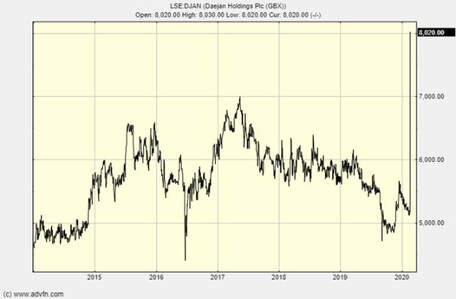

I bought Daejan (LSE:DJAN) on 5th February at £52.90 per share. My expectation was that this property company would continue to increase net asset value over the next five years. I would hold during that time, while the share price discount to net asset value would fall from an exceptional level of 56% when I bought to a more normal 20% to 30%. I was quite content to settle down to receiving a regular dividend of 2% of the purchase price while the company advanced and the share price moved up over a number of years. What I didn’t know was that the Freshwater family had been planning for a weeks to buy the 20.5% of the shares they don’t already hold. Honest, I had no inside information. So 16 days after my purchase the shares rocketed to just shy of the offer price of £80.50 and I sold at £79.41 after broker costs, a 50.1%. In early February I was pretty confident that the enormous gap between NAV and share price would close, but can’t take any credit for the speed that it happened. (Previous newsletters describe the rationale for investing in Daejan: 7th – 13th February) Is it a good thing? Net asset value is £120 per share and the offer p ………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

0 Comments

Leave a Reply. |

Glen ArnoldI'm a full-time investor running my portfolio. I invest other people's money into the same shares I hold under the Managed Portfolio Service at Henry Spain. Each of my client's individual accounts is invested in roughly the same proportions as my "Model Portfolio" for which we charge 1.2% + VAT per year. If you would like to join us contact [email protected] investing is about making the right decisions, not many decisions.

Categories

All

Archives

May 2023

|

RSS Feed

RSS Feed