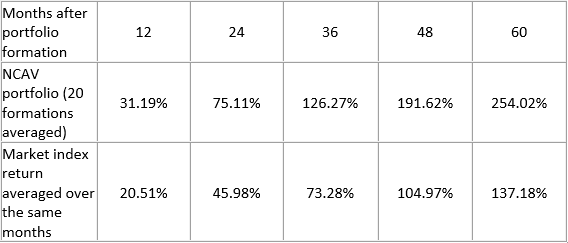

Newsletter 7 - Proof that net current asset value investing gives great returns 21st october 201421/7/2020 I’ve made you wait long enough - I’ll now explain the results of the research for a twenty year period employing the Net Current Asset Value approach for London shares. As a Professor it was my job to supervise PhD students and publish original research. One of the most interesting studies asked the question: “If, over the period 1981 to 2000, you had bought a series of portfolios of shares whose prices are less than two-thirds the Net Current Asset Value (see blog on 15th October for definition) would you have outperformed the market?” We (Ying Xiao and I) imagined that we had gone back in time. We searched the entire Official List each July (average of 1,109 companies). If the ratio of NCAV to market capitalisation is greater than 1.5 we imagined buying. We then ‘held’ the portfolios for five years, noting the month-by-month performance and compared it with the general market. The average number of companies fulfilling the criteria was 23. The average performance of the 20 portfolios is striking: In the first year after portfolio formation the NCAV shares averaged a return of 31% which was almost 11% more than the market. And it just got better and better the longer you held the shares (up to five years). This is good news for those of us looking to reduce transaction costs and delay tax payments on gains – just hold onto the shares. After 5 years, on average, NCAV ‘investors’ had turned £10,000 to £35,402. Average raw buy-and-hold returns There are many other tests in the paper, e.g. the NCAV are shown as less likely to be liquidated than the average share – over 5 years the liquidation rate is 2.6% compared with 4.2%. I guess all those BS assets must be good for something. For more detail you can read an earlier draft of the paper on my personal website: www.glen-arnold-investments.co.uk.

Note this paper used a purely quantitative criterion for qualification for inclusion in the NCAV portfolios – only whether the share price is one-third or more below the NCAV. In an academic paper we cannot test subject factors such as ‘prospects for the industry’ or ‘quality of management’ because these factors though vital, are subjective. Thus we can improve the sophistication and outcomes by overlaying the mechanical NCAV criterion with judgment concerning the quality of the business – see next blog

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed