|

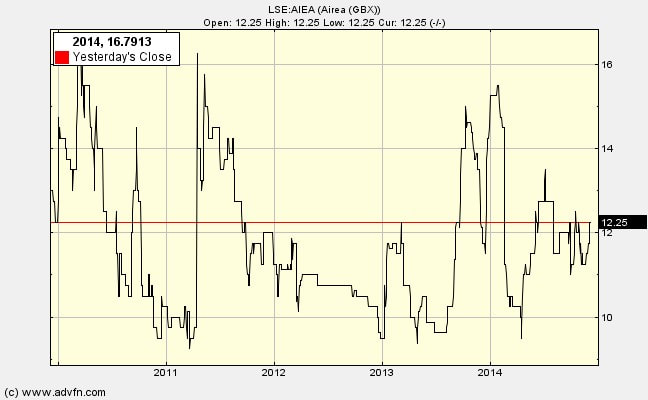

I bought into Airea (LSE:AIEA) last month after considering, amongst other things, whether the management are both (a) competent, and (b) shareholder oriented. The announcement last week is encouraging in both regards. Here is the problem they face: the company has 1,240 shareholders, but 460 of those hold 1,000 shares or less, worth under £122. It is not worth their while selling the shares through a broker given transaction costs.

Airea’s directors have found a way of: (a) helping these shareholders, (b) lowering its costs by not having to continue communication with so many shareholders, and (c) raising earnings per share by around 20% It proposes to purchase up to 10m shares, which is 21.6% of the total, with a bias towards purchasing from the 460 trapped investors. I applaud this imaginative solution. The company has £2m cash earning very little. By using £1.225m in this way it moves toward a more efficient balance sheet. The added bonus is that this action indicates a managerial team which is less focused on empire-building by hoarding cash and splurging it on acquisition etc., and more focused on achieving better returns on capital employed, increased eps and a rising share price. It helps that the two main directors have around 5% (soon to be 6%) of the equity. Hidden in the documents sent to shareholders was more good news: on the back of rising UK private construction and refurbishment “the success achieved in the second half of the last financial year has been maintained and the dip in sales seen in the first half of the year reversed”. This is despite the stagnation in the UK public sector and the Eurozone; when, if, they pick up the shares could really motor.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed