|

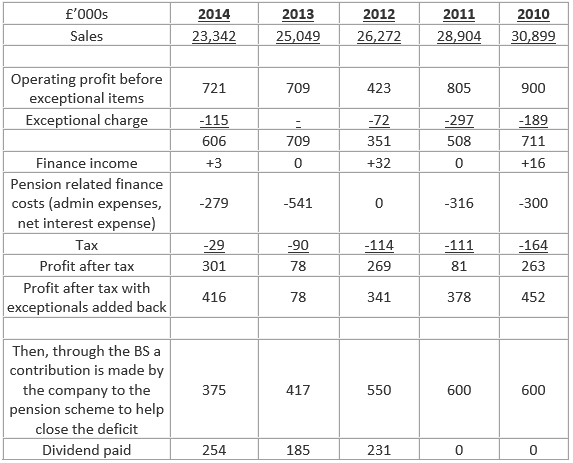

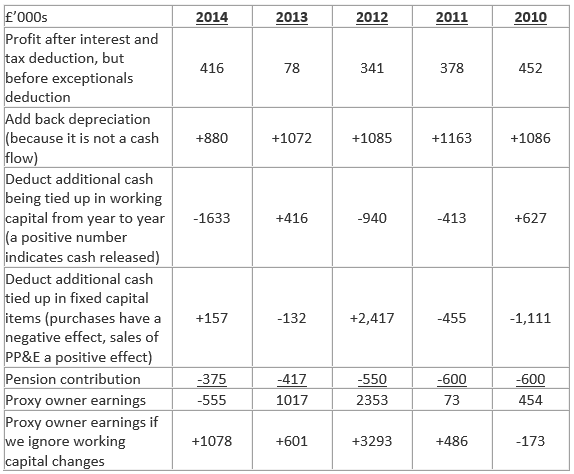

Previous blogs have highlighted Airea's low share price relative to net current asset value, and the bonus of extra value that might be tied up in property. We now look at another positive factor which allows us to offset a lower margin of safety on the assets side with a margin of safety on the income flow side. Here we are focused on the cash flows that could be taken out of the business without damaging the company’s economic franchise or reducing its unit volume of output or impacting the acceptance of value-generating projects. That is, the owner earnings. Before we look at owner earnings it is useful to understand what has happened with profits over the past five years. Profit after tax and before deducting exceptionals is fairly consistently in the £0.3m - £0.4m region and dividend yield is 5%. This is encouraging. However, the company also transfers about £0.4m to the pension scheme each year. Profit numbers Thus after the pension contribution the company does not produce very much. But, profit is not everything. If we look at the cash flow elements of the annual report we find that in arriving at operating profit the company has annual deduction for depreciation of between £0.8m and £1.538m. Even today the depreciation rate is around £0.88m. This is largely a legacy of being a much bigger company with plenty of fixed assets. The depreciation figure must be compared with the actual outflow on capital items to gain an impression of the difference between profit numbers and owner earnings numbers. In 2013 fixed capital item expenditure was £0.257m and in 2014 it was £0.157m, much less than the depreciation deduction. Thus owner earnings is much higher than profits – see proxy owner earnings table. Proxy for owner earnings (These are only proxies because I’m using historical amounts actually spent on changes in working capital and fixed capital items rather than the future focused “required expenditure needed to main the firm’s economic franchise, unit volume and invest in value-generating projects”). We need to make a judgement on future owner earnings, i.e. the cash that can be paid out to shareholders in future without impairing the company’s franchise, unit volume or investment in value-generating projects. If the firm is not growing then should the annual additional investment in working capital be assumed to be zero? For future years, on average, I think that is a reasonable assumption.

For a non-growing company annual fixed capital item expenditure is likely to be no more than £0.25m. Given these guesses a typical future annual owner earnings number can be estimated at (assuming no pick up in the economy):

Compared with a market capitalisation of £5.41m, that is not too bad. On the optimistic side there is potential for:

The next blog looks at the qualitative factors influencing the decision to inves

1 Comment

|

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed