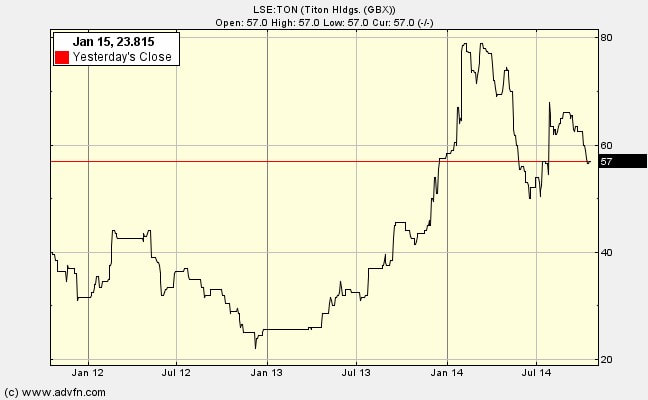

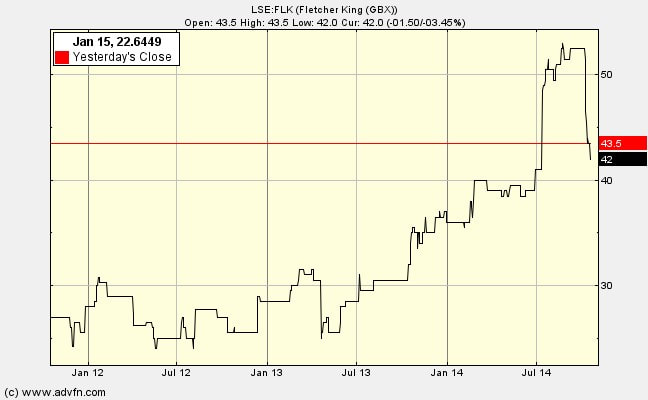

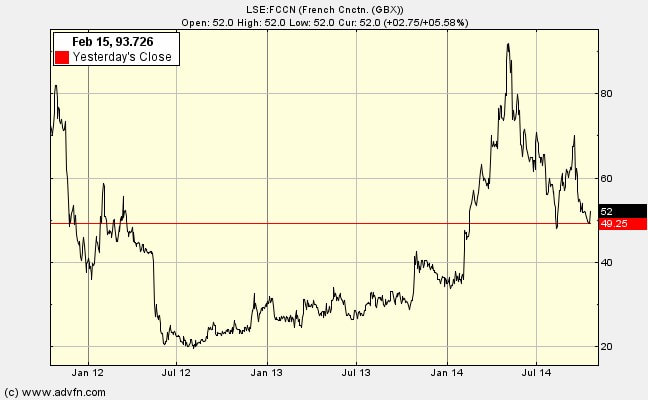

Newsletter 6 - Why should a share with high Net Current Asset Value rise? 20th october 201420/7/2020 Companies going through a torrid time, a few years of loss-making, or suffering from an economic or industry decline, are usually subject to a great deal of market pessimism. Sometimes this is indiscriminate. Alongside the dumping of dross, there is dumping of sound companies, where there are good grounds for believing that recovery will eventually occur. There are four possible paths of development that might reverse the destruction of value through the gradual dissipation of assets: First: Earning power can lifted through an improvement in the economic background. This might be the result of a general economic recovery. A good example here is Titon, (LSE:TON), a supplier to the house-building trade (window parts and whole house ventilation). The potential for a bounce-back in housing in the UK and Korea was not factored into the share price when I bought in 2013 – see my blog on 13.10.14 for the performance numbers – up 69%. I’ll explain my rational for investing in Titon in another blog. Sometimes the low share price seems very strange. In the case of Fletcher King, (LSE:FLK) a commercial property servicing company, (up 50% since I bought in August 2013), the market seemed to ignore the steady profits year-after-year through the recession, and its high operational gearing in the five years to early 2013. The market seemed to focus on the despised sector it was in. When there was a 20% rise in turnover in 2014 profit doubled and the share rose. Now that economic growth has resumed, the company is in investor's sights again. Earning power can also be lifted through the effects of ‘exit’ from the industry; competitors go to the wall or withdraw from some activities, allowing the few left standing to increase prices and raise profits; the share price rockets. Second: Management stir themselves. They may be competent, but faced a fierce onslaught. Perhaps they will regroup, learn from past mistakes and attack with renewed vigour. Alternatively, less able managers are replaced with more able. This happened with French Connection (LSE:FCCN) – up 62% over the 14 months I've held it. The clothing offered is now more attractive, unprofitable shops are being closed, etc. Third: A sale of the company to another.

The buyer should be willing to pay the liquidating value at least and so the NCAV investor gets a boost (this is a moot point for Mallett, arguable sold cheap). Fourth: Complete or partly liquidation. The management of a corporation selling at less than the liquidating value must provide a frank justification to shareholders for continuing. But, it is very difficult to get some of these turkeys to vote for Christmas! As I found with Mallett.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed