|

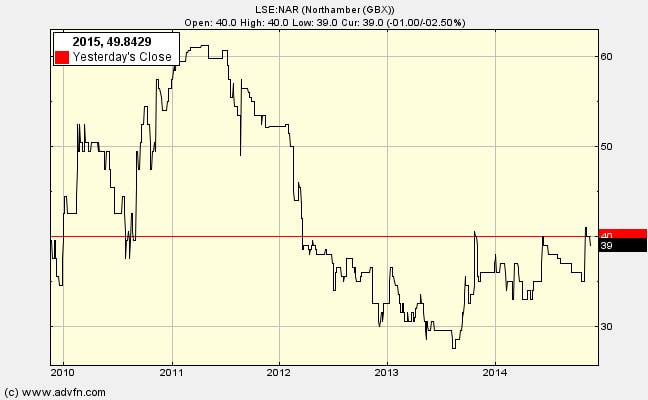

I was all set to reject the idea of adding more Northamber (LSE:NAR) shares to my Net Current Asset Value, NCAV, portfolio, despite its reappearance on my simple first-stage quantitative filter. My main reason for doubt, following an enthusiastic purchase for the 2013 NCAV portfolio, is that I thought the corporate strategy had changed too much. In 2013 my hope was that the managers continued to turn inventory and debtors into cash by gradually running down the operating business. But, I thought that changed this summer with the arrival of the 61% shareholder’s son as ‘Strategy Director’. Here we go, I thought, a freshly-minted management consultant given the brief to regenerate the operating business. Cue millions spent on ‘exciting ideas’. Bang goes the safer approach of liquidation-by-stealth.

But, it is not like that. At least, I’m now willing to give the benefit of doubt that money will not splashed around liberally. My change of heart came from reading the detail in the notes to the accounts and combining that with a few other things I know about the company. Before I explain why I’ve bought Northamber for the 2014 NCAV portfolio it’ll be useful background to explain first my motivation for buying it in 2013. Here is what I wrote in August 2013: Northamber appears to qualify as a Net Current Asset Value, NCAV, share. However, Benjamin Graham and I both like(d) an NCAV company to also have ‘good prospects for the business’. This is where the doubts creep in. Any help would be appreciated. Market capitalisation, MCap, is £7.7m. Based on the last (interim) balance sheet to 31 December 2012 the company has current assets of £22.4m including £3.2m of cash (no debt). To calculate NCAV we deduct current liabilities (£7.4m) and non-current liabilities (£0.05) to give an NCAV of just under £15m – almost double the current market cap. Of course, we cannot take the receivables and inventory at face value but need to reduce them to build in a margin of safety. Even taking an ultra-pessimistic approach NCAV is greater than market cap. A further consideration is the shift in the balance sheet over the past two years. Whereas it used to have over £11m of cash (resulting in the net cash being greater than MCap) the directors decided to stop paying rent on its warehouse. They had been trying for years to buy the freehold and they finally got a chance to do so. They paid £6.7m. Rent expense will now fall to zero from £0.6m (a 9% return on the spare cash rather than virtually zero). The company also owns its office building. In total there are around £9m of property assets. These have a reasonably stable market value. So, if worst came to the worst the company could run down its inventory (£6.6m) and its trade receivables (£12.7m). The proceeds, after paying off creditors (£7.4m), could be added to the cash of over £3m to provide a very nice cash pile (even if the amounts received for inventory and receivables are much less than the BS value). On top it could sell or rent out its £9m of property. There could be a company consisting of property plus cash of £3m? £10m? or £15m? Thus, there is reasonable hope that market capitalisation is covered by either (a) NCAV, or (b) property assets. If both turn out to be as valuable as the BS makes out we have a potential trebling in market price. Tomorrow I'll write about my 2013 doubts concerning the operating business, and the possible catalysts for change.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed