twice, once by net current assets and once by saleable property. Tomorrow I'll check out the how trading is going

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed