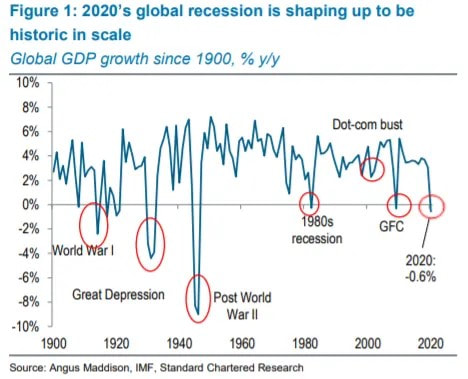

Our lives are going to be shaped by the coronavirus, not just our health, work, relationships, politics and social interaction but, of more direct relevance to an investment newsletter, economies, businesses and shares. If we are about to enter a depression as deep and widespread as the one in the 1930s hundreds of millions of people will suffer and millions will die, not just directly because of the virus but from the knock-on economic effects: starvation and poor access to basic medical care as dislocation lowers production and destroys the political and business order in poor countries and in pockets of “rich countries”. Expect foodbank queues to be as long as those of the soup kitchens of the 1930s. Expect personal bankruptcies, domestic violence and suicides to rise. Businesses will fail by the tens of thousands, large and small, and stock markets will fall dramatically from where they are now in over one hundred countries. And these effects will be played out over years, with many false dawns, and more violent downward shifts. There will be a strung-out deficit in consumer demand at the macro-economic level, as people become increasing afraid to buy for consumption, or to buy investment items. If that is the most likely outcome we need to position our personal finances and our portfolios to reduce the potential for regret, to hedge the downside, to have cash at hand to both weather the storm and to take advantage when green shoots come through. Some very able analysts are saying that another Great Depression might very well occur given the public health and fiscal errors made so far in fighting the virus. One even goes so far as to say it could be a “Greater Depression”. In future newsletters this week we’ll look at some arguments for and against. The Great Depression In the 1930s real output of the US economy shrank by 30% and unemployment went to 23%. It wasn’t quite so bad in the UK with 20% unemployment, but in Germany hyperinflation reigned as well as 30% unemployment – and we know the political consequences of Germany’s economic travails. Worldwide GDP fell by an estimated 15% (compared with 1% in the so-called Great Recession of 2008-10). International trade halved and construction virtually halted. There is no agreed definition of a depression other than saying it is a severe and sustained downturn. For our purposes I’ll use a decrease of GDP greater than 15% as a benchmark. A deep recession A deep recession is not much to celebrate, but it is perhaps the best we can hope for. It will result in the quantity of goods and services being produced in Europe and North America and many other countries being reduced by at least 6% and quite possibly by over 10% compared with the amount in 2019. That is just the first-order effect. To consider the second-order effects transport your thoughts forward 12 months from now and consider what you might have experienced. If you are British you might have s ………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

0 Comments

Leave a Reply. |

Glen ArnoldI'm a full-time investor running my portfolio. I invest other people's money into the same shares I hold under the Managed Portfolio Service at Henry Spain. Each of my client's individual accounts is invested in roughly the same proportions as my "Model Portfolio" for which we charge 1.2% + VAT per year. If you would like to join us contact [email protected] investing is about making the right decisions, not many decisions.

Categories

All

Archives

May 2023

|

RSS Feed

RSS Feed