|

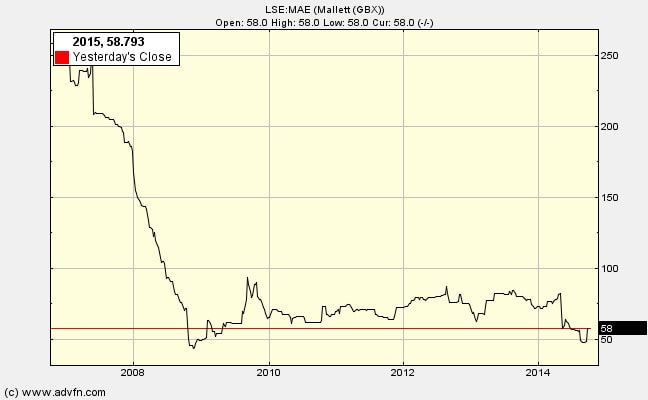

In previously blogs I described the extraordinary returns available to Net Current Asset Value, NCAV, investors. Before I present some academic evidence of success over a twenty year period I would like to share with you some thoughts on what pushes these shares down in the first place, and what might cause them to rise. Going down…… There are three reasons that even companies with large surpluses of current assets over liabilities fall in market price to below NCAV: First: The managers pursue value-destroying activities that whittle away shareholder’s assets though losses year after year. Second: The stock market has, in its manic-depressive fashion irrationally pushed shares down to unreasonable levels. This is particularly the case for smaller firms which can be badly neglected by the investing institutions. I have worked for a fund management house with a rule that no company with a market capitalisation under £200m is to be looked at. They need to buy shares in volume, and to be able to get out in volume. Thus many companies have no professional analysts examining their prospects and precious little institutional money flowing into their shares. This presents excellent opportunities for the switched-on small investor looking to invest a few thousand pounds. Third: Shareholders have not pressed the company to do the right thing by shareholders. This was brought home to me this summer when I attended the AGM of Mallett (LSE:MAE), the antiques dealer in Mayfair. As far as I could tell, after five years of losses the operating business was appalling and should either be greatly reduced in size to release money to send to shareholders, or if things continued to deteriorate, all assets should be liquidated and the money handed back to shareholders – more would be generated that way than the current market capitalisation. To give some idea of the calibre of the directors: the CEO did not attend his own AGM – busy in Asia, apparently. Needless to say, throughout the years of loss making the BoD had paid themselves very handsomely.

Clearly, the shareholders needed to act to stop the continued diminishing of shareholder value, and yet only two shareholders attended the AGM – it was not even that good, as the second attendee was a ‘representative’ of the Weinstock family, long-term 30% shareholders. Making my points about boardroom pay, long- term losses and the need to consider liquidation, I did not receive any support from other shareholders – they were a bit scarce at the AGM, and had not responded to my calls on the ADVFN bulletin board. So, management continued on its merry way, lowering shareholder value with every step. We have been saved, if you can call it that, by Stanley Gibbons offering to buy the company for 60p per share. It just shows you that (a) management teams can keep on destroying value for a long period before shareholders stand up and demand reform, and (b) you have to be sceptical in accepting BS numbers - Stanley Gibbons are buying at a one-third discount to reported NCAV. Oh dear, I have run out of space to present the ideas on what might correct the downward movement in share price. Sorry. I’ll do this in the next blog.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed