|

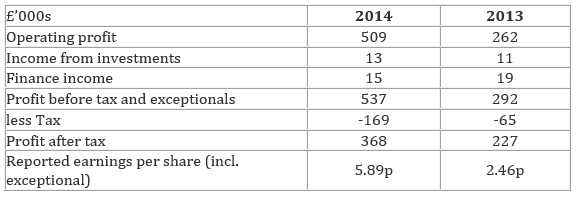

We have to acknowledge that here are some negatives about Fletcher King. I'll explain my 2013 concerns and then discuss the most recent reported numbers and my current worries about the company. First, the concerns I raised in August 2013: 1. Much of the value created is taken by staff. Of the £3m of so of annual revenue more than half is taken in employee benefits. Two directors each take about 10% of annual turnover in remuneration. While experienced and capable executives in the City can expect high rewards a Board that takes 25% of revenue and 250% of the profit before tax can legitimately be asked: Are you really operating this business for the benefit of all shareholders? 2. Are they too small? Will the larger property investors consider using a firm with so few surveyors? 3. Illiquidity of shares. Might shareholders be trapped? Should I be buying Fletcher King in December 2014? The most recent annual report (to April 2014) demonstrated the point I made about operational gearing in my 2013 analysis, there I said “FK has high operational gearing: with high fixed costs small percentage increases in revenues should feed through to large percentage increases in eps.” Right on schedule, annual revenue rose by 20% to £3.65m but profit after tax (excluding exceptional) rose an impressive 62%, from £227,000 to £368,000. The profit performance would have been even more impressive if it was not for the directors increasing their remuneration from £657,000 to £875,000. With David Fletcher on £371,000 and Richard Goode on £352,000 they each take away about the same as all the shareholders put together.

They certainly believe in bonuses. The 18 staff members shared performance-related payments of £642,000 (2013: £307,000). Of that, the directors got £505,000, the other 15 cost the company an average of over £76,000 in total annual remuneration. So we start off with a severe doubt about this company: Is it being run for the benefit of the leaders only? David Fletcher told me that FK has to pay competitively otherwise the talent will move to other employers. This argument has some validity, but even taking this on board you have to wonder about Fletcher and Goode’s remuneration. That is a large negative out of the way. Tomorrow I'll look a large positive – its balance sheet.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed