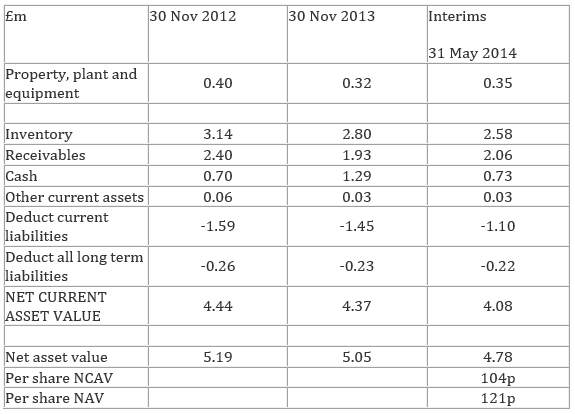

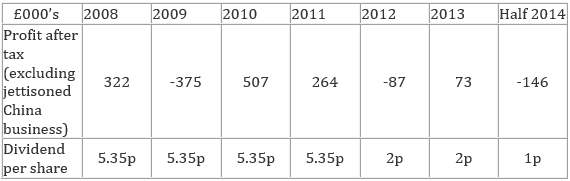

Newsletter 16 - the power is in the balance sheet of holders tech (lse:hdt) 5th november 201422/7/2020 With a market capitalisation of £1.65m (3.94m shares x 42p) Holders Tech is priced very low relative to its balance sheet assets. Its share price is one-third of net asset value and only 40% of net current asset value. The balance sheet Total liabilities of around £1.3m with no bank debt is an incredibly conservative way of structuring a BS. Thus, even if one-half of inventory and one-half of receivables are valueless, i.e. we knock £2.32m off, there is still £0.73m in cash plus £1.29m inventory plus £1.03m receivables. This is still plenty to offset the payables and the tiny amount of other liabilities. Profits and dividends Clearly, the profit record is patchy. It is quite worrying that the managers cannot produce consistent profits.

On the other hand, due to the strong BS and very restrained testing of new business tactics the company maintained a dividend even through the bad years. The dividend yield is 4.76%. I also looked at cash flow from operating activities over 6 years. There is no discernable pattern other than an overall performance oscillating around zero. Some years cash flow is positive (e.g. 2013: +£750k, 2012: +£897) due to a rundown of working capital. Other years there is a build-up in working capital resulting in cash flow falling below earnings (e.g. operating cash flow 2011: -£459, 2010: -£777m). An ‘owner earnings’ analysis produces much the same conclusion – bobbing around zero. All in all the profit, cash flow and owner earnings history is far from encouraging. We must hope that something changes. In tomorrow’s newsletter I’ll look at the qualitative factors

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed