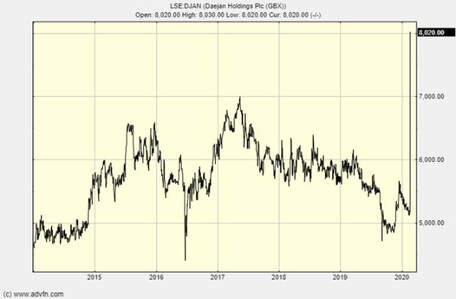

I bought Daejan (LSE:DJAN) on 5th February at £52.90 per share. My expectation was that this property company would continue to increase net asset value over the next five years. I would hold during that time, while the share price discount to net asset value would fall from an exceptional level of 56% when I bought to a more normal 20% to 30%. I was quite content to settle down to receiving a regular dividend of 2% of the purchase price while the company advanced and the share price moved up over a number of years. What I didn’t know was that the Freshwater family had been planning for a weeks to buy the 20.5% of the shares they don’t already hold. Honest, I had no inside information. So 16 days after my purchase the shares rocketed to just shy of the offer price of £80.50 and I sold at £79.41 after broker costs, a 50.1%. In early February I was pretty confident that the enormous gap between NAV and share price would close, but can’t take any credit for the speed that it happened. (Previous newsletters describe the rationale for investing in Daejan: 7th – 13th February) Is it a good thing? Net asset value is £120 per share and the offer p ………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

0 Comments

Daejan (LSE:DJAN) is completely controlled by the Freshwater family who hold 79.5% of the shares. We small shareholders are at their mercy. It is therefore important we consider whether the dominant shareholders tend to treat other shareholders badly.

The directors Benzion S E Freshwater, 71, Chairman and Chief Executive Joined the Board in December 1971 with primary responsibility for the Group’s finances. In July 1976 he was appointed Managing Director and, additionally, became Chairman in July 1980. Remuneration £1.25m. Solomon I Freshwater, 68, Executive Director Directs the Group’s operations in the USA and has responsibility for the Group’s UK sales division. He has been a Director of the Company since January 1986. Remuneration £1.25m Solly B Benaim, 63, NED Appointed to the Board in January 2017 and is an independent non-executive director. He was formerly Global Head of Real Estate at accountancy firm BDO. Remuneration: £25,000 ... If you want to read more of this article or more articles follow my newsletter here. Piotroski factors provide some insight into the likelihood of financial distress by examining trends in key accounting metrics over two years.

If all nine are in a positive direction then a very low level of distress is indicated. Any score under five out of nine should make us wary. The first factor is profits. Daejan was profitable in the year to 31st March 2019 with £159m operating profit and £120m profit after tax (ignoring exceptional items). In the six months to the end of September it made an operating loss of £8m after taking a £46m valuation hit on properties in NY. The loss after tax was £11m. A Piotroski point is awarded for the annual accounts analysis but not for the half-yearly analysis. ... If you want to read more of this article or more articles follow my newsletter here. In the past, when Daejan’s (LSE:DJAN) share price to shareholders’ equity (NAV) ratio fell below 0.6 the subsequent five years gave shareholders a return averaging over 100%. Today Daejan’s shares stand on a ratio of merely £52.90/£120 = 0.44.

The make-up of shareholders’ equity Daejan’s balance sheet is really simple: it holds about £2.6bn of property assets against which it has borrowed £0.5bn. It also has £0.1bn or so in cash and a similar amount in receivables, which is offset by payables. The company accountants acknowledge that the company will eventually have to pay around £0.3bn in taxes for things like unrealised gains when, eventually the assets are liquidated (deferred taxes). Market capitalisation is 16.3m shares x £52.3 = £852m. ... If you want to read more of this article or more articles follow my newsletter here. Osias was born in Poland in 1897. In 1939, leaving his wife and children in Poland with the intention of settling them in England once he could obtain visas, he set sail from Danzig for the UK. It turned out that Osias’ ship was the last to leave the port before the Nazi invasion. His wife and three children fled Danzig but were caught and, tragically, perished in the holocaust.

In London’s East End, he was virtually penniless but hard working, and eight years later in 1947 remarried, to Nechama Stempel. Their two sons, Benzion Freshwater and Solomon Freshwater are the two executive directors of the company today. Landmark London properties were acquired by the Freshwater family in the 1950s, and in 1959 their empire was sufficiently established to warrant a stock market listing. They chose the parsimonious method of a reverse takeover. Assets then amounted to £4m and shares traded at 29p. It grew rapidly through the 1960s – in one transaction over 3,000 houses and flats were bought at “what today would seem a paltry consideration” (company website) - becoming London’s “largest private landlord”. They bought and still own many 1920s and 1930s mansion blocks. ... If you want to read more of this article or more articles follow my newsletter here. I’ve bought Daejan (LSE:DJAN) for my modified price earnings ratio portfolio. It has two outstanding virtues. First its shares, at my buying price of £52.90, are merely seven times earnings per share when EPS is averaged over the last decade. Second, its net assets are worth £120 per share, thus it stands on a discount to net assets of 56% (no, it does not have high borrowing). Daejan holds residential blocks and commercial property in London, New York and elsewhere in the UK and USA, and rents them out. Occasionally there are opportunites to develop properties to enhance value, e.g. it holds a block on Oxford Street which it is going to redevelop soon. Mr Market seems convinced that there will be a recession in the UK and USA of such ferocity that rents are going to fall dramatically and property market values halve.

Well, maybe. In the early 1990s recession – which was pretty nasty - Daejan’s portfolio valuation fell by no more than 10% ... If you want to read more of this article or more articles follow my newsletter here. |

Glen ArnoldI'm a full-time investor running my portfolio. I invest other people's money into the same shares I hold under the Managed Portfolio Service at Henry Spain. Each of my client's individual accounts is invested in roughly the same proportions as my "Model Portfolio" for which we charge 1.2% + VAT per year. If you would like to join us contact [email protected] investing is about making the right decisions, not many decisions.

Categories

All

Archives

May 2023

|

RSS Feed

RSS Feed