|

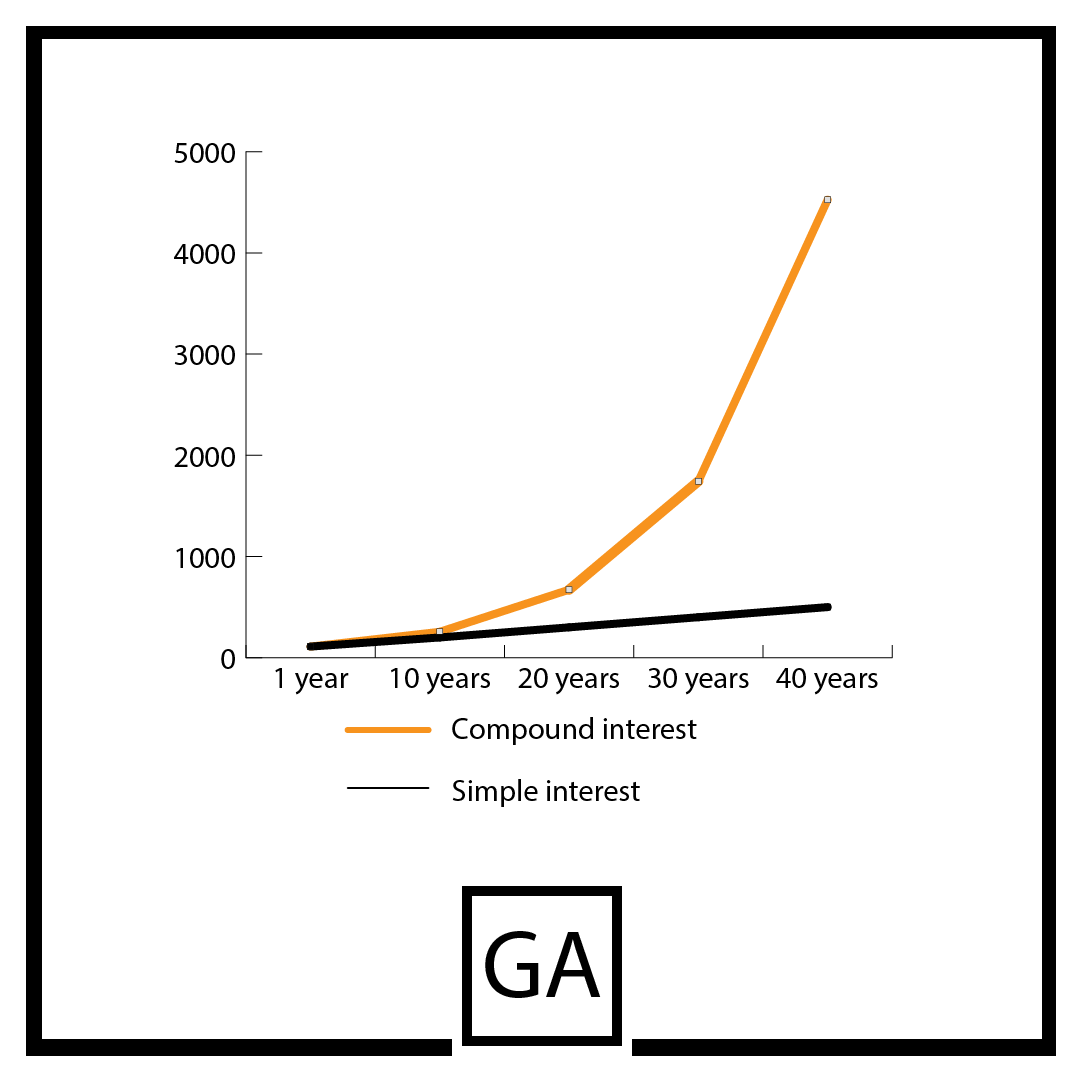

If someone makes a deposit of £100 in two investments both with an annual rate of 10% with just the difference of one having simple interest an the other compound interest, over a 40-year period the difference would be of £4025 with the simple interest one having £500 and the compound £4525 This is the power of compounding the return! Compounding is ploughing back the income received and then getting a return on the accumulated ploughed-back money as well as the original capital.

Quit the short term guessing game and invest long term Stock markets in the short term are a guessing game. Shares should be viewed as long-term investments and not short-term gambling counters. If you treat shares like an investment you can become a millionaire! Charlie Munger, a billionaire investor, says never interrupt it unnecessarily. Long-term investment is like planting trees. At first you can only find enough money to buy a few saplings. They look small and pathetic. Then you add to your collection month by month. For the first few years your wood looks unimpressive and hardly worth the effort. Still, you nurture and keep adding to it. Perhaps later you stop buying more saplings and decide to devote merely the minimal effort. Perhaps you turn away to other interests for a few years. Then, when you do look again, you are amazed to find that what was scrubland has been transformed into a magnificent arboretum with fine strong specimens. Time has worked its magic. What seem like small annual rates of growth can, with compounding, produce a great mass from small beginnings.

0 Comments

Connect Group (LSE:CNCT) has not had an attractive-looking balance sheet for many years. It had/has very high levels of intangible assets, especially goodwill, due to paying excessive prices for acquisitions. Even after including those doubtful “assets” in its balance sheet it could barely report a positive net current asset value. On top of that, it used to carry over £100m of bank debt – now down to between £50m and £90m depending on which day in the month you look at it.

Now that it has written-off large chunks of goodwill and other intangibles it shows a negative net asset value, NAV, of £74m. Excluding intangibles the net liability is £84m. Balance sheet data. £m August 2019 August 2018 August 2017 August 2016 Non-current intangible assets 10 51 107 165 Other non-current assets 22 44 51 62 Trade and other receivables 124 130 98 139 Other current assets 57 32 84 52 TOTAL ASSETS 213 257 340 418 Trade and other payables -174 -176 -136 -199 Other current liabilities -56 -64 -91 -83 Non-current liabilities -57 -63 -88 -123 NET ASSETS -74 -46 25 13How it survives its poor balance sheet The BS is heavily dependent on very large amounts of credit granted by its suppliers, mostly publishers - trade and other payables are £174m. Connect does not pay for newspapers and magazines until sometime after its customers have paid them. Newsagents pay via weekly direct debits but across the Group the average credit period taken by customers is 22 days but the average credit period taken by Connect from its suppliers is 31 days. A concern would arise if this positive cash cycle is interrupted, meaning that Connect would need to borrow more from banks. However, there is reassurance in the contract terms with publishers - they contain clauses granting long credit periods, and the contracts last for five years. Net bank debt While the company has brought down its debt levels by selling businesses and by applying some of its positive free cash flow to debt repayment, the indebtedness numbers are still very high. £m August 2019 August 2018 August 2017 Opening net debt -83.4 -82.1 -141.7 Free cash flow to equity +8.3 +20.2 +28.7 Pension deficit recovery -1.6 -4.7 -4.8 Dividend paid 0 -24.1 -23.6 Disposal proceeds 0 +12.9 +58.2 Cash flow from discontinued business 0 -8.8 -1.1 Finance lease creditor and other +2.8 +3.2 +2.2 Closing net debt -73.9 -83.4 -82.1 Net debt/EBITDA 1.9x 1.8x 1.2xSince yearend £15m has been raised via sale and leasebacks. Also another six months of stable trading to the end of February has probably reduced debt levels by around £6m. Covenants on bank loans:

………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1 n 2014 the big idea at Connect Group (LSE:CNCT) was to diversify into parcel delivery and at the same time gain synergy with the early morning News Distribution business by buying Tuffnells for £121m. Here are the performance numbers for Tuffnells under Connect’s ownership – not pretty reading for shareholders who forked out £121m.

£m 2019 2018 2017 2016 Less than year to August 2015 Revenue 165 175 183 174 114 Adjusted operating profit -14.1 -5.0 12.0 15.0 9.7 Exceptional items – write-offs -53.5 -52.7 -7.7 -8.9 -4.6 Statutory operating profit -67.6 -57.7 4.3 6.1 5.1 Assets n/a 109 167 176 177 Liabilities n/a -35 -36 -49 -41 Depreciation and amortisation -10.9 -57.7 -11.2 -10.4 -6.5 Additions to non-current assets 4.8 4.4 6.7 11.1 Perhaps we should be grateful turnover did not decline much, indicating that there are thousands of customers still coming to Tuffnells despite hiccups in customer service. Having said that, Gary Kennedy mentioned, at a November analyst’s briefing that Tuffnells’ “volumes continue to be soft” and “unfortunately in that business we are not at the point we expected to be. But I have no doubt we have the resolve to get there….We’ve fallen short – competitors are picking up customers. It’s a highly competitive market. Brexit doesn’t help.” Not exactly brimming with confidence, is he? There wasn’t any good news to report at January’s AGM other than Gary Kennedy, Chairman, saying that Michael Holt, who had recently been put in charge of Tuffnells, was doing “a sterling job”. The Tuffnells turnaround plan The directors have pointed to the following actions,

Some scenarios

I’m hopeful that the increased national demand for parcel delivery has greatly increased the chances of Tuffnells being profitable this year and next. If Tuffnells just breaks-even Connect Group makes about £23.7m pa after tax from Smiths News (perhaps declining by 4% pa in future). Company intrinsic value is then over five times its current market price.2. 2. Sell it An industry buyer is found to ………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1 Connect Group’s (LSE:CNCT) Smiths News produces profits and lots of cash flow year after year because it is a duopolist (alongside Menzies) delivering newspapers and magazines to shops. The duopolists tend to stick to their own territories when allocating their vans – it is pointless having two rivals vans passing each other in rural Norfolk for example, so either SN or M will take that contract.

A barrier deterring entry to the newspaper distribution business: A potential entrant would have to win five-year contracts from the major publishers on operating margins of around 3% and then organise a fleet of vans, with drivers and sorting depots. All the while, SN and M, with their efficiencies and experience, will be breathing down their necks and constantly undercutting on price. Connect’s Dawson Media Direct, DMD, which supplies printed and digital media to airlines and travel points in the UK and worldwide, has recently suffered after losing contracts because some airlines switched to electronic newspapers. In the year to the end of August DMD’s revenue and income, for the first time, are subsumed within Smiths News numbers. This is to be expected given that DMD is now quite small and engaged in media distribution. Smiths News Smiths News has a declining turnover because the volume of newspapers and magazines bought in the UK has fallen and is expected to continue to fall. Offsetting this are cover price rises, but nonetheless SN’s revenue has dropped by 3% - 5% per year – see table. This pattern has severely disturbed Mr Market – why buy into a business with falling sales? The pattern of sales also bothered Connect’s leadership team over the past decade. It bothered them so much they thought it a good idea to go out and spend ………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1 Connect Group (LSE:CNCT) has one business generating an operating profit north of £34m. For a £37m market capitalisation company that is a substantial amount. And this operating profit, from the Smith News newspaper and magazine distribution business, has been consistently high (2014: £40.8m, 2015: £23.2m, 2016: £34.1m, 2017: £36.1m, 2018: £25m, 2019: £36.3m, expectation for year to August 2020: £34m).

Smiths News has a 55% market share, and local monopolies all over the country. Its only opposition is Menzies News, which tends to stick to its own newsagent territories. Entry into this line of business is very hard given the strengths of the two incumbents. Over 80% of publishers have already signed up to contracts with Smiths News for another five years. If this business was the only one owned by Connect Group then, obviously, it’s a good share to buy. Mr Market, on the other hand, thinks, because fewer physical newspapers and magazines are being bought year by year, that SN will suffer greatly, and this has helped push down the share price. I do not see good reasons for such pessimism in the numbers coming out of the company. Even though volumes of papers/magazines sold have gone down by 5-10% per year for a long time now, the managers have largely offset this by finding efficiencies, and cover prices have risen. The main reasons, however, for Connect’s shares to be trading on a cyclically adjusted price earnings ratio of only 2.1 is not to do with Smiths News but derive from two large risk factors. The first is that the Tuffnells parcel delivery business, bought for £121m in 2014, might continue to lose money hand over fist for years to come. The second is that the Group’s high debt levels will become unsustainable should the cash flow of the Group decline substantially. Bankers – in normal times - may not be understanding if the EBITDA-based ratios used for loan covenants are breached. The nightmare scenario becomes possible if directors do not get a grip of the………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1 Connect shares (LSE:CNCT) have fallen more than most. While it was falling I examined three factors, looking for reassurance that it will be able to ride out the storm:

If banks were harsh the company can now turn to alternative sources (e.g. commercial paper sales direct to the BoE). I could be wrong on the willingness of banks to treat established customers very leniently. But even if I am wrong the factors below mean that Connect probably will not breach its banking covenants in the first place.

Amazon, Ocado, etc., can’t cope and are turning away customers for want of distribution capability. Tuffnells has an underused distribution network. Clearly this is a business opportunity for Tuffnells to greatly increase turnover and raise prices. Distribution is one of the Government mandated essential services along with nursing, supermarkets and utilities. The jury is still out on whether the management of the depots has improved.

It turns out that newsagents are classed along with pharmacies and supermarkets as essential, thus they can stay open. People need news now more than ever. The cash-cow that is Smiths News continues. Having done that research a fourth factor came as a very pleasant surprise, tipping me over the edge into buying the shares - the company issued a steady-as-she-goes trading update. In these conditions an expectation of profit falls of around 10% in the year to end August strikes me as wonderful, especially after the shares had more than halved in a few days. There won’t be many companies that can say they still make over £18m after tax this year and be standing on market capitalisation of £37m (246m shares x £0.151). More on the Trading Update According to Wednesday’s update Connect has a “critical role in the UK's news supply chain” and it is “an essential supply partner for many of our freight customers” which leads to “Core trading across the Group remain[ing] relatively robust despite the considerable disruption to the UK economy at present. Both Smiths News and Tuffnells are currently trading in line with expectations”. Current expectations of the three analysts covering Connect are dividends of 1p in 2020 and 1.033p in 2021. That would give the shares a dividend yield at my average b………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1 As far as I’m concerned the stock market does not exist. It is there only as a reference to see if anyone is doing anything foolish

Warren Buffett It is optimism that is the enemy of the rational buyer. Warren Buffett (B.H. 1990) If we can buy small pieces with satisfactory underlying economics at a fraction of the per-sh......To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1 Benjamin Graham ran a fund with assets under management of £2.5m in 1929. The crash wiped out most of that. In the Depression he pondered the meaning of "investing" as opposed to "speculation" and wrote the very influential Security Analysis book. Warren Buffett became his student in 1950. After regaining his investors' money, between 1936 and 1956 Graham achieved average annual returns of 20%.

A sound investment operation means you (a) conduct thorough analysis of the company (b) aim only for a satisfactory rate of return (c) always build in a margin of safety. If any of those factors are missing you are not investing but speculating (e.g. buying on tips or inside information ignoring analysis, trying to guess short term market moves). He realised he had been speculating prior to the Crash. The searing experience of the Crash led to the foundational value investing philosophy he developed in the 1930s. Peter Lynch ran The Megallan Fund at Fidelity 1977-1990 achieving average annual returns of 29.2%, but experiencing some sharp reversals from time to time. Aphorisms [Price fluctuations] provide [the investor] with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market and pays attention to his dividend returns and to the operation result of his companies Benjamin Graham The investor’s chief problem - and even his worst enemy - is likely to be himself....We have seen much more money made and kept by ‘ordinary people’ who were temperamentally well suited for the investment process than by those who lacked this quality, even though they had extensive knowledge of finance, accounting and stock market lore Benjamin Graham Yearly figures [of portfolio performance], it should be noted………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1 While value investors wait for the dust to settle we might want to ponder the thoughts of some experienced investors on market ups and downs. By dust to settle I mean understanding the new economic/business environment we are in. There are new rules on government help, disturbed demand patterns, interrupted supply chains, psychological trauma.

No one knows where all this is going to end up, but in the new world there will be a new set of strong players and weak players in markets, there will be companies with intrinsic value significantly higher than market price, and there will be companies with dangerously weak market positions and balance sheets. But until the macroeconomic and government counteraction fog has cleared we'll have great difficulty knowing which companies are bargains. We have usually made our best purchases when apprehensions about some macro event were at a peak. Fear is the foe of the faddist, but the friend of the fundamentalist. Warren Buffett (B.H. 1994) One of the ablest investment men I have ever known told me many years ago that in the stock market a good nervous system is even more important than a good head Philip ………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1 Great investors have seen many bad markets. And they learned from them:

In certain years you’ll make your 30 percent, but there will be other years when you’ll only make 2 percent, or perhaps you’ll lose 20 That’s part of the scheme of things, and you have to accept it….If you expect to make 30 percent year after year, you’re more likely to get frustrated at stocks for defying you, and your impatience may cause you to abandon your investments at precisely the wrong moment. Or worse, you may take unnecessary risks in the pursuit of illusory payoffs. It’s only by sticking to a strategy through good and bad years that you’ll maximize your long-term gains Peter Lynch There are 60,000 economists in the U.S., many of them employed full-time trying to forecast recessions and interest rates, and if they could do it successfully twice in a row, they’d all be millionaires by now....As some perceptive person once said, if all the economists of the world were laid end to end, it wouldn’t be a bad thing Peter Lynch Any individual stock does not rise or fall at any particular moment in time because of what is actually happening or will happen to that company. It rises or falls according to the current consensus of the financial community as to what is happening and will happen regardless of how far off this consensus may be from what is really occurring or will occur. Philip Fisher There’s no way you can live an adequate life ………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1 |

Glen ArnoldI'm a full-time investor running my portfolio. I invest other people's money into the same shares I hold under the Managed Portfolio Service at Henry Spain. Each of my client's individual accounts is invested in roughly the same proportions as my "Model Portfolio" for which we charge 1.2% + VAT per year. If you would like to join us contact [email protected] investing is about making the right decisions, not many decisions.

Categories

All

Archives

May 2023

|

RSS Feed

RSS Feed