|

In these febrile times I thought it worthwhile to post a newsletter I first sent out in November:

Warren Buffett has some wise words concerning the value investor's attitude to falling share prices. Truly disciplined value investors celebrate when shares fall in price. I'm currently writing the first chapter of third volume of The Deals of Warren Buffett which is on the purchase of shares in Wells Fargo in the middle of the California recession of 1990, when investors were, in general, running away from the banking sector, pushing down share prices. With regard to Wells Fargo Buffett wrote that “we welcomed the decline because it allowed us to pick up many more shares at the new, panic prices”. Investors, that is, those who expect to continue buying investments throughout their lifetimes, should have the attitude of looking to buy when shares are cheap and therefore feel good when prices decline, “instead many illogically become euphoric when stock prices rise and unhappy when they fall.” (1990 Letter to BH shareholders) Do you want food prices to rise? Buffett points out that people are not irrational about pricing when it comes to food. They know that they will, throughout a lifetime be buyers of food, and so welcome falling prices and dislike rising prices. In his 1997 letter he is even more specific, focusing on his favourite, hamburgers: “If you plan to eat hamburgers throughout your life and are not a cattle producer, should you wish for higher or lower prices for beef? Likewise, if you are going to buy a car from time to time but are not an auto manufacturer, should you prefer higher or lower car prices?” Small portions of businesses, called shares, entitle you to a percentage of its income in future years, so you want to buy these rights on the cheap. “Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. In effect, they To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

0 Comments

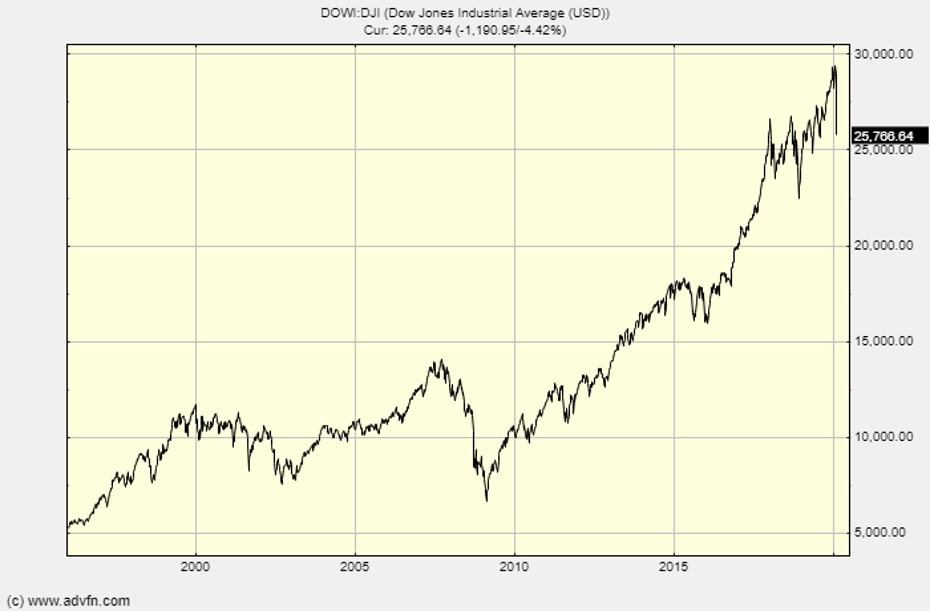

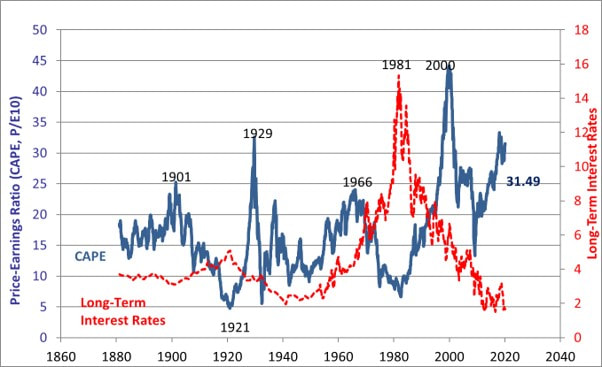

Yesterday I managed to buy some put option on the Dow Jones Industrial Average at a reasonable price – before the worst of the sell off. They are June expiry 200 options. They rise in value as the Dow Jones falls. I’ve already made a substantial paper gain but will wait sometime before I sell. As you know, I’ve been banging on about the stretched valuation of the US market and the over-indebtedness of many companies (in America, China and Europe) for a long time. Thus for at least two years I’ve been buying put options on the Dow. I had no idea what the trigger would be but figured that when stock market exuberance comes on top of excessive debt we’re standing at a precarious position that may lead to a tipping point. The trigger for a sell off might have been war, disappointment with a few leading companies, a banking crisis, trade encumbrances, or any one of a dozen causes. It’s turned out to be a virus. So, for two years I’ve paid premiums to hold these options at regular intervals, and, when the expiry date went by, I lost everything I’d put into options. Before the expiry of one lot of options I bought another load, with expiry dates 6-9 months later. It was disheartened to see my insurance premium money flow out and get nothing in return. But that is what insurance is like – when the bad event happens you are covered, meantime you lose premiums. I still hold March expiry 185 puts on the Dow as well as these June expiry options. The 185 puts will be worth nothing if the Dow remains above 18,500 between now and the expiry date of 20th March. I have until 19th June for the options I bought yesterday to move “into the money”. Previous newsletters on the Dow and puts: 8th Feb 2019, 20th & 26th June 2017, 20-21st Dec 2017, 24th Sept 2018, 8th July 2017, 29th Aug 2019. Over-priced market? Looking at Professor Robert Shiller’s (Nobel Laureate) CAPE, which he updates regularly on his website – see chart below – we find that the recent level of 31.49 is almost double the historical average. There have been two occasions when it was higher. They are 1929 and 1999! CAPE = Cyclically adjusted price earnings ratio. Take the last ten years of earnings per share and average them. Divide the current share price by the average EPS. It’s designed to allow for a range of economic circumstances in the earnings number used when considering current valuations. It has been used as an indicator of likely future performance: it’s been found that when CAPE is low shares tend to do very well over the next 5 years. Conversely, when CAPE is high they do badly.

I’ve written a lot on debt levels in other newsletters (see list above), but I was struck by a statistic in The Economist this week: of all the rich world’s established companies one in eight does not make enough profit to cover interest payments, let alone principal – and this at a time of absurdly low interest rates. An economic shock on the scale of Covid19 could tip thousands of companies into financial distress. The put options I bought yesterday The exercise price of the put option I purch ………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1 Hi Glen

Novice investor here with just a couple of general questions I wondered if you help me understand. When the market crashes like this , where does all the money disappear to , surely it must end up somewhere an another asset somewhere. Also is the crash because people are selling or is it that they are not buying or both? Thanks Pete Hi Pete, Real assets are things like houses or farmland. The assets we buy in the financial markets are claims. So, a share is a claim on future profits and dividends (put crudely). Price is different to value. What the market is doing is trying to value the future income accruing to the claimholder. Thus, if you own a company you are trying to figure what the future flows will be to you, the shareholder. Then, because those moneys come in at various points in the future you discount them (i.e. £20,000 received in 20 years is not worth the same to you as £20,000 due in month - so you discount the 20 year flow more than the one month flow). The market is continuously trying to estimate future flows and the correct discount rate to use. As a result it comes up with prices, through the buying and selling actions of market participants. Prices may reflect accurate the VALUE of future flows, or they may not. Last week investors were content that future flows will grow at a nice rate and that equity investing was a fairly low risk activity (hence a low discount rate). This week, investors are far more fearful that (a) future cash flows will decline (b) that shares are very risky things. Hence investors have lowered PRICES. We value investors have to consider whether the new PRICES are high or low relative to our VALUATION of companies (this depends on the cash flows generated by the business which, in turn, depends on strategic position, assets, quality of managers, operational and financial stability, etc). Analogy: you buy a house because you have a family of six people. The VALUE of that house is the benefit of living there for 20 years and its sale price in 20 years (discounted to present). If one month after buying, the price of houses in your area fall by 20% have you lost money? Did anyone lose any cash because of the theoretical possibilit………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1 The virus' impact on psychology and social interaction (the diminishing of it) encouraged me sell a couple of companies which were already looking quite high.

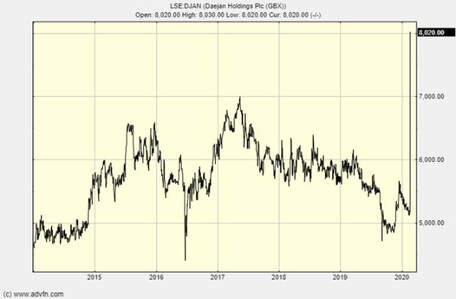

I've sold my Dewhurst "A" shares (non-voting) at about £7.20p. I first bought at just over £3. I've also sold my TClarke shares at 112p (bought at 79.16p). I'll write up why I chose these two in later newsletters. For now, I thought I'd express why the virus worries me so much. To focus on the economic cost, leaving to one side the human cost, the death rate of the virus is no great shakes for the economy. What really matters for businesses is the reaction of humans to fear of an event. There will be lockdowns; kids off school; parents off work looking after kids; factories unable to get workers to assemble; offices closed up; meetings cancelled; capex postponed; purchases postponed; holidays cancelled; aircraft half empty, and; panic buying of essentials. The world of business was vulnerable without this virus. Here are the highlights from this week's The Economist article "Downturn, disrupted" which demonstrate fragility: In the last recession 11m people lost their jobs in rich countries and the profits of big listed firms in Europe and America dropped by 51% and 30%, respectively. S&P historic falls: Dec 2007-Mar 09: 55% May-sept 2001: 27% Jul-Oct 1990: 20% Aug 1981- Aug 1982: 23% Feb-Mar 1980: 18% Nov 1973-Oct 74: 42% In downturns in 2000-02 and 2007-08 sales growth at Amazon and Microsoft slowed sharply. Smartphone sales have already slowed, Apple is struggling to ship phones from China. Ruthless cost cutting has always been part of playbook for companies outside the tech industry when the economy slumps. After a bout of dealmaking, goodwill in BS is at a record high of $3.6trn for S&P companies. This can indicate trouble. In 2000-01 and 2007-09 firms made huge goodwill write offs as they confessed to dodgy deals. In America 97% of S&P firms in 2017 presented at least one metric of their performance in a way that was inconsistent with GAAP, up from 76% in 2007. (Galbraith's "bezzle" is at play at the top of cycles) Since 2007 overall corporate debt has risen. In Europe non-financial corporate debt stands at nearly 110% of GDP, compared with under 90% in 2007. In America businesses are now borrowing more than households for the first time since 1991. In the rich world 1 in 8 established companies makes too little profit to pay the interest on their loans, let alone the principal. That’s up from 1 in 14 in 2007. A recession half as bad as the 2007-9 slump would result in $19trn of corporate debt – nearly 40% of the total – being owed by such straightened companies. The clincher I greatly respect Nouriel Roubini, who teaches at NY Stern School of Business and has been an influential policy adviser. He is one of the few economists to predict the 2007-08 (IMF position paper 2006) foreseeing mortgage defaults, mortgage-backed securities unravelling and the global financial system crisis and recession. Professor Roubini published an article in the Financial Times a few hours ago. Here are the highl ………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1  I bought Daejan (LSE:DJAN) on 5th February at £52.90 per share. My expectation was that this property company would continue to increase net asset value over the next five years. I would hold during that time, while the share price discount to net asset value would fall from an exceptional level of 56% when I bought to a more normal 20% to 30%. I was quite content to settle down to receiving a regular dividend of 2% of the purchase price while the company advanced and the share price moved up over a number of years. What I didn’t know was that the Freshwater family had been planning for a weeks to buy the 20.5% of the shares they don’t already hold. Honest, I had no inside information. So 16 days after my purchase the shares rocketed to just shy of the offer price of £80.50 and I sold at £79.41 after broker costs, a 50.1%. In early February I was pretty confident that the enormous gap between NAV and share price would close, but can’t take any credit for the speed that it happened. (Previous newsletters describe the rationale for investing in Daejan: 7th – 13th February) Is it a good thing? Net asset value is £120 per share and the offer p ………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1  Speaking at last week's annual meeting of the Daily Journal Charlie Munger invited shareholders to remain sane and rational, and not only with regard to share selection, but in all aspects of life. I've transcribed his words: Part of the reason that some of the companies I’ve been affiliated with that have been successful, it’s not that we’re so smart, it’s that we stayed sane. A lot of what goes on is absolutely nuts. One of my favourite tricks is the inversion process. To give an example: When I was a meteorologist in WW2 they told me how to draw weather maps and predict the weather. But what we were actually doing is to clear pilots to take flights. And I just reversed the problem, I inverted. I said suppose I wanted to kill a lot of pilots, what would be the easy way to do it? I soon concluded that the only easy way to do it was to get so much ice on the planes that they couldn’t handle it or to get the pilot to a place where he’d run out of fuel before he could safely land [He was stationed in Alaska]. So I made up my mind I was gonna stay miles away from killing pilots by either icing or getting them sucked into conditions where they couldn’t land. I think that helped me be a better meteorologist – I just reversed the problem. And if somebody hired me to fix India I would immediately say, ‘what could I do if I really wanted to hurt India?’ I’d figure out all the things that would most easily hurt India and then I’d figure out how to avoid them. Now, you’d say it’s the same thing, just in reverse. It works better to frequently invert the problem…You can help India best if you really understand what will really hurt India the easiest and worst. Every great algebraist inverts all the time because the problems are solved easier. Young [people] should do the same thing in the ordinary walks of life. You don’t think of what you want, you think of what you want to avoid. When you’………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1  Charlie Munger, the billionaire investor, friend and colleague of Warren Buffett, gave sage advice to help investors, and more normal folk, last week at the 2020 AGM of the Daily Journal Annual Meeting. Here is a some of it: Value investing and fishing Question: In investing, I’m curious to know how you weigh the quality of the horse versus the odds offered on the horse. Charlie's answer: Both are important. Basically, all investment is value investment in the sense that you’re always trying to get better prospects than you’re paying for. But you can’t look everywhere at once anymore than you can run a marathon in 12 different states at once. And so, you have to have some system for picking some place to look, which is your hunting ground. But you’re looking for value in every case. I think the strongest companies are Chinese. It really helps if you know which hunting ground to look in. In fact, we all do better if we hunt where the hunting is easy. I have a friend who is a fisherman. He says, ‘I have a simple rule: fish where the fish are’. You want to fish where the bargains are, that’s simple. If the fishing is lousy where you are, you’ll look for somewhere else to fish. Immediate gratification is the way to ruin. Deferred gratifiers do better over the long pull than these impulsive children that have to spend money on Rolex watches or some other folly. ... If you want to read more of this article or more articles follow my newsletter here.  Charlie Munger, Warren Buffett’s business partner, now aged 96, gave some brilliant advice to investors when speaking last week at the 2020 AGM of the Daily Journal Annual Meeting (he is the chairman). Don’t play in game where you are stupid Q. How do you research companies? A: Of course, if it’s complicated technologically I tend to leave it to others. There may be an occasional variation in that. But basically, I just don’t do it. I want to think about things where I have an advantage over other people. I don’t want to play a game where the other people have an advantage over me. If you have a pharmaceutical company, and you’re trying to guess what new drug is gonna be invented, I’ve got no advantage. Other people are better at that than I am. I don’t play in a game where the other people are wise, and I’m stupid. I look for a place where I’m wise and they’re stupid. And, believe me, it works better! God bless our stupid competitors. They make us rich. That’s my philosophy. I think you have to know the edge of your own competency; you have to kinda know that this is too tough for me, I’ll never figure this out. I’m very good at knowing when I can’t handle something. Do well by doing good I’ve never be associated with a company that works harder than Costco to make sure the customers are served well. I just love success that occurs that way. I hate success where you are deliberately trying to cheat people or sell them something that’s not good for them. I would choose that approach even if it made less money. In fact, I think you make more. It reminds me of Warren Buffett’s favourite saying, ... If you want to read more of this article or more articles follow my newsletter here. Daejan (LSE:DJAN) is completely controlled by the Freshwater family who hold 79.5% of the shares. We small shareholders are at their mercy. It is therefore important we consider whether the dominant shareholders tend to treat other shareholders badly.

The directors Benzion S E Freshwater, 71, Chairman and Chief Executive Joined the Board in December 1971 with primary responsibility for the Group’s finances. In July 1976 he was appointed Managing Director and, additionally, became Chairman in July 1980. Remuneration £1.25m. Solomon I Freshwater, 68, Executive Director Directs the Group’s operations in the USA and has responsibility for the Group’s UK sales division. He has been a Director of the Company since January 1986. Remuneration £1.25m Solly B Benaim, 63, NED Appointed to the Board in January 2017 and is an independent non-executive director. He was formerly Global Head of Real Estate at accountancy firm BDO. Remuneration: £25,000 ... If you want to read more of this article or more articles follow my newsletter here. Piotroski factors provide some insight into the likelihood of financial distress by examining trends in key accounting metrics over two years.

If all nine are in a positive direction then a very low level of distress is indicated. Any score under five out of nine should make us wary. The first factor is profits. Daejan was profitable in the year to 31st March 2019 with £159m operating profit and £120m profit after tax (ignoring exceptional items). In the six months to the end of September it made an operating loss of £8m after taking a £46m valuation hit on properties in NY. The loss after tax was £11m. A Piotroski point is awarded for the annual accounts analysis but not for the half-yearly analysis. ... If you want to read more of this article or more articles follow my newsletter here. |

Glen ArnoldI'm a full-time investor running my portfolio. I invest other people's money into the same shares I hold under the Managed Portfolio Service at Henry Spain. Each of my client's individual accounts is invested in roughly the same proportions as my "Model Portfolio" for which we charge 1.2% + VAT per year. If you would like to join us contact [email protected] investing is about making the right decisions, not many decisions.

Categories

All

Archives

May 2023

|

RSS Feed

RSS Feed