1 Comment

Uğur Demir

1/7/2020 02:13:44 am

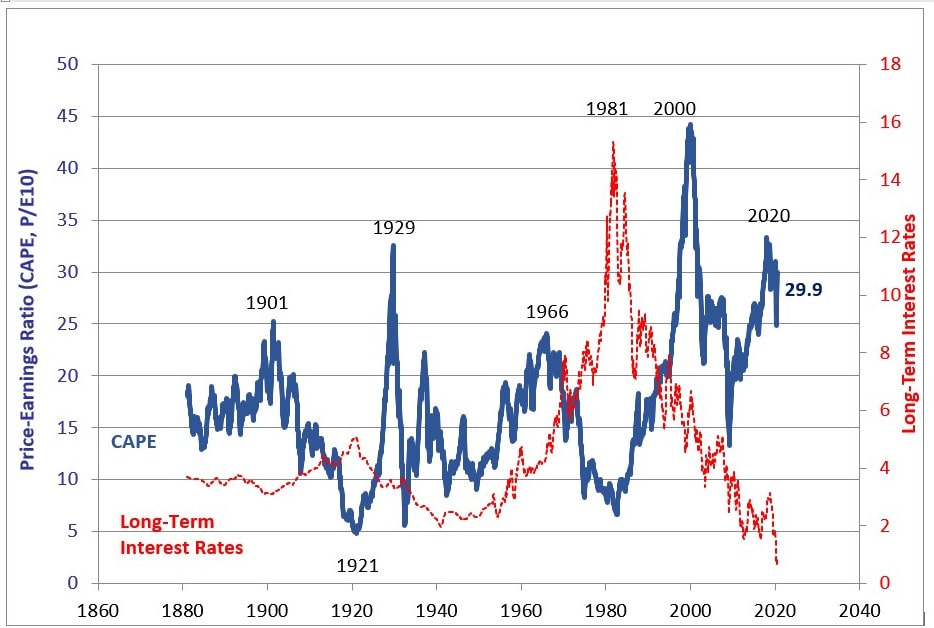

First determenant of this situation is the yield trap. Investors, both profressional and personal, have been left without option. Out of stocks and high yield bonds there is no investment return. Their risk and return are historically imbalanced. Since the stock market momentum is a self filling prophecy the money flocks to it. With out a deep correction or a bear market it seems hard to reverse. While central banks are buying securities directly those seems unlikely too.

Reply

Leave a Reply. |

Glen ArnoldI'm a full-time investor running my portfolio. I invest other people's money into the same shares I hold under the Managed Portfolio Service at Henry Spain. Each of my client's individual accounts is invested in roughly the same proportions as my "Model Portfolio" for which we charge 1.2% + VAT per year. If you would like to join us contact [email protected] investing is about making the right decisions, not many decisions.

Categories

All

Archives

May 2023

|

RSS Feed

RSS Feed