|

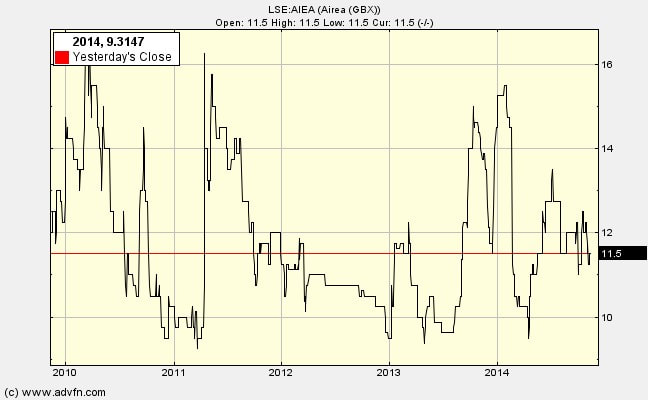

Airea (LSE:AIEA), which I bought last week at 11.7p per share, has a strong balance sheet but it is dominated by the pension deficit. So this blog takes a closer look at that. In the balance sheet summaries shown below the non-current liabilities are overwhelmingly due to the figure estimated for the pension fund deficit. You can see how much this figure moves about, impacting net current asset value, NCAV. Airea plc balance sheet items to 30th June With such a large amount owing to pensioners a small change in the discount rate used to estimate present value has a large effect on the deficit. The current discount rate used is that of corporate bonds at 4.25%.

This is remarkably low compared with what the fund has used in the past. Indeed, in the history of the bond market 4.25% is a remarkably low number. If the discount rate was lowered by 0.1% then £0.63m will be added to the deficit. What are the chances of that worsening occurring? Here we need to make a judgment on the path of future interest rates in the bond markets. Will they go up or go down? If they rise by 1% to a more normal 5.25% then the pension deficit (ceteris paribus) disappears as the liability drops by £6.3m for every 1% point movement. Another way in which the deficit can be eliminated is if equity markets rose, increasing the value of the fund’s assets. On the other hand, Airea could be hit by a rise in life expectancy. If the average pensioner lived for one year longer than the current assumptions then £1.7m will be added to the liability. But the current assumptions do not seem too worrisome because the pension scheme was closed to the accrual of benefits in 2005 and the average age of a beneficiary is now 65. For actuarial calculations, on average Airea’s pensioners are estimated to live to 86.3 years for males and 88.5 years for females. What are the odds of these numbers having to be raised? Would the average pensioner have to live into their 90s for there to be a serious problem for this company? There are 53 active scheme members, 54 deferred pensioners and 70 pensions in payment. In the next newsletter I'll discuss the encouraging profit and owner earnings numbers for Airea.

2 Comments

Leave a Reply. |

Archive

I wrote newsletters for almost 10 years (2014 - 23) for publication on ADVFN. Here you can find old newsletters in full. I discussed investment decisions, basics of value investing and the strategies of legendary investors. Archives

October 2020

Categories |

RSS Feed

RSS Feed