|

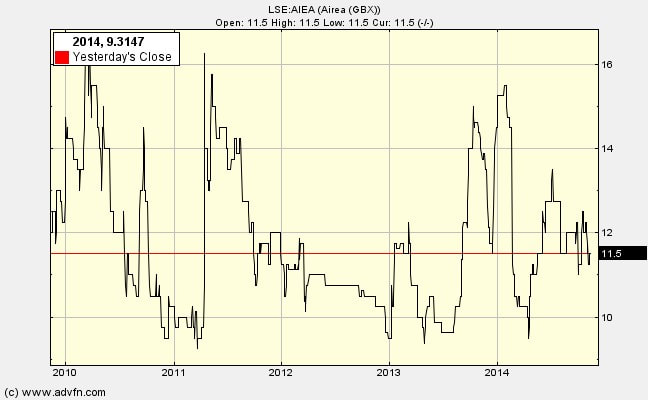

This blog considers first the possible sources of revival in the business of Airea, and second the important questions we need to ask while holding its shares. What could cause a revival for the company?

Questions I need help with

Can anyone help with the following?

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed