|

This newsletter asks if Dewhurst (LSE:DWHA) possesses any extraordinary resources, potentially lifting its return on capital employed above the industry average? (see chapter 10 of The Financial Times Guide to Value Investing for more on these ideas for strategic analysis)

Yes. They are already applying their reputation, contacts, knowledge of continuous improvement in manufacturing, knowledge of customer requirements to the new businesses they acquire in closely-related niches. They can continue to employ these competitive strengths to additional acquisitions. Directors point to synergies in product development carried out in London having an impact on operations in America, Australasia and Asia. Some questions

0 Comments

This Newsletter starts the examination of the corporate strategic position of Dewhurst (LSE:DWHA). Is it strong vis-à-vis its rivals, customers and suppliers? Is it vulnerable to substitute products or new entrants to its market? (The frameworks used are explained in chapters 9 and 10 of my book The Financial Times Guide to Value Investing). Industry analysis

(Asking if this industry is likely to achieve high rates of return on capital employed) It is very difficult to obtain information on these niche areas of engineering. In fact I could not find another push button manufacturer – this is more likely due to my unwillingness to search every international market rather than a complete absence of rivals. Much of what follows must be tentative given the poverty of solid data.

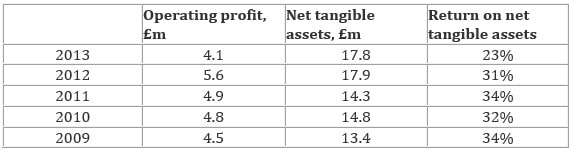

The next Newsletter asks if the company has an extraordinary resource. It also poses some concerns. Dewhurst (LSE:DWHA) came out very well on my April 2014 analysis on its return on capital employed, which is a key indicator of ability to price products high relative to cost and therefore sign of a strong economic franchise. It also presents little to worry about in the balance sheet or in the Boardroom. Return on tangible assets employed With the company displaying a long history of high retention of earnings (low dividend payout ratio) put to good use in acquisitions and organic growth, generating returns on tangible assets of over 30%, there should be significant future growth in owner earnings to look forward to if this performance continues.

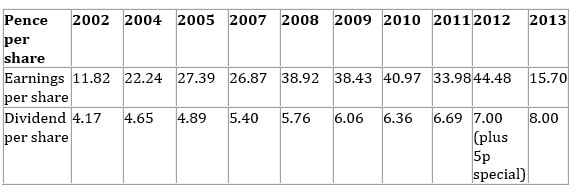

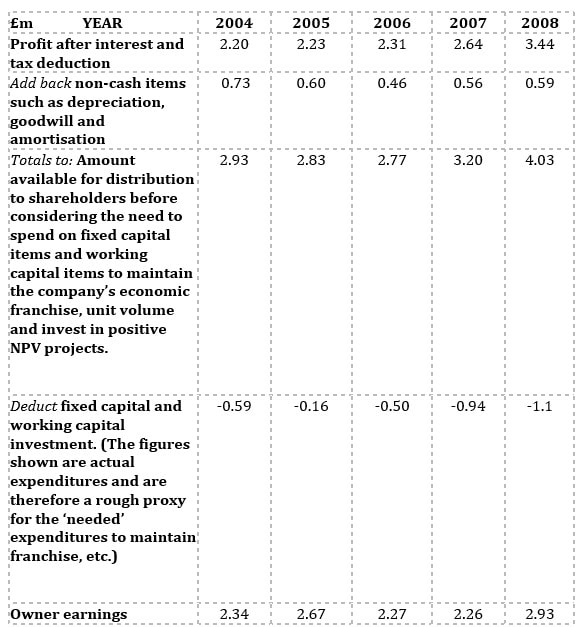

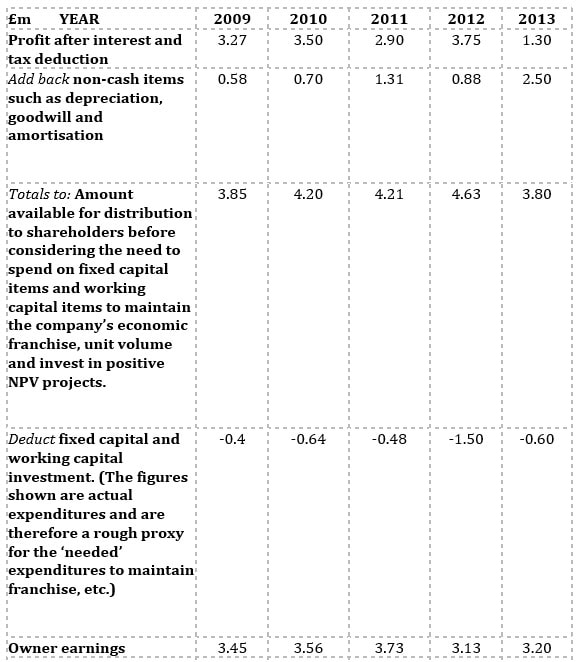

Balance sheet strength (based on 2013) Net asset value in total; £21.87m Net asset value per ‘A’ non-voting share: £2.57 Net tangible asset value in total: £17.86m Net tangible asset value per ‘A’ non-voting share: £2.10 Borrowing: zero Cash: £10.5m Pension deficit: £10.5m Character of the managers They have stuck to engineering, and with the exception of the mistake of the traffic management business (bollards, to put it politely!), they have focused exclusively on those areas where they have competitive advantage: lift components, keypads, train buttons, etc. However, they are now moving a little further away from the core by going for lift car manufacture and escalator belts. These moves are measured (£1m to £2m purchases every one or two years) and they are still reasonably well related to the core. They tell it like it is. No embellishment, frequently subsequent events show them to have been overly pessimist. Smart in assessing value in forms other than in engineering. For example, they recognised that the value of the factory in Hounslow would be worth considerably more if they obtained planning permission to build houses and then sold the land. It was sold for £6m in cash (£5m plus £1m of VAT) and then they paid a special dividend. The family own over 50% of the voting shares and have consistently demonstrated that they run the business as ‘if they are the sole asset of their families and will remain so for the next century’ (Buffett 1999), with steady growth within their circle of competence, constant bearing down on costs, high quality interaction with long-term customers, conservative investment and borrowing policies. Bulletin Board comments on the character of the managers are overwhelmingly positive. They are highly respected with long track record of treating shareholders well. They have carefully nurtured a family business in which they take great pride. Richard Dewhurst (Chairman) has an engineering degree and an accounting qualification. He has worked at Ford and as a management consultant. David Dewhurst, MD, has an engineering degree and previously worked at a brand design consultancy. Total director emoluments in 2013 were £654,000, with the highest paid director receiving £189,000. Richard Dewhurst bought 2,000 Non-voters in October 2013 at £2.849. The next Newsletter will outline an industry analysis and an extraordinary resource search analysis To gain an understanding of the qualities of this business we'll start with conventional earnings numbers and move on to the more sophisticated approach of owner earnings estimation (based on my April 2014 analysis - I'll update in a later Newsletter). Conventional earnings per share and dividends per share analysis. In 31 out of the last 32 years the dividend has grown by 5% or more. Estimated value per share using the dividend growth model and assuming an 8% pa required return with 5% pa future growth in dividend: Price = 8p ÷ (0.08 – 0.05) = 267p Note the very large dividend cover ratio. This might indicate that dividend could be raised significantly if the company does not have good internal projects to invest into. Price-earnings ratio for ‘A’ shares using average eps for 5 years: 320p ÷ 34.71p = 9.2 Owner earnings analysis (I first calculate what earnings were left for shareholders to take out of the business assuming that what the company actually invested in new working capital items and in new fixed capital items was the amount necessary to maintain the quality of the economic franchise, unit volume and invest in value generating projects. This is a bold assumption. When we move to forward-looking analysis to value the firm we need to make an another bold assumption on the real amount needed to invest in new WC and fixed capital items in the future. The historical analysis helps us make that judgment.) To estimate intrinsic value we could take a rough average of recent owner earnings numbers and assume either (a) that this will continue year after year with no growth, or (b) less conservatively, that the annual owner earnings number will grow by, say, 5% per year. Let us take £3.3m as the proven annual earnings power.

Intrinsic value = £3.3m ÷ 0.08 = £41.25m The company has 8.5 million shares in issue therefore the value of each share (ignoring the premium for voting rights) is £41.25m ÷ 8.5m = £4.85.

Intrinsic value = £3.3m ÷ (0.08 – 0.05) = £110m On a per share basis: £110m ÷ 8.5m = £12.94 In the next Newsletter Ill look at return on capital employed, balance sheet strength and managerial character Yesterday Chairman, David Phillips, and the two NED (the Operations Director was busy elsewhere - for the second year running) gave a warm welcome to the three shareholders who turned up. David clearly wanted to encourage questioning and discussion of the company, its strategy and performance. The fact that he wants to engage with shareholders is reassuring given his dominant stake (he could choose to be aloof and to degrade minority shareholder interests). I get the feeling that he would not behave dishonourably/unfairly with regards to minority shareholders. This feeling is reinforced by knowledge of the friendships he has established with long standing holders such as the 11% shareholder. But, it is only a feeling.

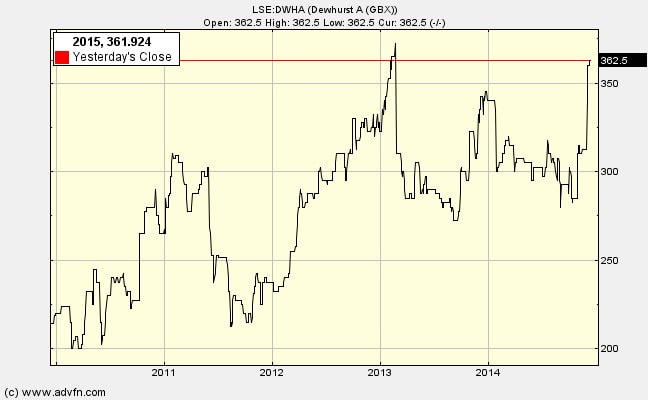

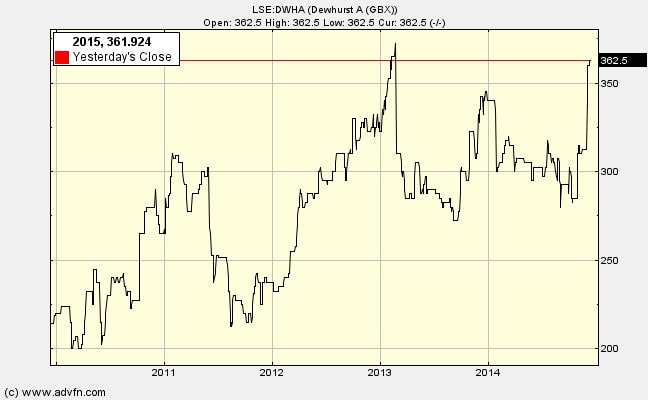

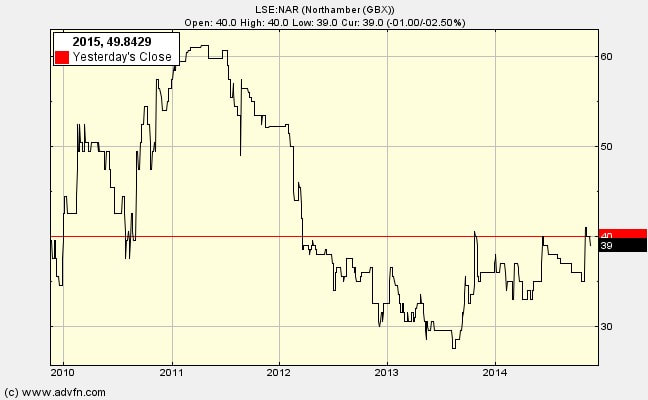

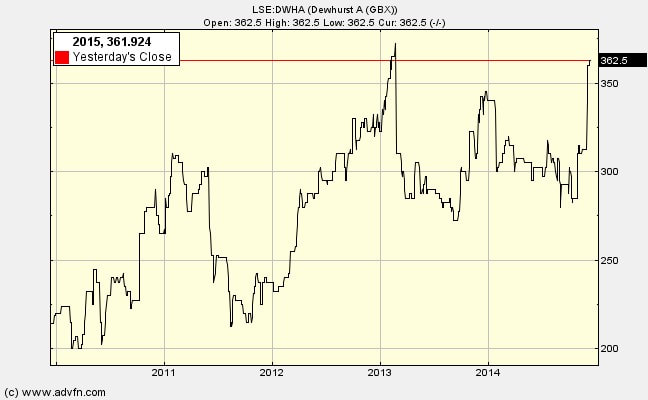

(Please read previous blogs for the background on Northamber and why I bought into it in the first place) On operations The ‘legacy business’ is still limping along with the introduction of new product lines replacing old empty revenues with new profitable activity. I did not detect terrific optimism that a great transformation was underway here. Nor was there much detail on what was actually going on. Basically, the operating business is still struggling with the long downward pressure on prices, margins and volume. There are merely small glimpses of light. Whether profits will appear this year or in some later year is not terribly clear. David declined to forecast, but would refer to ‘looking to channels to market that have retained profitability’. In regard to empty revenues he said: ‘there are a few more to shed’. There was some discussion about the fear of flailing around, throwing money at projects to see if a breakthrough can be found. David said that through long experience that he is very cautious in trying new ideas. He commits only small amounts of money to start, testing the market, and only if it shows promise permitting a gradual build-up. His son, Alex (Strategy Director), is like-minded, according to his father. Recruitment to the new areas of the business, such as expanding CCTV sales, involves high initial costs, but overall remuneration has not gone up much. You could argue that it should be going down, with more saved from the closing down the old than is spent in the new. So much capital in an unprofitable business The illogic of having £20m+ of capital tied up in an unprofitable business was made time and again in an hour-long discussion. To be fair, the BoD have been giving a great deal of thought to alternative treatments of that money. For example, there was little objection to my suggestion of handing a substantial proportion of future releases of capital from WC and fixed items to shareholders. But there was no commitment, and it will not be in the near term. As I’ve stated in earlier Newsletters the property assets are worth substantially more than their book value – especially now that planning permission has been granted for conversion of the Chessington offices to residential. Thus, in rough terms the MCap of £11m or so is covered once by my estimate of property value and once by what can be released through running down the operating business (including £5m of cash). Even with more losses, so long as they were modest, there is a margin of safety here. They are not obsessively committed to the operating business (there are hints of exasperation) and so alternative ideas on generating/returning shareholder value will be considered. There is a good chance that capital tied-up in both will be released over the next few years. I hope this helps. I’d like to introduce you to Dewhurst (LSE:DWHA). I think this is a Warren Buffett and Charlie Munger type of share. That is, it has a strong economic franchise, managers of integrity and talent, excellent accounting numbers, and, when I bought ‘A’ shares in April 2014 at £3.15, was available at a reasonable price. Since then it has reported (in its preliminary statement for the year 30th September) greatly improved profits and strengthened its franchise and BS further.

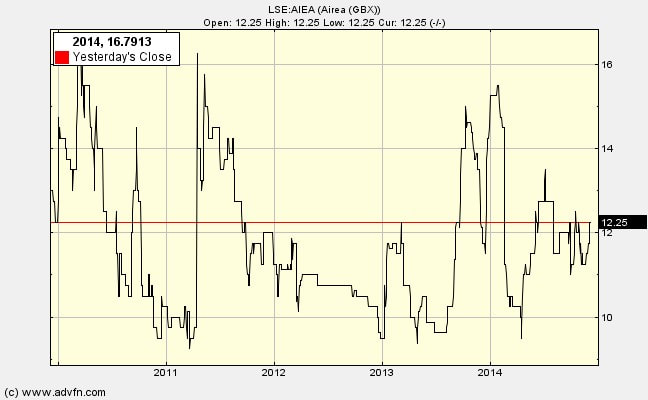

The question now is whether to buy some more or does the share price (at £3.65) already reflect the improvements? I’ll start with the multi-year analysis I posted on my personal website last April which led to my buying (this will take a few Newsletter posts). Then I’ll summarise the 2014 annual results as they relate to my initial analytical framework. April 2014 analysis Dewhurst is a stalwart manufacturing company run by the same family for a century. It designs and manufactures components for lifts, ATM and other keypads, and for trains. The two brothers currently in charge have decades of experience in this field and are supported by a stable professional team. They have grown profits both by organic means with an almost obsessive interest in design prowess and manufacturing efficiency, and by a measured acquisition strategy of companies supplying (generally) complementary products. Often these acquirees have had a long association with Dewhurst as suppliers or customers. Dewhurst are niche engineers, leaders in a number of small fields. For example, they control 90% of the UK market for lift buttons. The family has stuck to its knitting. Demand for individual product lines can be somewhat volatile from year to year, but because they apply their core knowledge and other strengths to selling into three distinct markets (lifts, trains, keypads for ATMs, petrol pumps and ticket machines) and do so all over the world, the various ups and downs generally even out to produce a history of remarkably steady progress. They display resilience through economic vissitudes. There are 3.3m Ordinary shares carrying voting rights and 5.2m Non-voting ‘A’ shares. Thus any overall earnings or valuation figure should be divided by 8.5m shares to derive per-share numbers. The Ordinary shares and the ‘A’ non-voting ordinary shares rank equally in all respects pari passu except that the ‘A’ non-voting ordinary shares do not carry the right to receive notices, attend or vote at meetings of the company. Until September 2012 the ‘A’ and the Ordinary shares were priced in the secondary market very close to each other. Then something strange happened given that the economic rights are equal – the voting shares rose a great deal more than the non-voting. Thus today (April 2014) the voting shares trade at £5.20 whereas the ‘A’ shares trade at £3.20. Market capitalisation: 3.3m Ordinary shares x £5.20 = £17.16m 5.2m Non-voting ‘A’ shares x £3.20 = £16.64m Total capitalisation = £33.80m Revenue split (2013) Lifts £34m Transport £3m Keypads £10m In the next Newsletter I'll look at earning numbers over 11 years. I bought into Airea (LSE:AIEA) last month after considering, amongst other things, whether the management are both (a) competent, and (b) shareholder oriented. The announcement last week is encouraging in both regards. Here is the problem they face: the company has 1,240 shareholders, but 460 of those hold 1,000 shares or less, worth under £122. It is not worth their while selling the shares through a broker given transaction costs.

Airea’s directors have found a way of: (a) helping these shareholders, (b) lowering its costs by not having to continue communication with so many shareholders, and (c) raising earnings per share by around 20% It proposes to purchase up to 10m shares, which is 21.6% of the total, with a bias towards purchasing from the 460 trapped investors. I applaud this imaginative solution. The company has £2m cash earning very little. By using £1.225m in this way it moves toward a more efficient balance sheet. The added bonus is that this action indicates a managerial team which is less focused on empire-building by hoarding cash and splurging it on acquisition etc., and more focused on achieving better returns on capital employed, increased eps and a rising share price. It helps that the two main directors have around 5% (soon to be 6%) of the equity. Hidden in the documents sent to shareholders was more good news: on the back of rising UK private construction and refurbishment “the success achieved in the second half of the last financial year has been maintained and the dip in sales seen in the first half of the year reversed”. This is despite the stagnation in the UK public sector and the Eurozone; when, if, they pick up the shares could really motor. I would value your comments on the following – what have I missed? Fletcher King (LSE:FLK) falls between two investment approaches. It has reasonably good qualitative factors, sufficient to qualify for a Benjamin Graham NCAV share. That is, able managers with a reasonable degree of integrity regarding minority shareholders’ interests, a good solid business, battle-hardened in the recession and a high degree of stability (e.g. long profit record, no borrowing, no pension scheme). But there is an insufficient margin of safety in the balance sheet. To qualify on quantitative grounds I would need the share price to fall to NCAV, i.e. 36.4p to buy more.

The Buffett and Munger investment approach is much more demanding in terms of having a strong economic franchise surrounded by a deep and dangerous moat. Fletcher King does not make that grade. Having said that, I will not be selling my current holdings at current prices for two reasons: (1) it is important to stick to a rule to prevent the tendency to sell NCAV shares too early. This guards against the psychological imperative to cash-in to gain the boost to ego from recording a profit (or fear of regret from not crystalising a gain), thus frequently losing out on the potential for multi-baggers to grow. It also reduces churn, lowering expenses and tax on the portfolio. This rule is bound to lead to individual-decision regret from time to time, but overall it will produce a better return. (2) This is a good point in the cycle for property-related businesses to thrive. However, when the time comes for great over-excitement about the commercial property market around the country I will be looking to sell. I’m hoping that will be after FK has reported a string of increasingly profitable years, and when latecomers are piling into the share, pushing it back to where it was in the last property boom, around 110p. I hope, I hope. So, it is on my watch list to buy at 36.4p, 30% below the current price. if Mr Market pushes down there (stranger things have happened) I'll be very interested in picking up some more. Investment is not about constant buying and selling activity; flitting about from flower to flower. It is about constant activity in terms of PREPARATION. While preparing it is about controlling emotions captured by the words DISCIPLINE and PATIENCE. With these all in place and occupying most of the investor's effort, from time to time there will be a need for DECISIVE ACTION, but this is rare. I’ll keep an eye on FK, and update after the interims appear in a couple of weeks. Clearly, at the current share price Fletcher King (LSE:FLK) does not qualify as a NCAV share because its share has risen so far above NCAV. The question now becomes whether its robust operating performance indicates that it is a ‘strong economic franchise with capable and high-integrity (shareholder orientated) managers’? In other words it is less a Benjamin Graham share and more a Warren Buffett share. I have some doubts. First, it has very limited customer captivity. It would find it difficult to raise prices above competitors simply based on the notion that it has extraordinary relationships, or reputation, or capabilities, or knowledge.

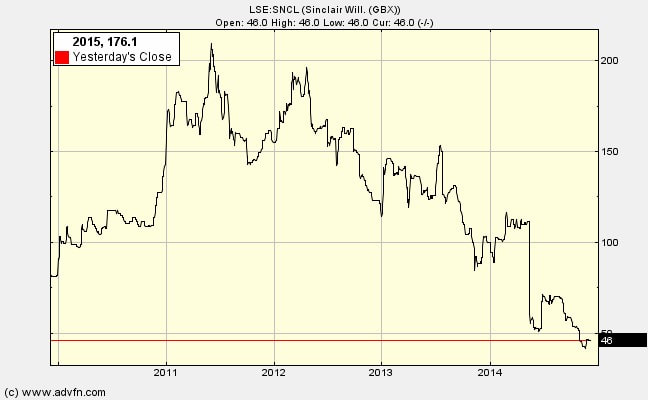

It has some edge over some competitors in these qualities, but these are not sufficiently strong to warrant the term ‘extraordinary resource’. I think that customers will switch agents if FK tried to raise margins too high. Second, sense of duty to minority holders. I get the feeling that the senior team have some sense of fiduciary duty to all shareholders, but they manage to temper this with their urge to pay themselves very large bonuses in the good times. On the other hand remuneration does go down in recessions. Which brings me to the third point - the cycle. This is a highly cyclical company because activity in commercial property is highly cyclical. Cyclical companies should not always be shunned, but they must come cheap. Fourth, average return on capital employed through the cycle should be high to qualify as a strong franchise share. FK fails on this point because it holds so much of shareholders’ money unnecessarily. It could easily return a couple of million pounds and double its ROCE because profits will be lowered by only £0.01m, but shareholders capital usage halves. With net assets of £3.729m, ROCE is £0.368m/£3.729m = 9.9% With £2m paid out to shareholders ROCE rises to £0.367m/£1.729m = 21.2% An alternative is to use the spare cash to create more fee-generating-capital-gain-making SHIPS. Just don’t leave it producing a return of 0.5%!!!! Tomorrow I conclude my analysis, and a decision on whether to buy I was asked to look at William Sinclair. It is not a company that had come up one of my screening system, but I was interested because, superficially at least, it has lots of net assets. However I found some problems; I think I'll stick to my normal methods of finding good shares from now on. Anyway, for those of you interested in William Sinclair "supplier of growing media" (peat etc.), here is what I discovered. This share does not have a hope of getting into my portfolio on the basis of trading performance and managerial potential - both are bad. So I looked at it as a possible net current asset value share. I’m sorry if the following contains errors, but I cannot spend too much time on this one – please correct mistakes. The following figures are somewhat tentative as it is not at all clear what is happening to the BS of this company.

Market capitalisation is £7.9m From latest interims: Inventory £13.6m, Receivables £23.9m, Tax refund £0.5m, Cash £0.9m. Thus total current assets amount to £38.9m. We need to at least deduct payables (£14.2m) and pension deficit (£22.1m). This leaves £2.6m. However there was an influx of cash in July of £12.25m. But even with that influx “net bank debt” stood at £3.5m in September (it was £25.7m in March). We also need to deduct the extortionate convertible loan (they must have been desperate, and the desperation indicates limited surplus value in property to offer lenders). Even at its nominal value it is £8.24m (it may amount to more). Thus we have £2.6m + £12.25m - £3.5m - £8.24m = £3.11m NCAV before we do the usual thing of knocking off a proportion of inventory and receivable to be more conservative (do you trust this managerial team to avoid rose-tinted views on value of inventory and receivables?). Thus NCAV is probably negative. Does the property in the BS help? Well, as far as I can tell from the Notes this is mostly land in hilly country. Difficult to value that. The 9 acres in Lincoln? Even if worth £1m per acre I’m not tempted. Can anyone tell us if it has lots more industrial land? Qualitative factors: Reasonable business prospects? No Capable management? No Stable? Impossible to tell if BS is stable with the information available, but it probably is not. Operations are not stable. Conclusion: No margin of safety here. I have much more solid, lower risk shares to put my money into my portfolio. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed