|

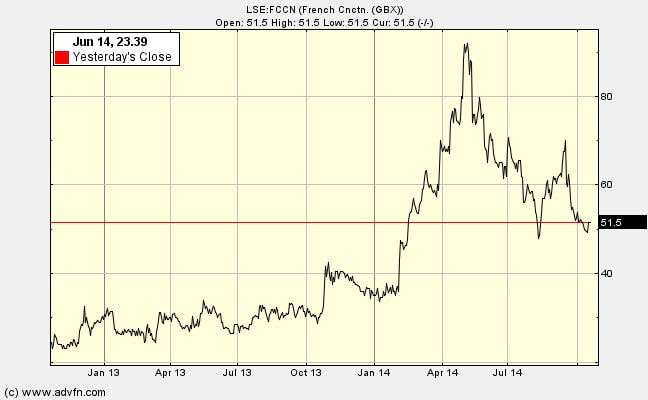

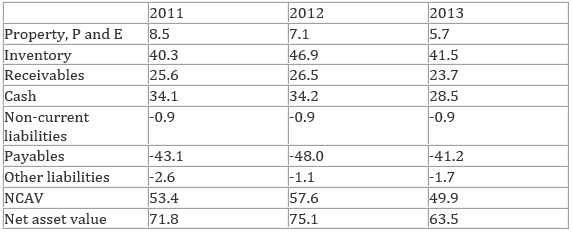

I bought when the market capitalisation was £30m (share price 30p) and the Net Current Asset Value was greater at £49.9m. What was I thinking? This is what I posted on my personal website in 2013: Some positives 1. Cash at year end 31 January 2013: £34m, with no bank debt. January is a very advantageous point in the year to report net cash. However, even at the worst point net cash was reported as £10.6m during the year. Even better: in May 2013 it reported cash of £15.7m compared with £10.4m the previous year. Also no pension deficit. 2. NCAV Bear in mind that Graham insisted that we reduce the reported receivables by one-fifth and the inventory by one-third of their reported value. Even with these deductions NCAV is significantly greater than market capitalisation. The question are:

(a) Whether inventory is really worth what the company says it is? (b) Whether cash will be squandered? 3. While UK/Europe retail is doing very badly, the licensing and wholesale business continues to thrive (with a few bumps). Licensing alone can generate £5-£9m with few capital requirements 4. All it takes for the turnaround is good design. New head of design in May 2013 New head of Retail in Sept 2012. New head of production in October 2012 New head of Multichannel October 2012 5. Asian growth: An aspirational brand in Asia, especially in China and India where operations are profitable and growing (opening 4 new stores in China this year and 10 in India). 6. Store leases in UK/Europe are likely to be for 15 years. This means that on average they have 7-8 years to run. Therefore over the next few years, store by store, they can (a) stem losses by selectively not renewing leases (b) get rent reductions in a hard hit store rental market. The cash available combined with further reductions in working capital requirement releasing more cash, will see them through the next few years. Disposals in 2012/13: 2 stores in UK/Europe, 3 in N America. In process of closing one store and 6 concessions. Likely to close two more this year. About 10% of leases up for renegotiation each year 7. e-commerce is rising in importance, now 10% of sales 8. Sell in 30 countries with 1,000 stockists. Skilled weeding out of unprofitable activities still leaves much to build upon. 9. Branded sales (wholesale and licences for glasses etc.) of £400m, on which royalties are paid. Brand is still powerful in some segments/geographies 10. Trading revenue is now generally flat rather than falling, but such green shoots could wither. 11. Founder determination not to be seen as a failure in the retail game

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed