|

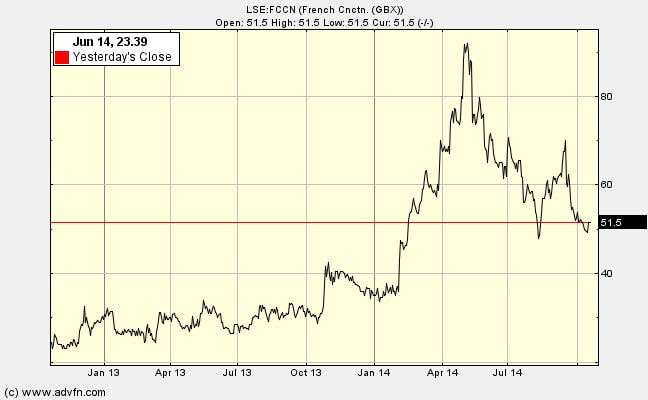

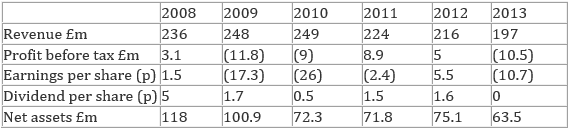

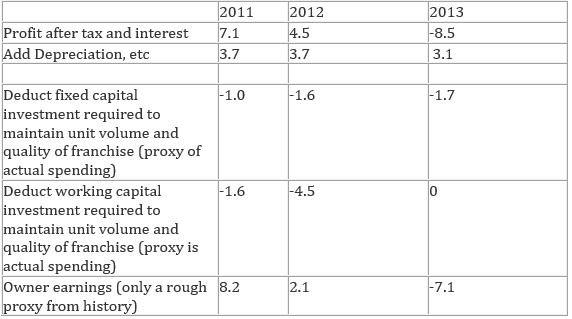

I posted these comments on my website in July 2013 (after writing I bought at 30p): French Connection’s (LSE:FCCN) profit record is appalling. The only reason for looking at it is because it has net current assets much larger than market capitalisation and there are some reasons to believe that the assets will not be run down before profitability is restored. The fact that I put the probability of a return to health at less than 50% does not fatally wound the case for investment because if a turnaround is achieved the pay off will be 3-fold, 4-fold, 5-fold or more. There are many negatives to weigh against the positives. I would be interested to hear how you weigh them. Some data Share price: 30p Market capitalisation: £30m Net Current Asset Value (as reported): £49.9m (see post on 15.10.14 for NCAV definition) Revenue: Approx. 70% UK/Europe (141 shops, 71 stores in UK and 46 concessions in UK and Europe). Operating profit: UK/Europe: Retail lost £16m. Wholesale made £3.9m N. America (17 shops): Retail lost -£1.6m. Wholesale made £7.8m Rest of world: wholesale made £0.5m Other income: UK £6.8m, N.A. £0.7m, RoW £1.6m Reasons for doubt In most NCAV firms you will find several reasons to want to hold your nose. Let’s look at those negatives for FC first: 1. Record No value generated for shareholders for a very long time. A story of decline. There are some businesses where management do not have to be smart every day because the franchise can carry them through years of poor management, (e.g. Coca Cola, Disney, Diageo). In retail you need to be smart every day because there is always a competitor with great innovation and flair snapping at your heels – especially in fashion retailing. An owner earnings analysis does not make for comforting reading either 2. Comments from many sources that they still have not yet got the pricing and store display right in the UK/Europe stores, even if there may be a glimmer of light on the styling.

3. Comments, unconfirmed, that the dominant shareholder (42%), founder, chairman and CEO is domineering and inflexible 4. Lease obligations amounting to over £200m, but spread out over many years. Should they be included in liabilities? (if so, how do we account for the assets these obligations provide?) 5. Even the Board are not anticipating a quick turnaround; aiming for breakeven in the year ending 31.1.15. 6. The brand is old and faded. So far, the analysis is leading to a rejection – however, in the next blog I’ll look at some of the positives present in July 2013.

0 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed