|

Yesterday Chairman, David Phillips, and the two NED (the Operations Director was busy elsewhere - for the second year running) gave a warm welcome to the three shareholders who turned up. David clearly wanted to encourage questioning and discussion of the company, its strategy and performance. The fact that he wants to engage with shareholders is reassuring given his dominant stake (he could choose to be aloof and to degrade minority shareholder interests). I get the feeling that he would not behave dishonourably/unfairly with regards to minority shareholders. This feeling is reinforced by knowledge of the friendships he has established with long standing holders such as the 11% shareholder. But, it is only a feeling.

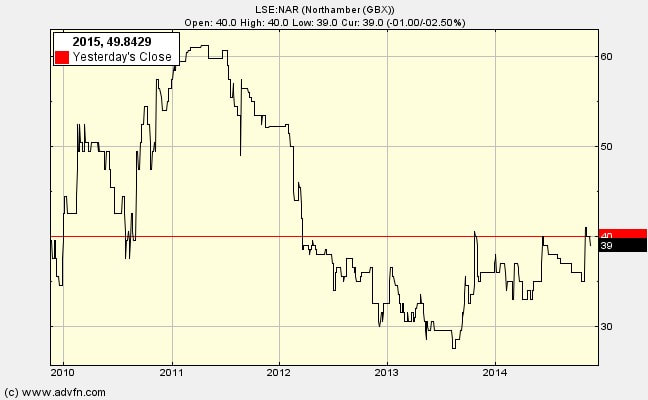

(Please read previous blogs for the background on Northamber and why I bought into it in the first place) On operations The ‘legacy business’ is still limping along with the introduction of new product lines replacing old empty revenues with new profitable activity. I did not detect terrific optimism that a great transformation was underway here. Nor was there much detail on what was actually going on. Basically, the operating business is still struggling with the long downward pressure on prices, margins and volume. There are merely small glimpses of light. Whether profits will appear this year or in some later year is not terribly clear. David declined to forecast, but would refer to ‘looking to channels to market that have retained profitability’. In regard to empty revenues he said: ‘there are a few more to shed’. There was some discussion about the fear of flailing around, throwing money at projects to see if a breakthrough can be found. David said that through long experience that he is very cautious in trying new ideas. He commits only small amounts of money to start, testing the market, and only if it shows promise permitting a gradual build-up. His son, Alex (Strategy Director), is like-minded, according to his father. Recruitment to the new areas of the business, such as expanding CCTV sales, involves high initial costs, but overall remuneration has not gone up much. You could argue that it should be going down, with more saved from the closing down the old than is spent in the new. So much capital in an unprofitable business The illogic of having £20m+ of capital tied up in an unprofitable business was made time and again in an hour-long discussion. To be fair, the BoD have been giving a great deal of thought to alternative treatments of that money. For example, there was little objection to my suggestion of handing a substantial proportion of future releases of capital from WC and fixed items to shareholders. But there was no commitment, and it will not be in the near term. As I’ve stated in earlier Newsletters the property assets are worth substantially more than their book value – especially now that planning permission has been granted for conversion of the Chessington offices to residential. Thus, in rough terms the MCap of £11m or so is covered once by my estimate of property value and once by what can be released through running down the operating business (including £5m of cash). Even with more losses, so long as they were modest, there is a margin of safety here. They are not obsessively committed to the operating business (there are hints of exasperation) and so alternative ideas on generating/returning shareholder value will be considered. There is a good chance that capital tied-up in both will be released over the next few years. I hope this helps.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed