|

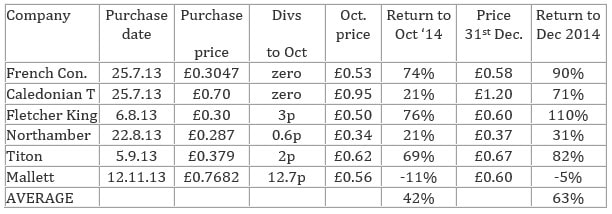

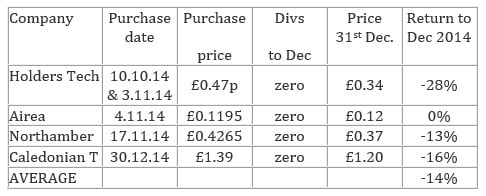

A Happy New year to you all – thank you for joining our little band. After 3 months of newsletter writing it is time to review things. So far I have concentrated on net current asset value, NCAV, investing, with only one purchase fitting an alternative type of investing philosophy making an appearance: Dewhurst, a Buffett and Munger type share. So let’s look at how the NCAV portfolios are doing. There are now two. One for shares bought in 2013 and one for 2014. These are all the shares I bought for the NCAV portfolios (however I sometimes continued to buy more of these, often at higher prices than these initial prices). The 2013 NCAV portfolio Despite losing money on Mallett, which was bought by Stanley Gibbons in November for £0.60 per share, I think we can regard the 2013 portfolio as a success. Do not expect me to produce returns at this sort of extraordinary level in future. If I can achieve a few percentage points more than the market over a year I’ll be more than happy. And, remember that I’m bound to have periods, often lengthy periods, when I underperform the market – that is the nature of the game we are in. The 2014 NCAV portfolio Most of the apparent decline in the 2014 portfolio is simply bid-offer spread.

Note that I have entered Caledonian Trust into the 2014 NCAV portfolio despite not having writing a newsletter on it yet. This is because I bought some only two days ago. Next week I’ll explain my rationale. I must admit that I am somewhat disappointed to have found only four companies in 2014 that meet my strict criteria for inclusion in a NCAV portfolio. And this is not for the want of trying. For example, at the beginning of December I screened every share on the Official List and on AIM. I did the same exercise at the end of the month. However, in my searching I did find some which, though not qualifying yet, are worth putting onto a watch list to see if the deficit in one or more of the qualitative or quantitative factors can be made up over the next few months. I’ll write about these in future newsletters as I keep my eye on them. Note that just because I write about them does not mean they are ready for buying. Stick to the rules I will not lower my standards simply to get into something. It is better to be patient. And there is no harm in increasing stakes in old favourites if they still meet the criteria. As Mae West said: “too much of a good thing can be wonderful”. I do not have a clue on where the stock market as a whole is going. Nor do I have a clue where macroeconomic variables are going, despite (or perhaps because of!) holding a PhD in economics. I concentrate on individual companies and consider whether their intrinsic value is significantly greater than their current market price. Occasionally this results in not being able to find any companies with sufficient margin of safety. To some people this absence of buying appears to be commentary on market being too high. Perhaps the market is, perhaps it isn’t. I don’t know about the market. All I know is that sticking to the NCAV criteria means that bargains are currently difficult to find. They will be searched for, however - constantly. Hope for falling share prices in the near future, even for my existing companies – then I can pick up some more. I will also look for bargain shares using other investment approaches, which I’ll summarise in the next newsletter. I’ll be investing using these other approaches a lot more in 2015.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed