|

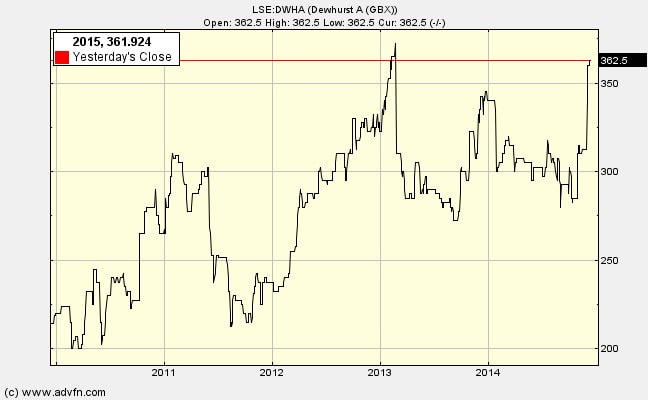

Dewhurst has had a bumper year with the best ever earnings per share at 46.22p. Thus, with the ‘A’ non-voting shares at £3.65 the price-earnings ratio is only 7.9. And this PER is available for a share that over the last decade has pretty consistently raised both its eps and dps such that both have doubled. (To read the company announcements you need the voting shares page on ADVFN, which is (LSE:DWHT))

Here is another ratio for you: Return on tangible assets employed was 29% for the year (measured by operating profit before deducting amortisation divided by tangible assets). And this is no freak year. The figures for the last 6 years have averaged around this, with the lowest being 23%. This is phenomenally high, indicating an ability to achieve high margins on sales (even in so-called bad years). Owner earnings have now exceeded £4m in a year, or at least the proxy for owner earnings using the actual additional investment in working capital and fixed capital items rather than the future required investment needed to sustain competitive position, unit volume and finance value generating new projects. Owner earnings proxy (2014 year) Profit after interest and tax deduction £3,930,000 Add back non-cash items (deprec + amorti) £1,194,000 Deduct additional working capital -£634,000 Deduct additional fixed capital investment -£361,000 OWNER EARNINGS PROXY £4,129,000 Intrinsic value compared with current market capitalisation On the assumption that future annual owner earnings (what can be taken out of the business by shareholders without damaging the economic franchise) are £4m then the intrinsic value of the firm is £50m assuming a shareholder required rate of return of 8% pa: Intrinsic value with no growth in owner earnings in the future = annual owner earnings/discount rate = £4m/0.08 = £50m. If you assume growth of 3% (a lot less than for the last 10 years) then intrinsic value is £4m/(0.08 – 0.03) = £80m. Current market capitalisation: Voting shares: 3.309m shares x £4.45 = £14.725m Non-voters: 5.166m shares x £3.70 = £19.114m Total MCap = £33.839m Qualitative elements I have been following this company for many years and have met Richard and David Dewhurst a few times. They love what they do – all the detailed ins-and-outs of engineering and continuous improvement. They know their industry inside out. I imagine their Dad talked about it around the dinner table when they were 2 years old. Historically, Richard and David’s statements have been very conservative, if not overly pessimistic. Then they usually outperform their predictions. This year we have upbeat (for them) comments: “Currently demand remains stable” “All but one of the overseas operations registered sales growth” “Double digit sales increases in UK” “Australia seems more buoyant…UK and North America are also reasonably positive, whilst elsewhere the picture is more uncertain” “We believe that the improvements we have seen on the sales side will be sustained” “We have been able to start the year with a strong order book that should continue through the coming year” Dupar controls : “grown strongly” “good sales of handrails…encouraging sales of a wider range of escalator spare parts” (last year’s acquisition integration going well then). Hong Kong (operated for 4 years): “built up an excellent reputation for its products and services…market remains quite buoyant” Lovely focus on doing what they do best: No acquisitions “Instead our focus has been on trying to improve the effectiveness of the operations of the Group. As part of those efforts we have been developing our range of metrics and working to ensure there is a clearer link between our business strategies and our employees’ individual objectives and contributions.” “Building our sales of complete fixtures [for lifts]…..complete signalisation” “Continued to work on improving processes throughout the year, with particular focus on waste” “Online monitoring system for lifts seems just what the market needs” You’ve guessed it! I think there is a large margin of safety with this share, so I have bought some more.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed