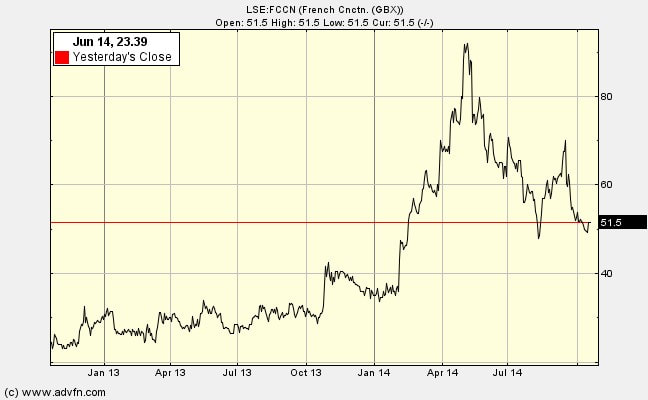

Newsletter 11 - french connection - deciding whether to invest back then 28th october 201422/7/2020 Before I post on whether FC (LSE:FCCN) is a good investment now, I’ll go over the line of logic I was following in July 2013. I mused on the following ideas: "Don’t forget that Graham did not mechanically purchase all NCAV shares. He also examined for business prospects, stability and quality of management. Here we are on shaky ground with FC because we really do not know, we can only think probabilistically But then, with this investment category we are not doing a Warren Buffett & Charlie Munger ‘Inevitable’ analysis in which we expect excellent management, economic franchise with a deep and dangerous moat and fantastic stability in every case. Graham thought that high NCAV firms might turnaround because of one of the following:

In the case of FC I cannot see clearly the most likely reviving factor. I can say that exit from the industry by rivals is very unlikely to be valuable because there is also so much industry entry to keep pressure up. Liquidation will not release value because everything will be taken by the landlords. The main hope is a change in the quality of management. Are they now properly awake? Is the new talent really good? We will not know for some time – we can only play the odds." UPDATE (OCT 2014): New management seem to be improving matters. In the next blog I provide the data which contributed to the decision to invest in 2013.

1 Comment

|

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed