|

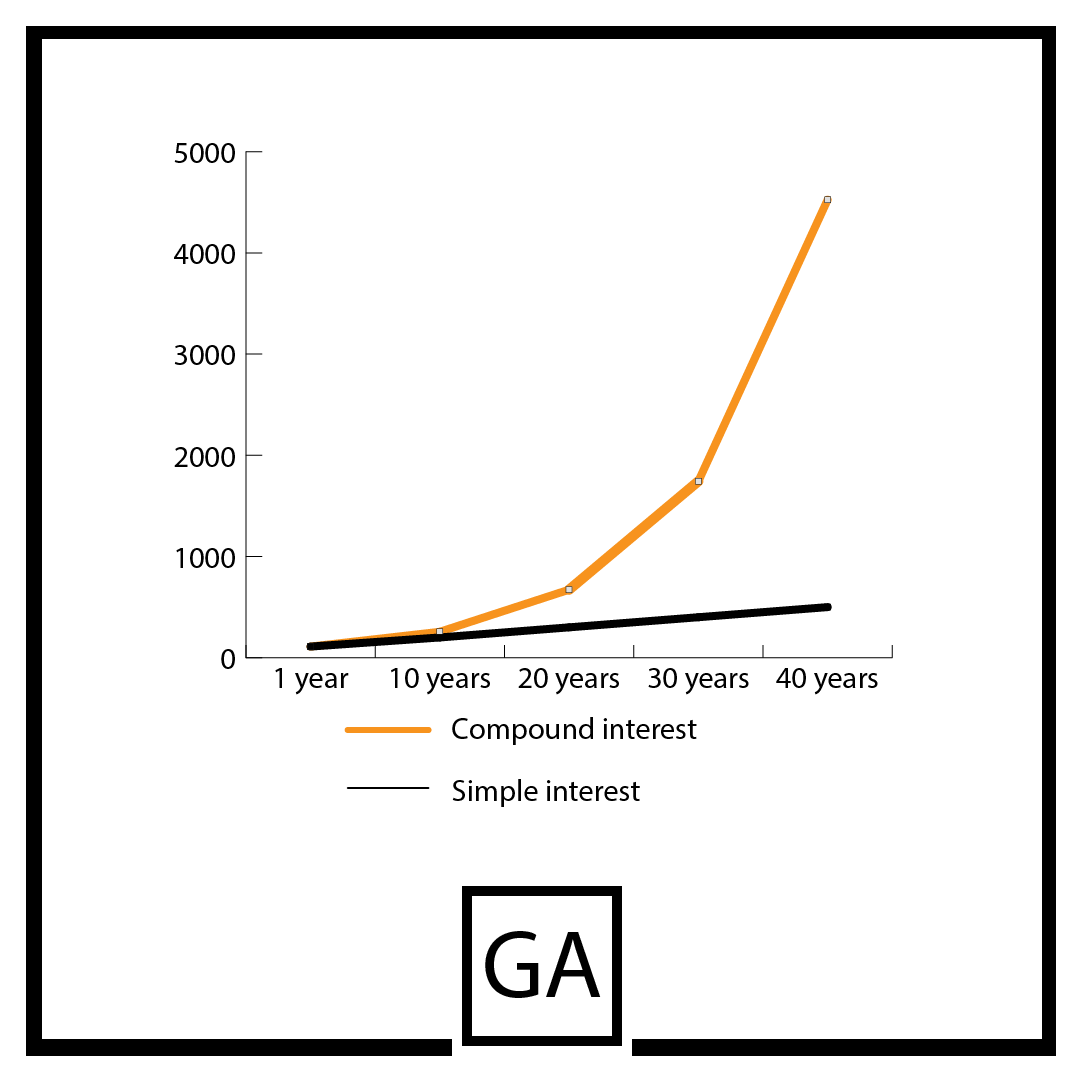

If someone makes a deposit of £100 in two investments both with an annual rate of 10% with just the difference of one having simple interest an the other compound interest, over a 40-year period the difference would be of £4025 with the simple interest one having £500 and the compound £4525 This is the power of compounding the return! Compounding is ploughing back the income received and then getting a return on the accumulated ploughed-back money as well as the original capital.

Quit the short term guessing game and invest long term Stock markets in the short term are a guessing game. Shares should be viewed as long-term investments and not short-term gambling counters. If you treat shares like an investment you can become a millionaire! Charlie Munger, a billionaire investor, says never interrupt it unnecessarily. Long-term investment is like planting trees. At first you can only find enough money to buy a few saplings. They look small and pathetic. Then you add to your collection month by month. For the first few years your wood looks unimpressive and hardly worth the effort. Still, you nurture and keep adding to it. Perhaps later you stop buying more saplings and decide to devote merely the minimal effort. Perhaps you turn away to other interests for a few years. Then, when you do look again, you are amazed to find that what was scrubland has been transformed into a magnificent arboretum with fine strong specimens. Time has worked its magic. What seem like small annual rates of growth can, with compounding, produce a great mass from small beginnings.

0 Comments

Leave a Reply. |

Glen ArnoldI'm a full-time investor running my portfolio. I invest other people's money into the same shares I hold under the Managed Portfolio Service at Henry Spain. Each of my client's individual accounts is invested in roughly the same proportions as my "Model Portfolio" for which we charge 1.2% + VAT per year. If you would like to join us contact [email protected] investing is about making the right decisions, not many decisions.

Categories

All

Archives

May 2023

|

RSS Feed

RSS Feed