|

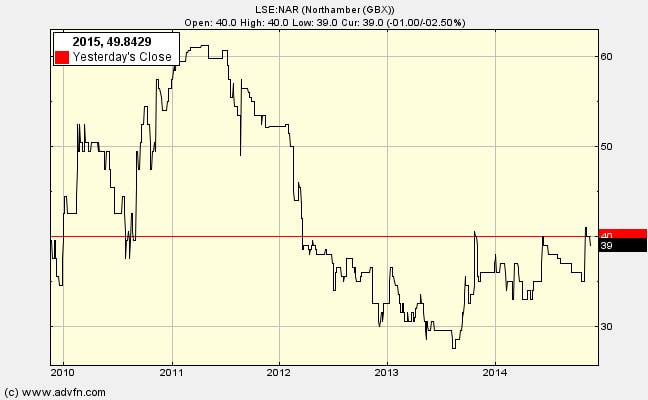

On the face of it Northamber (LSE:NAR) is struggling, with losses of over £1m in each of the last two years. However, there may be hope. The poor overall result for the year to 30th June 2014 needs to be split into two halfs. Naturally, managers reporting poor overall results will try and direct your attention at the good bits. It is left to us to discern if the positives outweigh the negatives, so sceptical analysis is required. Here are the up-beat statements:

“tough decisions allowed us to implement our new strategy in the second half and this has already led to a significant improvement versus the first half……..when examined as the first half versus the second half in light of the strategy shift the results are more encouraging. The second half delivered our highest half year growth rate in revenue for more than five years with a revenue growth of almost 8% between the first half and the second half and a reduction in losses of over 30% over that time period.” “the upward momentum we have experienced in the latter part of this year may well continue. On that basis I am more optimistic than I have been for some time on the future for the company.” What is the evidence for improvement? David Phillips, chairman, rather clumsily and confusingly (perhaps he got too excited) opens his review by directing our attention at ‘Good Debtors’ (there was ‘a 38% increase, then rising to 57% as at end of September 2014’). Quite a few shareholders did not know what he was on about. I think the secret lies in Note 13 showing trade receivables of £11,669,000, and that, of these, only £282,000 are ‘past due but not impaired’ by more than 30 days. I may be misunderstanding here, but I think that means a lot of additional sales went through in the final two months of the year – boosting receivables by £3.2m compared with the previous year (up from £8.5m to £11.7m), but not greatly increasing the amounts owed beyond the normal due date. In other words, the quantity of goods dispatched in May and June have risen significantly and will have been paid for in July and August. So when David Phillips says the “upward momentum we have experienced in the latter part of this year may well continue. On that basis I am more optimistic than I have been for some time on the future for the company”, I think I know the base on which his optimism if founded. Of course, short term boosts can quickly reverse, so caution is still required. In the final blog on Northamber I'll examine whether they are wasting money trying to find a new formula.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed