|

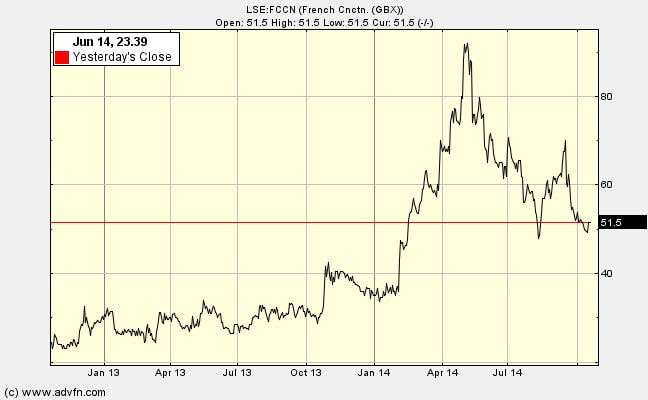

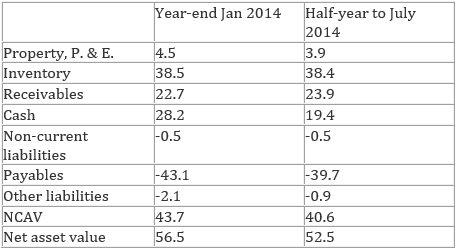

Since buying French Connection (LSE:FCCN) for 30.47p in July 2013 the shares have had a roller-coaster ride, up to 91p, and then down to 47p. At the current price of 53p, and market capitalisation of £50m should I buy some more Given that this is a Net Current Asset Value investment, the first place to look is the BS: Over the past year NCAV has shrunk from £49.9m to £40.6m while market capitalisation climbed from £30m to £53m. And this comparison is made before we adjust down the BS values of inventory (say by one-third) and receivables (say by one-fifth) in order to offset any potential overly optimistic BS valuations.

There are encouraging signs on the quality of the operating business, even though the Group remains unprofitable: stores are being closed to reduce the drag of the loss-makers; LFL sales in UK/Europe Retail are up 6.6%, with less need to sell off stock in a seasonal sale; forward orders for Wholesale are up; overhead is down; licensing is still improving, and; there are good prospects for a continued rate of closure of non-contributing stores of around 8 per year in UK/Europe. In short, they have made a start on the long road to recovery: they seem to have better buyers attracting more customers and are lowering overhead. But… but…. losses of £3.9m for the latest half-year are worrying. They are clearly not out of the woods yet. The share price rise means that French Connection no longer qualifies as a NCAV investment. Furthermore it has not transformed itself into a candidate for my ‘strong economic franchise’ investment portfolio. If the share price falls to under 35p I will take another look because there would then appear to be sufficient margin of safety in the NCAV position. For now, I’m quite content to sit out the remaining four years until the selling horizon is reached for NCAV portfolios. If the managerial improvement continues this could be a ten-bagger. After all, the share was once (2004) over £5. Unlikely, but it could happen. If there are enough of these in the portfolio I expect to do well overall.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed