|

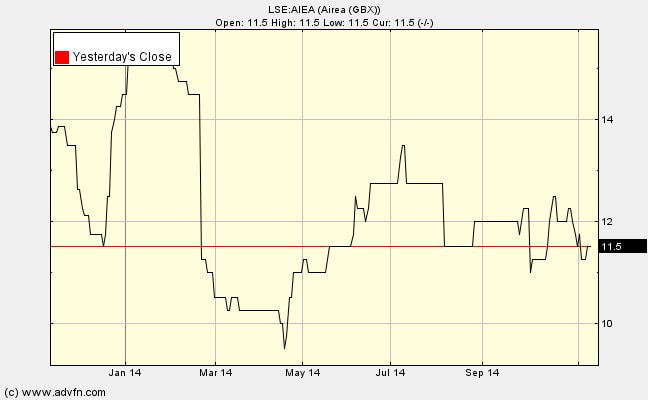

I've bought into another small company with a strong balance sheet and a lot of potential. Airea (LSE:AIEA) has a net current asset value more than its market capitalisation, but only by a narrow margin: NCAV is £5.465m whereas MCap is £5.41m (at a share price of 11.7p, my buying price). Normally, I would reduce the value of BS inventory and of receivables to build-in a margin of safety. This would lower the NCAV of Airea below MCap and therefore disqualify it from further consideration. However, investing is not a mechanical exercise – we must employ judgement. I’m prepared to take a risk on two offsetting factors, one in the balance sheet and the other in the income/owner earnings. But, there is one big negative factor to consider: a large pension deficit. I would value your views on the points I make below – there is probably a great deal I have missed. Some background Airea used to be called Sirdar, a struggling textile company. In 2007 Sirdar sold off property, paid off debt, closed business operations, but held on to two divisions. The first is Burmatex which makes contract carpets and carpet tiles. Its target customers are architects, specifiers and contractors for the education, leisure, commercial, healthcare and public sectors. Think offices, schools and hospital floors covered in hard-wearing carpet. Most of the division’s £16-17m of sales are in the UK, but it does export, principally to Europe. Naturally, the long recession and government spending clampdown was not good for the business. With macroeconomic recovery matters might improve, but it remains a competitive business. I think I’m right in saying that Headlam is its main competitor with 10 times the turnover. Please correct me if I’m wrong here. The second division is Ryalux which makes posh wool carpets for the retail trade. It uses words like ‘bespoke’, ‘custom made’, ‘colour match’. Its slightly more affordable wool-rich range is Pownall. Turnover of around £7m, through retailers. The recession has held down this division too. Is it a coiled spring, to be released as the economy recovers? The balance sheet First note is that there is no debt, but there is £2m of cash. An intriguing aspect of the balance sheet is the great influence that the actuaries estimating the pension deficit have on the non-current liabilities. Virtually all the non-current liabilities shown in the BS is pension fund deficit. The present value of schemes liabilities is estimated at £46.9m whereas the fair value of the schemes assets are £41.2m. If the actuaries decide to lower the discount rate used to convert the liabilities to a present value the raised amount feeds directly into the current liabilities thus reducing NCAV. Given the importance of the pension deficit for both the BS and for the cash flow drain I’ll discuss it in more detail later. Airea plc balance sheet items to 30th June Rumour has it that the industrial property may be more valuable than the BS shows because there might be some potential for gaining planning permission to convert to residential. If you know anything about this could you let us know please. Thus £3.4m (or more) in property is one of the large positives for this company, beyond NCAV. Property has a stated value of 7.35p per share, compared with the current share price of 11.7p.

In tomorrow's blog I'll discuss the pension deficit

1 Comment

|

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed