|

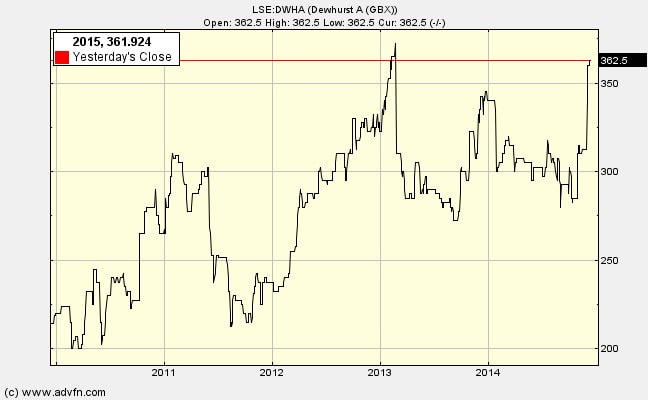

This Newsletter starts the examination of the corporate strategic position of Dewhurst (LSE:DWHA). Is it strong vis-à-vis its rivals, customers and suppliers? Is it vulnerable to substitute products or new entrants to its market? (The frameworks used are explained in chapters 9 and 10 of my book The Financial Times Guide to Value Investing). Industry analysis

(Asking if this industry is likely to achieve high rates of return on capital employed) It is very difficult to obtain information on these niche areas of engineering. In fact I could not find another push button manufacturer – this is more likely due to my unwillingness to search every international market rather than a complete absence of rivals. Much of what follows must be tentative given the poverty of solid data.

The next Newsletter asks if the company has an extraordinary resource. It also poses some concerns.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed