|

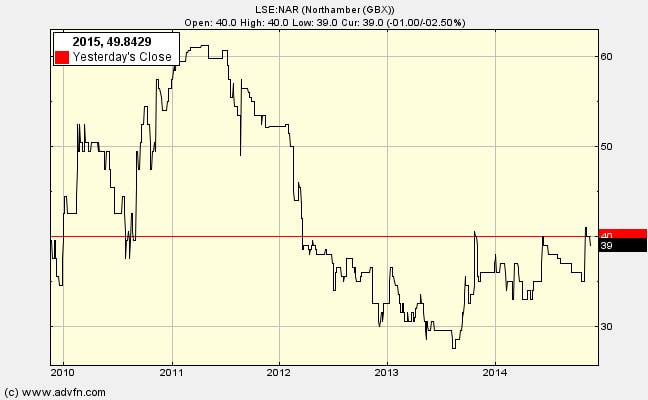

Northamber's (LSE:NAR) managers showed some steel in 2013, encouraging me to buy back then. But are they able to overcome the obstacles they face? Comments made in 2013:

Managerial quality and commitment Directors have sensibly withdrawn from the most unprofitable activities rather than chase after sales in a highly competitive industry. There is always a worry that majority share controlling directors will behave dishonourably and suck money out of the company while it is decline. However here is evidence of a sense of responsibility and duty to fellow shareholders and workers: Chairman and CEO, David Phillips, again waived a large portion of his salary in 2012. It was reduced to only £15,000. The annual reductions in workforce shows grit, but as also resulted in reported low morale on the shop floor. The sound financial position is used as a competitive weapon in negotiating with both customers and suppliers. Lost vendors such as IBM, Fujitsu and Allied Telesis in the past 2 years, often due to failure to push through enough volume. High degree of realism in assessing the business and the industry economics, e.g. ‘it is not possible to be positive about the immediate future’. (Interim Statement 2012) Stability Over the last five years profits average out at just above zero. However, this must be seen in the context of very poor sales in the industry and a halving of sales for this company. There seems to be an ability to stabilise the roughly breakeven position by improved overhead control (down by £0.6m in 2012), improved stock turnover ratios (9.9 times in 2011 and 13.8 times in 2012 resulting in £4.7m of cash being released), shift to higher gross margin product lines (gross margin in 2010: 6.69%, 2011: 6.8%, 2012: 7.7%) and directors waiving of salary. The saving of £0.6m rent each year will again help stabilise. Solvency is not an issue, nor is pension fund obligations (there are none) nor rent obligations (none). Dividend yield is currently 4.5% (1.3p/29p). Given the BS strength, this should be sustainable. Despite the high dividends (2008: 2.2p, 2009: 1.6p, 2010: 1.6p, 2011: 2p) NAV has declined only a small amount: 2008: 90.1p, 2009: 89.4p, 2010: 88.5p, 2012: 85.7p December 2012: 82.7p. It is thus treading water rather than collapsing in a heap. David Phillips, the founder and 61.47% shareholder, is now 68 years old and has shown some signs of wishing to hand over responsibility to others. The transition phase may lead to some instability. Peter Hammett was brought in as a senior operations manager (not on Board) in 2013, but left after just 6 months ‘to save costs’. He is on ‘holiday’ – classed as a consultant. Questions: (1) Will they get swamped by the competitive pressure in this industry, resulting in perennially low profits but continued high capital commitments? Or will the industry economics improve sufficiently to allow acceptable ROCE? (2) Alternatively, will they increasingly see themselves as ‘property plus cash firm’ with an irritating appendage of a wholesaling business draining managerial attention and other resources for little reward? If so will ROCE potential outside of wholesaling become the guiding light? Or will outright liquidation or liquidation by stealth be attractive options? If so will the directors treat the minority shareholders decently? (3) Are they capable of weighing up the alternative uses of the capital at their disposal rather than automatically stick with what the activities they know and love regardless? Is there sufficient clarity on the future industry economics for them to work out the best uses of shareholder capital? Are they true to the fundamental meaning of the statement in the Dec 2012 interims: ‘we are best placed to benefit from any commercial viable opportunity that becomes available that do not overly risk our custodianship of our shareholder asset base’? Tomorrow I'll update the analysis to November 2014

1 Comment

|

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed