|

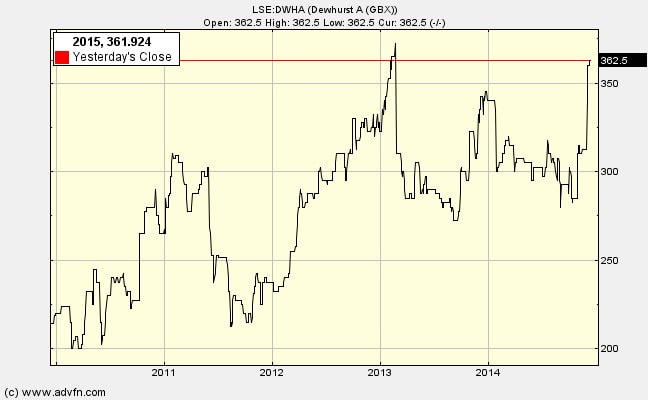

This newsletter asks if Dewhurst (LSE:DWHA) possesses any extraordinary resources, potentially lifting its return on capital employed above the industry average? (see chapter 10 of The Financial Times Guide to Value Investing for more on these ideas for strategic analysis)

Yes. They are already applying their reputation, contacts, knowledge of continuous improvement in manufacturing, knowledge of customer requirements to the new businesses they acquire in closely-related niches. They can continue to employ these competitive strengths to additional acquisitions. Directors point to synergies in product development carried out in London having an impact on operations in America, Australasia and Asia. Some questions

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed