|

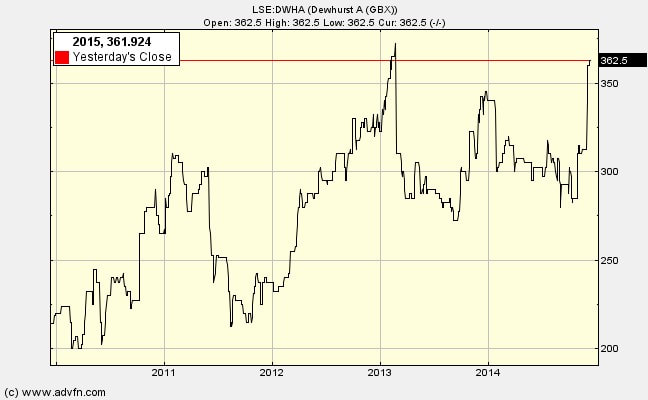

I’d like to introduce you to Dewhurst (LSE:DWHA). I think this is a Warren Buffett and Charlie Munger type of share. That is, it has a strong economic franchise, managers of integrity and talent, excellent accounting numbers, and, when I bought ‘A’ shares in April 2014 at £3.15, was available at a reasonable price. Since then it has reported (in its preliminary statement for the year 30th September) greatly improved profits and strengthened its franchise and BS further.

The question now is whether to buy some more or does the share price (at £3.65) already reflect the improvements? I’ll start with the multi-year analysis I posted on my personal website last April which led to my buying (this will take a few Newsletter posts). Then I’ll summarise the 2014 annual results as they relate to my initial analytical framework. April 2014 analysis Dewhurst is a stalwart manufacturing company run by the same family for a century. It designs and manufactures components for lifts, ATM and other keypads, and for trains. The two brothers currently in charge have decades of experience in this field and are supported by a stable professional team. They have grown profits both by organic means with an almost obsessive interest in design prowess and manufacturing efficiency, and by a measured acquisition strategy of companies supplying (generally) complementary products. Often these acquirees have had a long association with Dewhurst as suppliers or customers. Dewhurst are niche engineers, leaders in a number of small fields. For example, they control 90% of the UK market for lift buttons. The family has stuck to its knitting. Demand for individual product lines can be somewhat volatile from year to year, but because they apply their core knowledge and other strengths to selling into three distinct markets (lifts, trains, keypads for ATMs, petrol pumps and ticket machines) and do so all over the world, the various ups and downs generally even out to produce a history of remarkably steady progress. They display resilience through economic vissitudes. There are 3.3m Ordinary shares carrying voting rights and 5.2m Non-voting ‘A’ shares. Thus any overall earnings or valuation figure should be divided by 8.5m shares to derive per-share numbers. The Ordinary shares and the ‘A’ non-voting ordinary shares rank equally in all respects pari passu except that the ‘A’ non-voting ordinary shares do not carry the right to receive notices, attend or vote at meetings of the company. Until September 2012 the ‘A’ and the Ordinary shares were priced in the secondary market very close to each other. Then something strange happened given that the economic rights are equal – the voting shares rose a great deal more than the non-voting. Thus today (April 2014) the voting shares trade at £5.20 whereas the ‘A’ shares trade at £3.20. Market capitalisation: 3.3m Ordinary shares x £5.20 = £17.16m 5.2m Non-voting ‘A’ shares x £3.20 = £16.64m Total capitalisation = £33.80m Revenue split (2013) Lifts £34m Transport £3m Keypads £10m In the next Newsletter I'll look at earning numbers over 11 years.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed