|

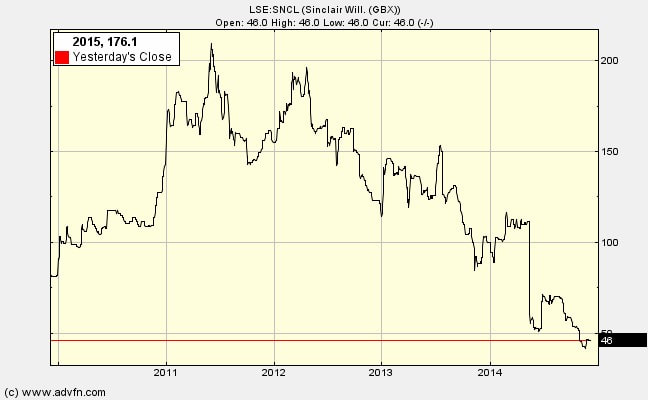

I was asked to look at William Sinclair. It is not a company that had come up one of my screening system, but I was interested because, superficially at least, it has lots of net assets. However I found some problems; I think I'll stick to my normal methods of finding good shares from now on. Anyway, for those of you interested in William Sinclair "supplier of growing media" (peat etc.), here is what I discovered. This share does not have a hope of getting into my portfolio on the basis of trading performance and managerial potential - both are bad. So I looked at it as a possible net current asset value share. I’m sorry if the following contains errors, but I cannot spend too much time on this one – please correct mistakes. The following figures are somewhat tentative as it is not at all clear what is happening to the BS of this company.

Market capitalisation is £7.9m From latest interims: Inventory £13.6m, Receivables £23.9m, Tax refund £0.5m, Cash £0.9m. Thus total current assets amount to £38.9m. We need to at least deduct payables (£14.2m) and pension deficit (£22.1m). This leaves £2.6m. However there was an influx of cash in July of £12.25m. But even with that influx “net bank debt” stood at £3.5m in September (it was £25.7m in March). We also need to deduct the extortionate convertible loan (they must have been desperate, and the desperation indicates limited surplus value in property to offer lenders). Even at its nominal value it is £8.24m (it may amount to more). Thus we have £2.6m + £12.25m - £3.5m - £8.24m = £3.11m NCAV before we do the usual thing of knocking off a proportion of inventory and receivable to be more conservative (do you trust this managerial team to avoid rose-tinted views on value of inventory and receivables?). Thus NCAV is probably negative. Does the property in the BS help? Well, as far as I can tell from the Notes this is mostly land in hilly country. Difficult to value that. The 9 acres in Lincoln? Even if worth £1m per acre I’m not tempted. Can anyone tell us if it has lots more industrial land? Qualitative factors: Reasonable business prospects? No Capable management? No Stable? Impossible to tell if BS is stable with the information available, but it probably is not. Operations are not stable. Conclusion: No margin of safety here. I have much more solid, lower risk shares to put my money into my portfolio.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed